- Bitcoin is being positioned as a hedge against AI-driven corporate disruption.

- Strive Asset Management has raised $750 million to acquire bitcoin.

- CEO Matt Cole warns that half of the S&P 500 may disappear due to AI.

Strive Asset Management is preparing for an economic storm. The trigger is not inflation or war, but artificial intelligence. Matt Cole, CEO of Strive, sees AI as a force that may eliminate half of all entry-level white-collar jobs in the next five years. To weather this disruption, Strive is turning to Bitcoin as part of its strategy, viewing it as a financial hedge and a tool for long-term resilience.

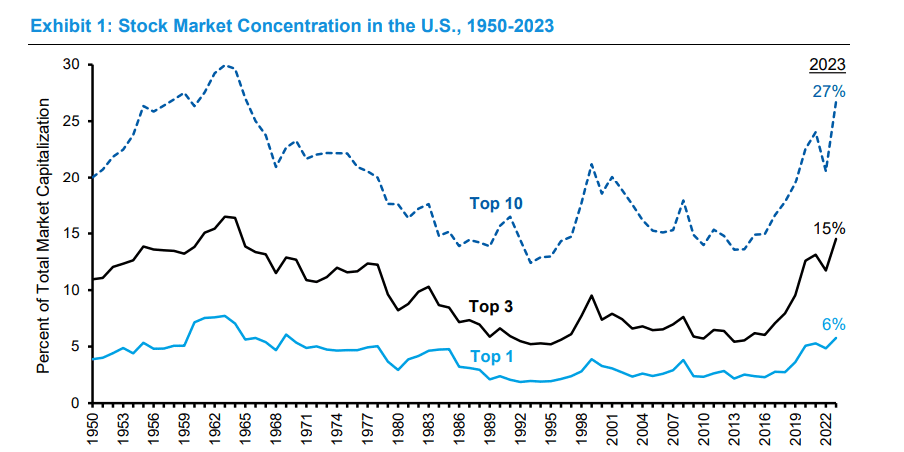

Worse, he thinks that nearly half the firms that make up today’s S&P 500 could vanish afterward. To combat this threat, Cole suggests using bitcoin as a tactical hedge. Just like the internet revolutionized the business landscape from 1990 to 2020, AI might do similarly. During that time many companies delisted from S&P 500 were replaced by rapidly growing technological giants.

Cole observes a repetition of history. He fears that firms which do not take action today will not be able to survive tomorrow with even reduced operations. His advice to the executive is to hold Bitcoins in great quantity at present to protect themselves from future damages. In late May, Strive completed a $750 million private investment in public equity (PIPE) transaction.

The purpose of this capital is very simple: acquire Bitcoin. Cole considers this digital asset a safe haven. It’s a decentralized alternative, completely dissociated from any specific industry. As AI undermines business profits and restructures sectors, Bitcoin brings steadiness along with long-term worth.

Breaking the Mold in Asset Management

Strive Capital does not conform to a traditional approach. The firm steers clear of political and ideological investment frameworks, including ESG and DEI. Instead, those concepts advocate for financial discipline and market resilience. Strive has approximately $2 billion in assets spread across thirteen ETFs and is forging its own path.

The team takes bolder approaches. Under Cole’s leadership, Bitcoin is not a hedge within an expansive strategy seeking higher returns but rather the very essence of the approach. Most firms focus on passive investing or “beta” strategies, which aim to replicate the performance of the overall market.

Strive intends to take a more active approach to “alpha” investing, which could potentially offer higher returns. This is a high-risk, high-reward strategy, but Cole believes the firm is well-equipped for it. Cole brings a wealth of experience managing $70 billion formerly at CalPERS, one of the largest U.S. pension funds. He also has personal conviction in Bitcoin since he purchased it back in 2016.

A Bold Strategy for an Uncertain Future

What makes Strive special is the unique blend of its experience. The leadership team includes bitcoin advocates and biotech experts. One board member comes from a hedge fund that exclusively invests in biotech. This provides Strive with a distinct advantage. They get innovation and are disruptive technology-friendly.

That’s an important requirement in such a fast-changing world. With the acceleration of AI, businesses will face greater pressures than ever before. Some will go under, others may adapt to the new conditions of life. Strive thinks that companies holding Bitcoin on their balance sheets would stand a better chance of surviving the AI age than their non-Bitcoin-holding counterparts.

Related Reading: Bitcoin’s Strategic Shift in 2025: Why Dolphins Are Dominating Accumulation

How would you rate your experience?