- A Bitcoin correction is likely, with big players already adjusting.

- The Strategic Bitcoin Reserve news was already priced in.

- Selling now secures profits before a 40-50% market drop.

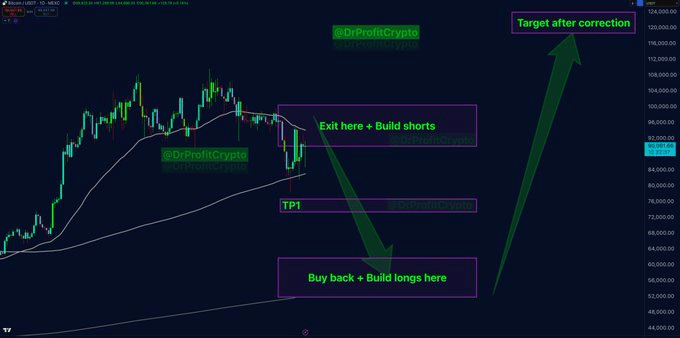

Bitcoin has been in a powerful bull run, yet every bull cycle has corrections. A well-known trader has made a public announcement that he is selling 50% of his holdings in Bitcoin and going short between $ 90K–and $102K. His take. The market had been expecting a different outcome from the crypto summit. Instead of new Bitcoin purchases, headlines were dominated by BTC seizures. Individual investors took the Strategic BTC Reserve as a major development.

Most believed that this would lead to new highs for bitcoin. But for seasoned traders, this had been factored in. Trump signing the deal wasn’t a surprise. It just happened a day earlier than everyone had been expecting. This shift in timing is where bitcoin’s first major correction in this cycle starts.

Bitcoin Profit Strategy as Market Correction Looms

The trader has a clear plan in mind: lock in profits before a sharp decline. His entry had been at $16K and now that BTC is at near-record highs, he has locked in big profits. He has sold half of it, put short orders in and left the rest in position for long-term profits. His short targets? A correction to $ 50K–$60K.

BTC has not yet had a proper correction in this cycle. Bull runs have always had at least one 40-50% pullback before continuing. Trump is signing the agreement now and not months later and has altered the timeline of the market. Those who are still bullish despite this shift could be in for a surprise. Selling 15% off the top is smart if Bitcoin declines by 50%.

Bitcoin Strategy Shift for Maximum Gains

The trader’s plan is simple: Sell on strength and buyback on weakness. His short is in the range of $90K to $102K and his buyback is $50K—$60K. If executed well, this strategy could help him double his holdings in BTC and profit on the market downturn.

For most retail investors, this may appear to be a small dip. But veteran traders understand that Bitcoin is cyclical. The real goal is long-term accumulation. This correction is not the end of a bull market—it is a chance to buy at lower rates. Those selling now will have funds to invest at better rates and catch a future run.

Related Reading: Bitcoin (BTC) $90,000 Surge: Is It Ready for a Long-Term Bull Run?

How would you rate your experience?