- BIT Mining plans to build a $300M SOL treasury as part of a new long-term strategy.

- The company will raise capital in phases and shift existing crypto holdings into SOL.

- It aims to support Solana infrastructure, including staking and validator operations.

BIT Mining has announced a major move into the Solana ecosystem. The company, known for its mining operations and hardware, will now focus on building a large treasury of SOL. This new direction marks a shift from traditional mining to broader blockchain engagement.

JUST IN: BIT Mining (NYSE: $BTCM) is going all-in on #Solana.

— Roundtable Network (@RTB_io) July 10, 2025

The firm plans to raise up to $300M in phases to build a $SOL treasury – converting existing #crypto holdings into #SOL as part of a long-term strategy. pic.twitter.com/mUqSsKKIf5

The company wants to finance in increments between $200 million and $300 million to buy SOL. It will also swap some of its current crypto assets for SOL with the goal to keep it for the long haul. The announcement comes following months of research and internal discussions.

Leaders believe the best platform for sustainable blockchain growth is Solana. The network offers fast transaction speed, high scalability, and surging adoption from developers. Those qualities, they argue, make Solana a smart investment target.

BIT Mining Plans SOL Treasury

BIT Mining will initiate its plan for accumulating the treasury by gradually deploying the capital. It shall introduce funds by way of incremental offerings in accordance with the prevailing market conditions. The company shall use new capital along with its existing assets. The dual track minimizes risk and builds a sound base in the context of Solana.

The group will monitor prices, demand, and states ofliquidity intently. Decisions will be informed byflexibility. The end goal does not lie in near-term profit but in position establishment over the long-term. The management expects this methodology to afford BIT Mining high exposure toSolana’s future growth.

In addition to buying SOL, BIT Mining will stake tokens for regular on-chain revenues. Those rewards will create streams of income as they contribute to network decentralization. The company may also operate validator nodes, bringing it further in sync with the security and infrastructure requirements of the Solana network.

Market Context Supports the Strategic Timing

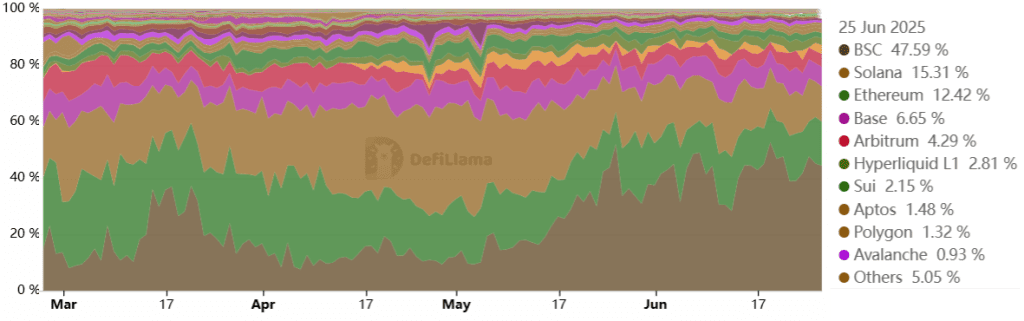

Solana has only just reclaimed the spot of the second-largest decentralized exchange by volume of trades. It crossed over the 30-day DEX action of Ethereum, though BNB Chain retains the top spot. SOL’s price has not, though, reflected the same strong upward movement.

Traders cite the brisk correction in the memecoin sector, previously behind the heating up of network usage. Top-tier memecoins on Solana, including Giga, Popcat, and Bonk, have posted 25% to 42% losses over the last weeks. The correction has tempered speculative investor interest in the near term but has not discouraged long-term developers and builders.

BIT Mining believes the dip is temporary and the period offers good entry points. The company sees long-term value in the infrastructure of Solana. Through the move, it positions itself not only as a miner but as one ready to transform as a blockchain innovator.

In the future, BIT Mining will increasingly position itself in Solana by opportunistically investing, by staking SOL to claim rewards, and possibly running validator nodes. The long-term goal is to create stable revenues and participate in the network’s development.

Related Reading: Bitcoin’s Bullish Surge: What’s Fueling the $111K Price?

How would you rate your experience?