- After a record Q4, MARA is leveraging its mining infrastructure to support AI inference and high-performance computing.

- Q4 revenue hit $214.4M, net income soared 248% YoY to $528.3M, and Bitcoin holdings reached 44,893 BTC.

- MARA boosted its mining capacity to 53.2 EH/s, a 115% YoY increase while securing 300% more energy capacity.

MARA Holdings, one of the largest Bitcoin mining firms, is shifting its focus to artificial intelligence (AI) after delivering a stellar Q4 2024 earnings report. In its Feb. 26 fourth quarter statement, MARA said it is looking to become the base layer of infrastructure. The company aims to become the backbone of AI and high-performance computing applications, like Cisco’s role in the internet boom. By leveraging its mining infrastructure, MARA plans to provide essential tools for AI inferencing and energy management.

MARA’s Q4 2024 Shareholder Letter is here. Read the full report: https://t.co/w0iDVVZ3RV

— MARA (@MARAHoldings) February 26, 2025

Chairman & CEO @fgthiel shares key insights on our record-breaking year and what’s next for MARA. pic.twitter.com/xmFZYcwcUX

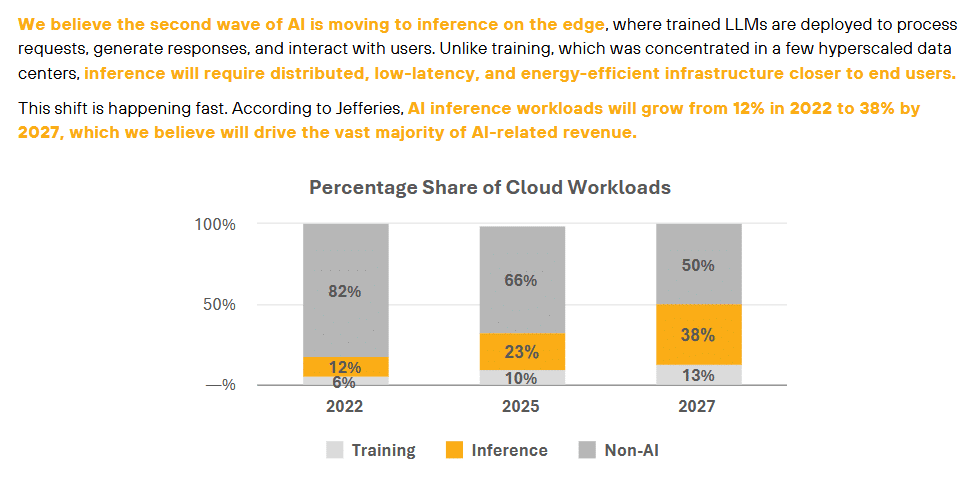

The company believes that its biggest opportunities are in the second AI wave compared to that initial rush. The company did not rush into AI training, in which enormous language models are developed. The company waited patiently to monitor market trends before turning to AI inference. AI models are in a position to process information and make independent decisions in that phase that requires massive computational power.

MARA Holdings $214.4M Revenue 44,893 Bitcoin

MARA Holdings reported a record $214.4 million in revenue for Q4 2024, significantly exceeding Wall Street’s $183.9 million estimate by 16.5%. The company also recorded $528.3 million in net income, marking a 248% year-over-year increase.

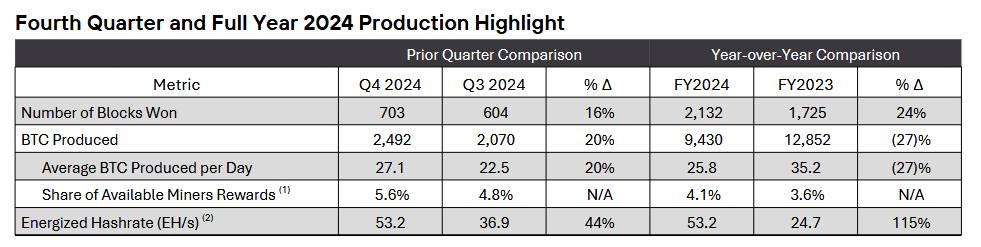

Other key financial highlights include a 207% YoY surge in adjusted EBITDA to $794.4 million and a 25% increase in Bitcoin production, with 2,492 BTC mined in Q4. MARA also adopted an aggressive accumulation strategy, retaining all mined BTC and purchasing 14,574 more using cash and note proceeds.

According to BitBo’s BitcoinTreasuries.NET data, by the end of 2024, MARA’s total Bitcoin holdings reached 44,893 BTC, solidifying its position as the second-largest corporate Bitcoin holder, behind only MicroStrategy.

MARA Hits 53.2 EH/s – 115% Bitcoin Mining Surge

MARA significantly expanded its Bitcoin mining capacity, increasing its energized hashrate to 53.2 exahashes per second (EH/s)—a 115% YoY increase. A major factor behind this surge was the company securing 300% more energy capacity in 2024, enabling its expansion to seven additional mining facilities.

MARA established 25-megawatt micro data centers in North Dakota and Texas to limit grid power dependency. The expansion secures its mining activities as a basis for its AI infrastructure ambitions. The company aims to provide key computing power for AI inference, a space that it projects will be as similar to the traditional cloud space.

Following its robust earnings report, MARA’s stock surged 5.9% in after-hours trading to $13.18 before settling at $12.89. According to Google Finance data, it closed the Feb. 26 trading session up 0.28% at $12.45.

With a growing treasury in Bitcoin, increased mining infrastructure, and AI-based strategic investments, MARA Holdings is positioning itself toward long-term leadership in AI and cryptocurrency. During the second AI wave, with its transition from mining Bitcoin into fueling advanced AI infrastructure, MARA can be a game-changer in the sector.

Related | Bitcoin’s Market Dominance: Wall Street’s Growing Crypto Impact

How would you rate your experience?