- Arizona’s SB 1373, which would create a state-managed digital asset reserve, has passed the committee and awaits a final House vote.

- Governor Hobbs’ blanket veto threat over disability funding puts the bill’s future in jeopardy.

- The State Treasurer can invest or lend up to 10% of seized digital assets annually, as the proposal allows.

Arizona is on the brink of making history in digital asset legislation. Senate Bill 1373 (SB 1373), the Strategic Digital Assets Reserve Bill, has successfully passed through the Arizona House Committee of the Whole and now awaits a final floor vote. If approved, it will be sent to Governor Katie Hobbs for official signature positioning Arizona as a potential first-mover in managing digital assets at the state level.

ARIZONA Update:

— Bitcoin Laws (@Bitcoin_Laws) April 17, 2025

Bitcoin Reserve Bill SB 1373 has been passed by the House Committee of the Whole (with a minor amendment).

The next step is Third Reading and final floor vote. pic.twitter.com/oOahjbZATR

SB 1373 proposes the creation of a Digital Assets Strategic Reserve Fund made up of digital assets seized in criminal investigations. The fund would be managed by the Arizona State Treasurer and could serve as a novel financial tool for the state. The proposed law would authorize the treasurer to invest up to 10% of the fund’s value annually into select digital assets. The bill also permits the lending of these assets to generate additional returns, as long as such activities do not introduce elevated financial risk.

However, the bill faces a significant political hurdle. Governor Hobbs has threatened to veto all new legislation until lawmakers pass a disability funding bill. This broad veto stance has already resulted in the rejection of 15 bills this week, casting uncertainty over SB 1373’s future despite its legislative momentum. Hobbs’ position puts Arizona’s digital asset ambitions at risk, even as the bill garners attention from both advocates and analysts.

Any bill not already on my desk will be vetoed until we have a serious, bipartisan funding solution that protects health care for Arizonans with disabilities.

— Governor Katie Hobbs (@GovernorHobbs) April 17, 2025

Bitcoin Bills Advance in Arizona Legislature

Julian Fahrer, founder of Bitcoin Laws and CEO of Apollo, expressed confidence that SB 1373 will clear the House, but he also noted the possibility of the bill merging with SB 1062 a separate proposal that seeks to redefine legal tender in Arizona to include digital assets. A merger could strengthen the legislative framework but may also delay progress or raise the stakes in negotiations.

SB 1373 is not the only digital finance initiative moving through Arizona’s legislature. A parallel bill, SB 1025, the Arizona Strategic Bitcoin Reserve Act proposes allowing the state treasury and retirement system to invest up to 10% of their portfolios in Bitcoin specifically. That bill passed through the House Committee of the Whole on April 1 and is also awaiting a full floor vote.

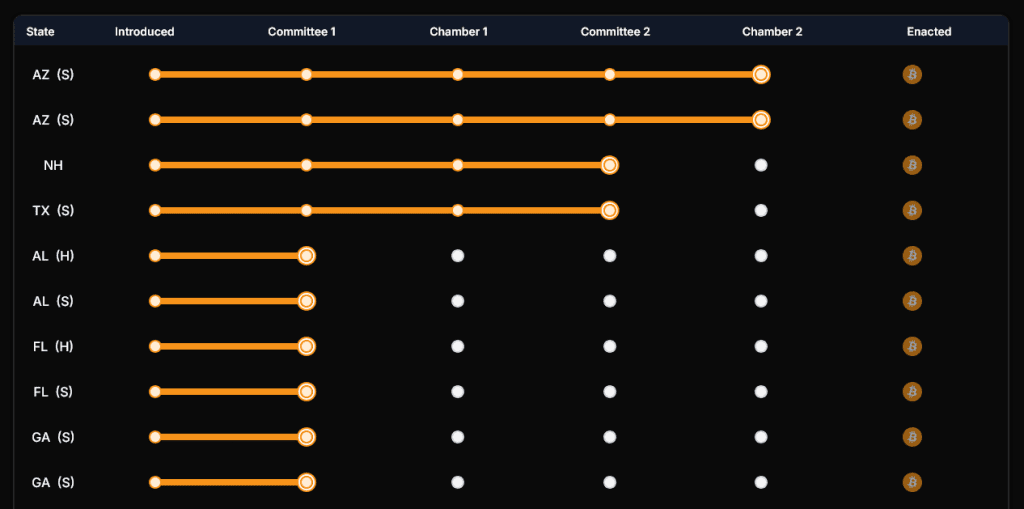

Arizona’s push to establish both a broad-based digital asset reserve and a Bitcoin-specific reserve puts it at the forefront of state-level digital asset policy. Utah passed a Bitcoin bill in March, but it removed key provisions in the final round. This trend isn’t isolated. Texas has also advanced its own Bitcoin reserve bill, while New Hampshire’s House recently passed a similar measure.

Arizona Leads Digital Asset Legislation Race

While Arizona appears furthest along in legislative development, Fahrer believes Texas may ultimately have the smoothest path to implementation due to encountering fewer political obstacles. Still, Arizona’s aggressive stance and legislative progress could set a powerful precedent for how states handle blockchain-based assets going forward.

As the final vote for SB 1373 nears, all eyes are on Arizona. If it clears the House and survives Governor Hobbs’ veto threat, the state could become a national leader in integrating digital assets into public finance, marking a pivotal moment in the evolution of U.S. financial policy.

Related | Ethereum Fees Hit Five Year Low Signaling Major Slowdown

How would you rate your experience?