- Binance limits new token listings to small supply shares to reduce selling pressure.

- Most new tokens allocate about 5% at listing, with large projects often below 1%.

- Tiered listings and BNB Chain growth improve transparency and market structure.

Binance has limited the share of new token supply released during listings, reflecting a shift in centralized exchange practices. Recent research shows exchanges now distribute only a small portion of total supply at launch. The change follows criticism in 2025 over selling pressure. Binance says smaller allocations improve transparency, protect markets, and align listings with long-term trading demand.

Research shows that 5% of the total supply of a token is typically distributed in centralized exchanges as part of a token listing. In cases of bigger projects with high, fully diluted valuation, the figure is commonly lower than 1%. These outcomes refute arguments that exchanges bring extra supply to markets.

In early 2025, Binance received criticism when most of the tokens listed had plummeted. Analysts believed this is a strain to list exposure, which caused short-term selling pressure. A number of projects were losing a lot of value in no time after trading started. Binance later explained that exchange allocations were not as big as many would think.

Demystifying Token Exchange Listings

— Ash (@ahboyash) December 23, 2025

CEXes have been getting heat lately where a common argument is that CEX listing = huge % allocated to exchange → Increased sell pressure

Listing partners have also ramped up transparency by releasing token allocation info, albeit info can… pic.twitter.com/2ut9M84xva

Binance Remains a Preferred Listing Venue

As a listing, Binance continues to be a preferred venue, even though it is tightening distribution. Major projects are still flowing into the exchange as a result of deep liquidity and global access. BNB Chain activity strengthens its position. In 2025, approximately 40% of new tokens were launched on BNB Chain.

BNB Chain has emerged as a leading platform for new tokens. Faster deployment and access to an existing user base are frequently mentioned in projects. This trend places BNB Chain in direct competition with Ethereum and Solana.

Binance disclosed that most projects allocate roughly 5% of supply during the listing process. These tokens support liquidity, airdrops, and trading incentives. Projects with higher valuations usually allocate less than 1%. Mid-tier projects often allocate more to encourage user participation.

Also Read: Crypto Market Outlook Signals Structural Growth Heading Into 2026

The market emphasized that the issuance of tokens does not include listing fees. Binance does not hold these tokens. Rather, allocations are given back to the users in the form of wallets, rewards, and ecosystem programs. Tokens are used to fund launchpools, liquidity projects, airdrops, and marketing.

Heavy Token Losses Drive Binance Listing Changes

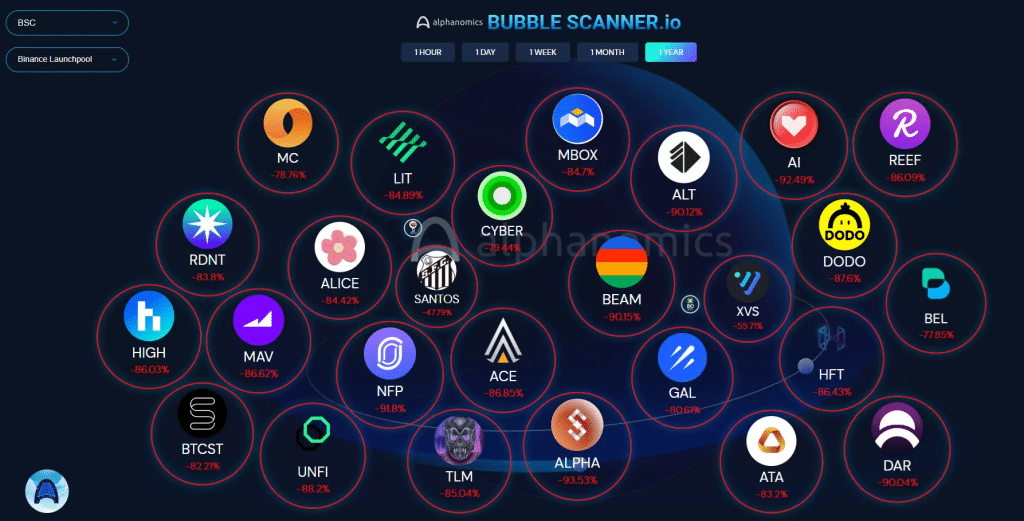

Numerous launches in 2025 have raised questions about the distribution of tokens. According to market data, the majority of the tokens that have been issued recently have fallen by more than 85%. Poor faith in altcoins caused the decrease. Losses occurred in both centralized and decentralized listings.

Source: Bubblescanner

Binance responded by implementing a more transparent listing framework. The exchange has now separated Binance Alpha, Futures, and Direct Spot markets. There are set criteria and development objectives in each level. The system will enhance transparency and minimize speculation.

There are also some tokens that are introduced on decentralized exchanges. DEX trading is associated with quicker price discovery and reduced control over selling. Whales and insiders typically influence early trading.

Despite market pressure, Binance supported multiple launches, with Alpha Spotlight tokens delivering strong short-term gains and continued use of Launchpad, Launchpool, HODLer airdrops, and wallet programs.

Also Read: Aave DAO Moves to Reclaim Brand Control as Governance Tensions Stir Community Debate

How would you rate your experience?