Takeaways

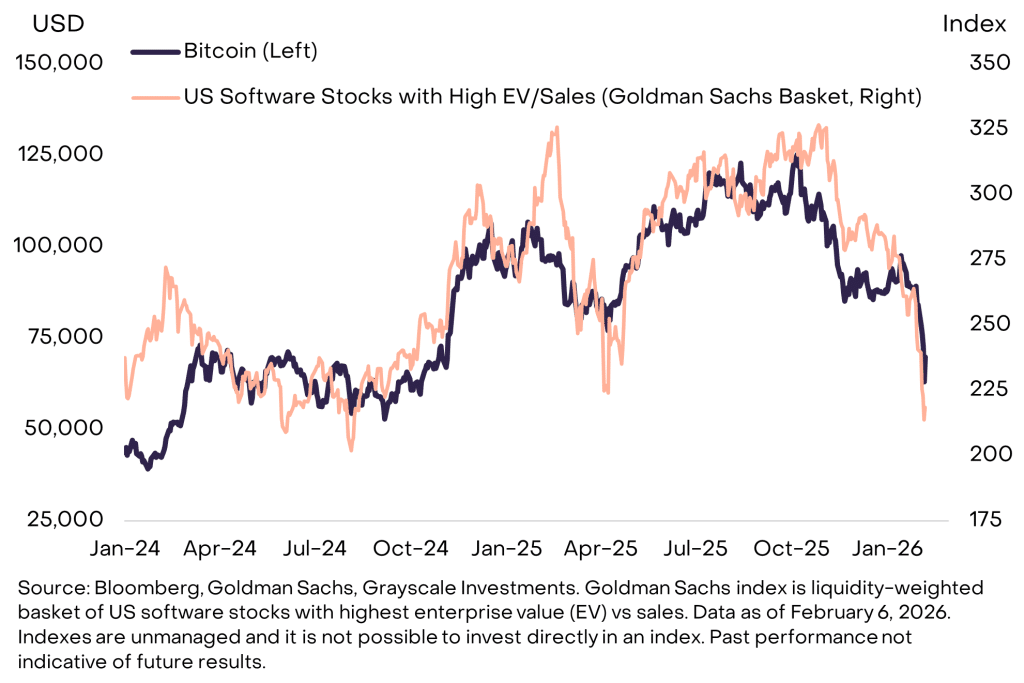

- Bitcoin moved with tech stocks during the recent sell-off.

- The asset shows traits of both gold and growth investments.

- Regulatory clarity and innovation may support a recovery.

According to the report, Bitcoin’s price dropped to nearly 60,000 dollars on February 5. It later regained some ground. The decline matched losses across high-growth software firms and early-stage technology stocks.

This pattern showed strong links between crypto markets and risk-focused equity portfolios. The move did not reflect a crypto-only shock. It followed a broader reduction in exposure to growth assets.

For more than a year, Bitcoin has tracked high-growth tech shares. Investors treated it as part of the same risk basket. When software stocks fell, Bitcoin followed. This relationship became clear during the latest drawdown.

Several crypto sectors lost more than half of their value in weeks. The scale of losses suggested forced selling and leverage unwinds rather than structural damage. Market data pointed to U.S.-based selling pressure.

Bitcoin Prices Drop on US Exchanges and Investors Rebalance

Prices on U.S. exchanges traded below offshore venues. Spot Bitcoin products listed in the United States also saw steady outflows in early February. At the same time, long-term holders stayed inactive. On-chain signals showed no large exit from early investors. This pattern suggested portfolio rebalancing instead of loss of faith.

Derivatives markets added more clues. Open interest in perpetual futures fell sharply since October. Funding rates turned negative across major tokens. These moves reflected widespread deleveraging. Such conditions often appear near local lows. Technical signals alone do not set direction. Still, they reduce downside pressure in the near term.

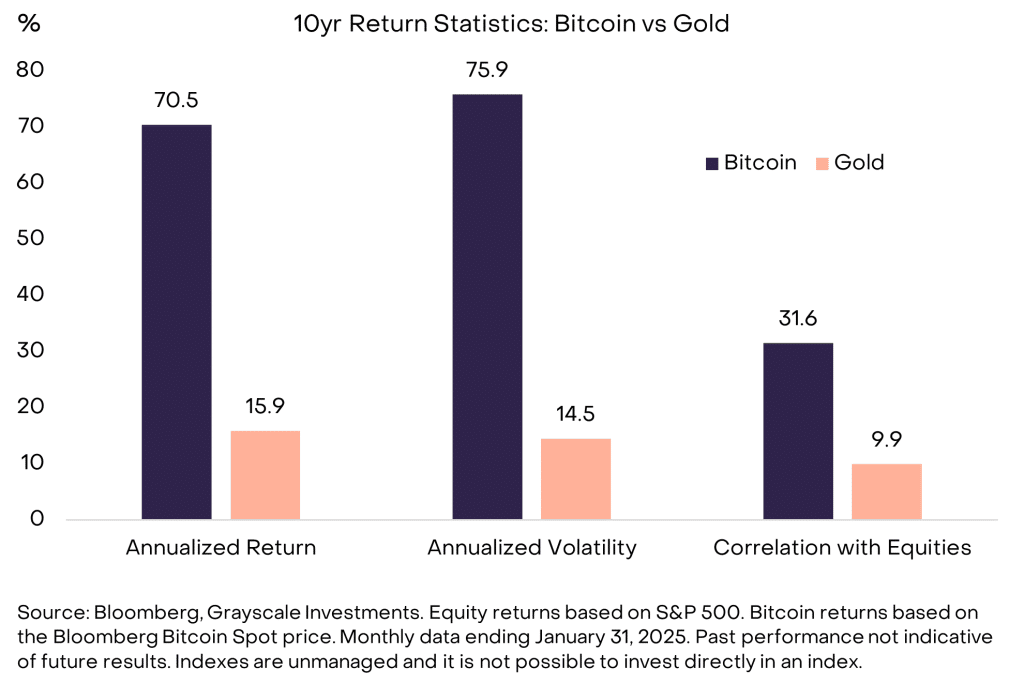

Bitcoin poses a key question for investors: is it like gold or a tech stock? It sits between both. Its fixed supply and independence support long-term value. The network has endured stress and runs globally. Yet Bitcoin is young. Unlike gold, it lacks deep historical acceptance and still reacts to growth expectations.

Ethereum and Solana Power Large-Scale Smart Contracts

Adoption continues to expand, but it has not matured. Investing in Bitcoin today means backing future use as digital money. If that future arrives, price behavior may stabilize. Volatility could fall. Correlation to stocks could weaken.

The path forward depends on several forces. Regulation stands at the center. Clear rules support stablecoins and tokenized assets. Progress may slow in some regions, but the global trend remains intact. Institutions continue to test blockchain-based settlement and payments.

Innovation drives fresh momentum. Privacy tools, perpetual futures, and prediction markets draw strong demand. Core infrastructure assets may gain first. Ethereum and Solana power large-scale smart contracts. Chainlink links data across networks. Zcash and Hyperliquid show interest in privacy and advanced trading.

Bitcoin stands apart. Its future rests on trust, security, and long-term strength. Price swings may continue. The real question is whether it fits the next computing era. That view will decide if investors treat Bitcoin as digital gold or a growth asset.

Also Read: Strategy Inc Becomes World’s Largest Corporate Bitcoin Holder with 713,502 BTC

How would you rate your experience?