- Bitcoin experienced its largest long liquidation event in the current bull run, with 7,500 BTC positions forcibly closed on April 6, triggering sharp price drops amid heightened market volatility.

- U.S. tariff hikes, proposed by President Trump, contributed to uncertainty, leading to significant outflows from Bitcoin ETFs, including $252.9 million from BlackRock’s IBIT ETF.

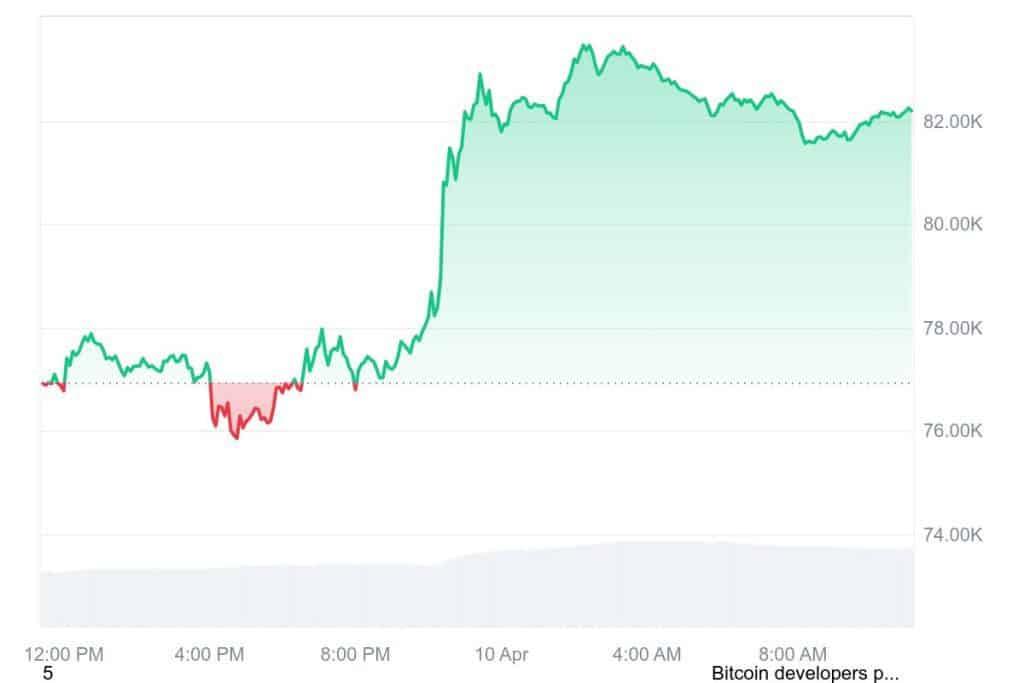

- Despite a rough week, Bitcoin rebounded from a low of $74,589.67, trading at $82,186, indicating potential for short-term recovery amid broader market turmoil.

The cryptocurrency market is currently grappling with significant uncertainty, with Bitcoin (BTC USD) at the center of attention. The leading digital asset has witnessed one of its most substantial long liquidations in recent history, as volatility surges amidst growing global concerns. While trade tensions and inflation fears loom over the market, some experts remain cautiously optimistic, suggesting that a recovery could be on the horizon.

Bitcoin has had a turbulent week, marked by a sharp drop in value and major liquidations. According to data from CryptoQuant, on April 6, the largest long liquidation event of the current bull run took place, with approximately 7,500 BTC positions being forcibly closed in just one day. This massive liquidation forced traders who had bet on Bitcoin’s price rise to lock in their losses.

The biggest Bitcoin long liquidation event of this bull cycle

— CryptoQuant.com (@cryptoquant_com) April 9, 2025

“On April 6, approximately 7,500 Bitcoin in long positions were liquidated, marking the biggest single-day long wipeout of the entire bull run so far.” – By @Darkfost_Coc

Read more ⤵️https://t.co/eqW2JE8TWD pic.twitter.com/IEthwRDRVz

Rising uncertainty in the global market, particularly in the wake of U.S. events, largely drove this dramatic sell-off. President Donald Trump’s economic policies. The announcement of tariff hikes sent ripples through the market, contributing to the liquidation frenzy and increasing volatility among investors. The hikes were later paused for 90 days.

Bitcoin ETFs See Record Outflows Amid Tariff Fears

The sudden price fluctuation of Bitcoin and other cryptocurrencies is directly linked to broader economic shifts. Analysts are pointing to President Trump’s proposed tariff hikes as a major trigger for the volatility. While his decision to pause the tariffs for three months temporarily alleviated some pressure, the fear of escalating trade wars and inflation continues to weigh heavily on market sentiment.

Bitcoin’s performance during this time has been notably erratic. Despite the recent price drop, analysts have highlighted a potential pattern forming in Bitcoin’s chart, the “Trinity Bottom,” which may suggest an impending price surge. However, people have mixed opinions on whether this pattern signals a short-term recovery or a more sustained downtrend.

THE HOLY TRINITY BOTTOM FOR BITCOIN!!

— Merlijn The Trader (@MerlijnTrader) April 4, 2025

This pattern flashed twice before.

Each time, $BTC rallied +81% on average.

It just triggered again.

You know what’s next. pic.twitter.com/6X9IvpYrYb

The uncertainty surrounding Bitcoin is also evident in the movement of Bitcoin Exchange-Traded Funds (ETFs). On April 8, Bitcoin ETFs in the U.S. experienced their largest daily outflow since March 11, with a staggering $326.27 million exiting the market. BlackRock’s IBIT ETF saw the largest outflow, losing $252.9 million, while Bitwise’s BITB and Ark 21Shares’ ARKB recorded smaller withdrawals of $21.7 million and $19.9 million, respectively.

The consistent outflows from Bitcoin ETFs over the past few days have left investors on edge, signaling that confidence in the market is waning. The broader market mirrored this trend as Bitcoin ETF trading volumes dropped to $3 billion, down from $6.6 billion on the previous Monday. Many traders are now waiting for further regulatory clarity before making any significant moves.

Bitcoin Bounces Back Amid Market Turmoil

These developments are impacting the global financial landscape. U.S. stock markets have suffered, with the Dow Jones down 0.84%, the S&P 500 falling by 1.57%, and the Nasdaq dropping by 2.15%. Japan’s Nikkei index plummeted by nearly 4%, while China’s Shanghai Composite posted a modest 1.3% gain. In Asia, investors had a mixed response.

Despite the challenging market environment, Bitcoin has shown signs of resilience. After dipping to $74,589.67 earlier in the week, Bitcoin rebounded strongly and is currently trading at $82,186, reflecting a 6.78% increase over the past 24 hours.

This rapid recovery has reignited hope among some investors that the sell-off may be temporary. Many are closely monitoring Bitcoin’s price action, wondering if the cryptocurrency will continue to rally or reverse course. The consensus among traders is one of caution, as market volatility remains high, and there is a strong call for patience until the dust settles.

Related | XRP Price Drops as Investor Sentiment Hits Extreme Fear

How would you rate your experience?