- Arthur Hayes forecasts Bitcoin could bottom at $70,000, a 36% correction from its peak, suggesting it is normal in a bull market.

- Bitcoin’s drop below $77K coincided with a sharp downturn in the Nasdaq, signaling broader market turmoil and volatility.

- Bitcoin ETFs faced major outflows, while crypto-related stocks like Coinbase and Robinhood experienced significant losses amid growing bearish sentiment.

Bitcoin has plummeted below the $77,000 mark for the first time since November 10th, briefly hitting $76,822 before rebounding to around $79,000, according to CoinGecko data. It marks a sharp 36% decline from its all-time high of $110,000, sending shockwaves through the crypto and traditional financial markets.

However, former BitMEX CEO Arthur Hayes was not surprised by the downturn. In a post on X, he urged traders to remain patient, predicting that Bitcoin could bottom out at $70,000, a 36% correction from its peak, which he deemed “very normal for a bull market.”

While Hayes sees a potential floor, he warns that Bitcoin’s recovery won’t happen in isolation. He outlined a grim sequence of events that could pave the way for a turnaround: a major stock market crash, the collapse of a key financial institution, and central banks resuming aggressive monetary easing. Only then, he suggests, would it be time to go all-in on crypto.

“BTC trades 24/7, anyone globally with internet can trade, it cannot be printed, failure results in bankruptcy or liquidation,” Hayes stated. He contrasted this with traditional stocks, which have limited trading hours, are vulnerable to political bailouts, and are deeply intertwined with government finances.

Bitcoin Drops Below $77K as Nasdaq Crashes

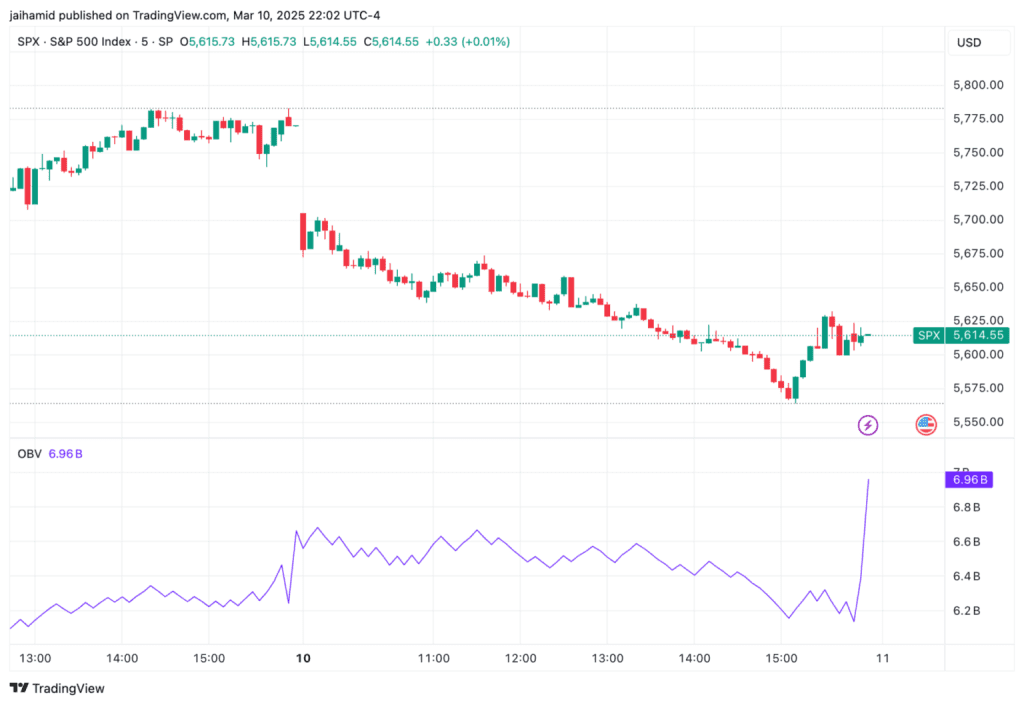

Bitcoin’s slump is not happening in a vacuum. The Nasdaq 100 suffered a brutal 1,050-point drop staggering 5.8% decline followed by another 300-point plunge in after-hours trading. Had markets remained open, the losses would have been dangerously close to triggering circuit breakers, a rare occurrence reserved for extreme volatility.

Futures markets painted an equally grim picture, with all major indices trending downward. S&P 500 futures dropped by 0.4%, while Nasdaq-100 futures saw a steeper decline of 0.9%. Meanwhile, Dow Jones futures also edged lower, losing 20 points, signaling a cautious start for the markets.

Delta Air Lines’ stock tanked 11% in after-hours trading after the company slashed its profit and sales forecast due to weaker U.S. travel demand. Meanwhile, the S&P 500 has now posted three straight losing weeks, with the Dow Jones falling below its 200-day moving average for the first time since November 2023.

“This is starting to feel like a capitulation in the market,” said Anastasia Amoroso, chief investment strategist at iCapital, during CNBC’s *Closing Bell.* She suggested that stocks were reaching oversold levels and could be nearing a short-term bottom.

Bitcoin Could Drop 50% Amid Market Decline

As expected, gold advocate and longtime Bitcoin critic Peter Schiff wasted no time seizing the opportunity. “Now that Bitcoin has dropped below $77K, it’s down 30% from its January record high,” he wrote on X. Schiff argued that the U.S. government would never consider Bitcoin as a reserve asset if it can lose value so quickly, warning that a 50% drop could be next.

Schiff linked the crypto crash to the broader economy, suggesting that as crypto millionaires lose money, the U.S. may have no choice but to revive its manufacturing sector.

Bitcoin ETFs have also been hammered by the downturn, with outflows reaching $867 million last week, per CoinShares data. It marks the fourth consecutive week of withdrawals, bringing the total outflows over the past month to a staggering $4.75 billion. The trend suggests growing bearish sentiment among institutional investors.

Major crypto-related stocks also experienced significant declines. Coinbase dropped by 17.6%, while Robinhood saw an even steeper decline of 19.8%. MicroStrategy (now Strategy) also hit, falling 16% amid the broader market downturn.

Trump Warns of Economic Transition and Bitcoin Impact

President Donald Trump addressed the economic turmoil during a Fox News interview, calling this a “period of transition.” His comments came shortly after Treasury Secretary Scott Bessent warned that the U.S. could face a “detox period” due to federal spending cuts.

Meanwhile, Goldman Sachs has revised its economic growth forecast downward, citing concerns over Trump’s proposed tariffs. However, despite market jitters, some analysts are downplaying the risk of a full-blown recession, pointing to strong payroll reports and continued consumer spending growth.

As traders brace for a high-stakes week, key economic reports could dictate the Federal Reserve’s next moves. The Job Openings and Labor Turnover Survey (JOLTS) is released on Tuesday, followed by the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. Any signs of cooling inflation could pressure the Fed to accelerate rate cuts potentially providing a lifeline for stocks and crypto.

Ultimately, all eyes are on central banks. If policymakers step in with fresh stimulus measures, as Hayes predicts, risk assets could find their footing again. Until then, the market remains on edge, with Bitcoin traders bracing for a potential final leg down before a new rally begins.

Related | Trump to Host White House Crypto Summit at Scheduled Time

How would you rate your experience?