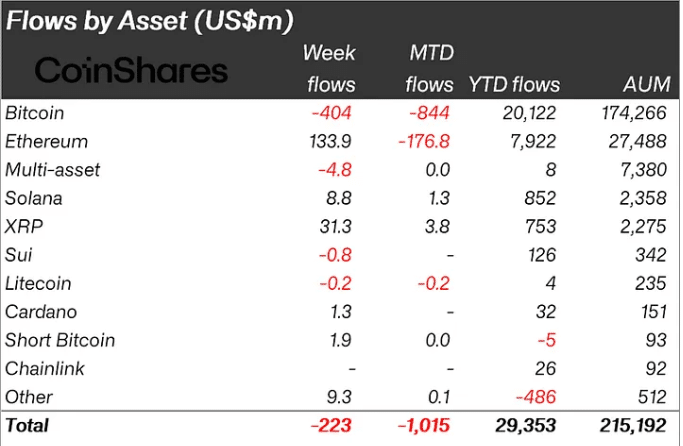

- Digital asset funds saw a sudden reversal, ending the week with $223 million in outflows.

- Bitcoin led the losses, while Ethereum, XRP, and Solana attracted inflows.

- Market movements followed hawkish Fed signals and shifting investor sentiment.

Digital asset investment products, including Bitcoin, ended their 15-week inflow streak with sharp outflows totaling $223 million. The week began on a strong note with $883 million in fresh inflows. But conditions changed rapidly. Investors reacted to hawkish comments from the Federal Reserve and stronger-than-expected economic reports from the U.S.

According to the report from Coinshares, the flows of more than $1 billion out of digital funds had occurred. Market participants de-risked. The flows are seen as temporary corrections after weeks of gains. Digital assets had seen $12.2 billion over the last month, which equaled half of 2025’s year-to-date inflows.

Solana and SEI See Steady Investor Support

Bitcoin enjoyed the week’s largest outflows at $404 million. It nevertheless still possesses a strong year-to-date inflow of $20 billion, though. It only shows just how effective Bitcoin remains at following rate expectations as well as large macro moves.

Ethereum fared even better. It registered its 15th consecutive week of inflows, adding $133 million to the system. Such a sustained trend bodes well for investor aspirations of future Ethereum uses as well as ecosystem growth.

XRP came next through $31.2 million inflows. Solana got $8.8 million, while SEI contributed $5.8 million. Even tiny coins such as Aave and Sui received funding, albeit modest, $1.2 million, as well as $0.8 million, respectively

Bitcoin Faces Distribution Pressure as Long-Term Holders Sell

Meanwhile, Alphractal CEO & Founder Joao Wedson tweeted that Bitcoin long-term cycle analysts point to some of the diverging on-chain signals that show increased distribution from long-term holders. These are investors that have continually sold substantial portions of BTC, nearly half of the amount that exists within ETFs at the moment.

One such indicator, Coin Days Destroyed (CDD), saw a surge of action from old wallets. Earlier, such action aligned on localized market peaks. Reserve risk measures as well as SOPR data signal more coins sold at gain, which might spur a bearish near-term reversal.

Not all of the data, however, means the cycle is over. The macro market top monitoring Alpha Savior indicator has still not been activated. As agreed upon by analysts, the final peak still awaits, which should occur when the $69,000 point is regained by Bitcoin once again.

While bitcoin falls, there are altcoins still gaining traction. Demand from investors is still extremely sensitive to economic cues. Short-term caution is still the rule of the day for now, but the long-term picture is still healthy. Crypto cycle far from done; it might just be cooling before the next phase takes over.

Related Reading: Bitcoin on the Edge: Will $113K Hold or Trigger a Breakdown?

How would you rate your experience?