- Strategy launches 5 million STRC shares with a flexible 9% annual dividend to raise funds for Bitcoin purchases.

- STRC shares are priced at $100, with monthly dividend adjustments to maintain stability and attract investors.

- A $740M Bitcoin purchase highlights confidence in Bitcoin’s long-term market growth and price prospects.

Strategy, the largest corporate owner of Bitcoin in the world, has issued new stock. The company intends to offer 5 million shares of its Variable Rate Series A Perpetual Stretch Preferred Stock (STRC). This project will assist Strategy in raising capital to purchase additional Bitcoin and sustain its overall corporate requirements, according to a press release.

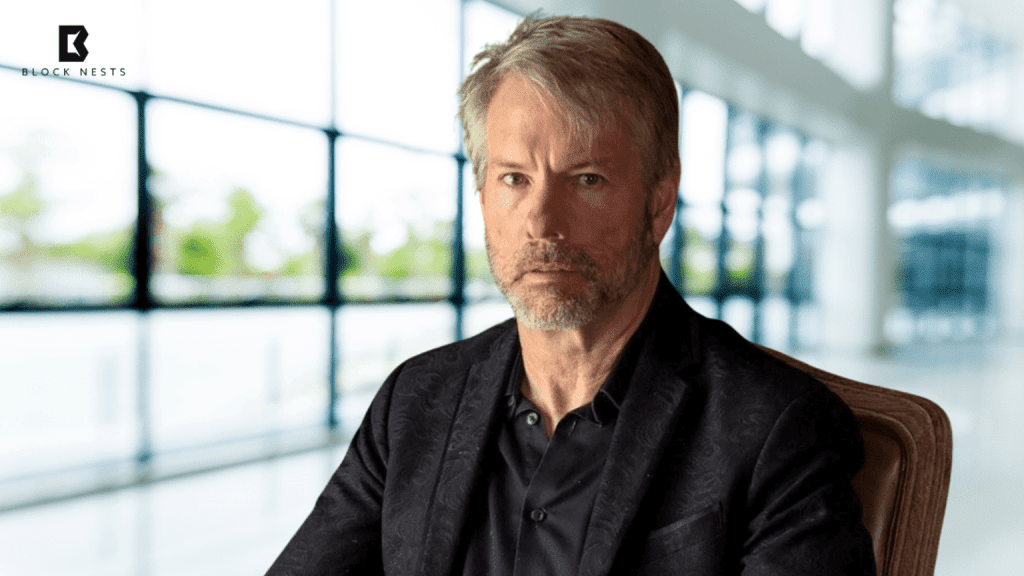

The offering proceeds will be used to fund general corporate purposes, specifically in the purchase of Bitcoin, and working capital requirements. Michael Saylor, Strategy’s founder, announced the news on X on Monday. The offering of the stock, IPO, will be open to a limited number of investors but each share of STRC will come with a 9% annual dividend. The dividend amount will be flexible and will change over time in accordance with market conditions.

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR pic.twitter.com/LaQSrrMsEg

— Michael Saylor (@saylor) July 21, 2025

STRC Dividend Structure

The shares of STRC will not feature a constant dividend rate like other stocks. The stocks will be sold at a price of 100 dollars each and the dividend will increase on a monthly basis. Initially, it will be charged at 9% annually but it will be adjusted according to market requirements. This new structure is meant to enable the stock to sustain the price above 100$ per share, which is very important in attracting investors.

This offer is after a $4.2 billion equity-raising project, which was announced this month. The proceeds of that offering will also serve to purchase additional Bitcoin that will strengthen the effort by Strategy to expand its Bitcoin balance. This is in line with the overall company plan of employing financial tools to increase its cryptocurrency assets.

Also Read: Michael Saylor’s Bitcoin Chart Post on X Triggers Fresh Strategy Speculation

Bitcoin Accumulation Strategy

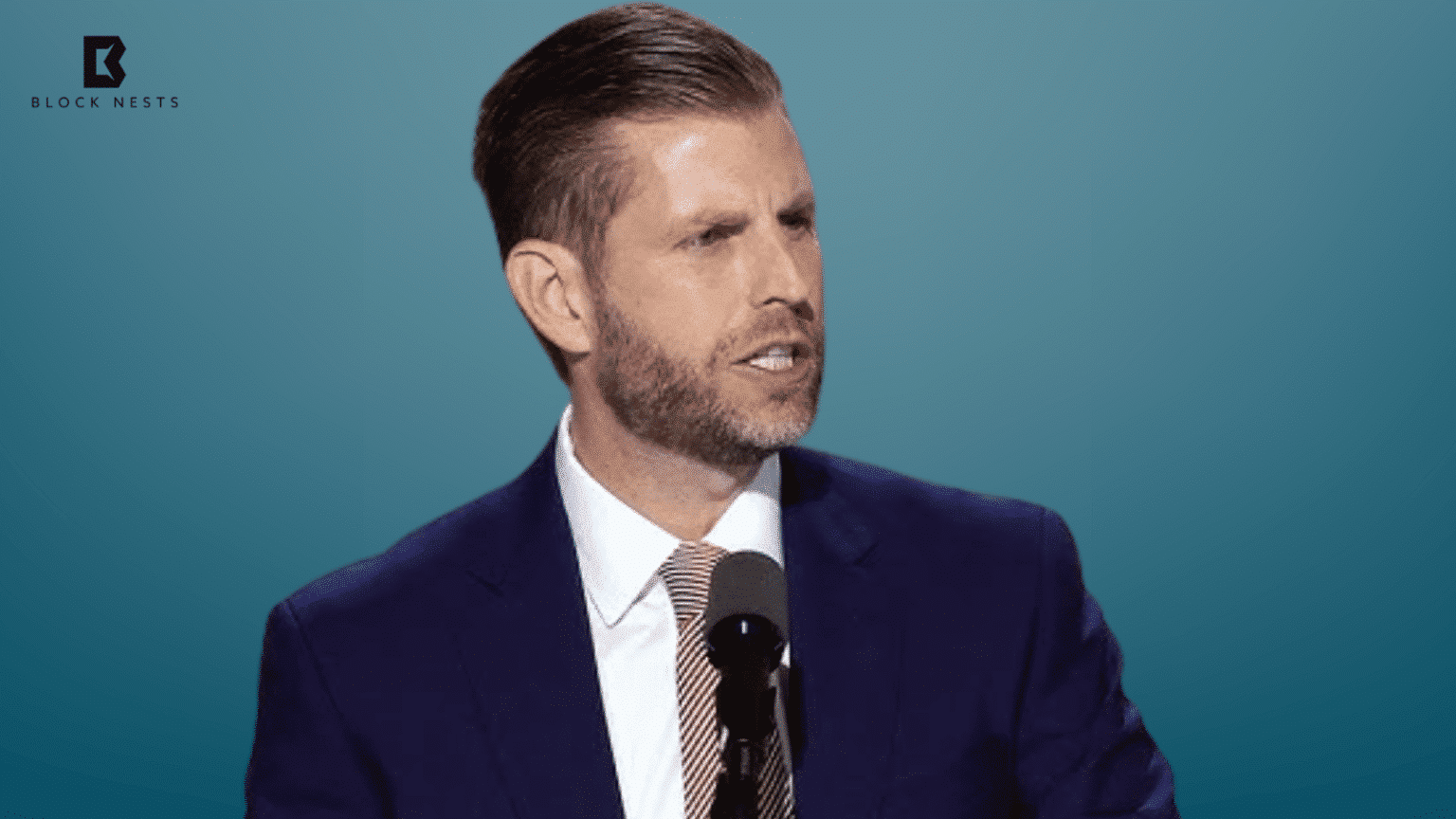

Bitcoin author Adam Livingston has called the new offering a new financial lifeform. He compared it to a synthetic stablecoin, in that it allows immediate conversion of fiat to Bitcoin. Livingston added that under the mechanism, Strategy can change the rate of dividends a month to maintain the stock at around $100. This will make STRC shares a secure source of Bitcoin accumulation.

$STRC pays a variable monthly dividend – starting at 9% per annum – compounded if unpaid, and paid in cash.

— Adam Livingston (@AdamBLiv) July 21, 2025

But here’s the kicker:

Strategy can tweak the rate each month to keep $STRC trading near $100 par like a synthetic stablecoin with yield.

You're not buying stock.…

Strategy purchased a significant amount of Bitcoin, totalling $740 million, that same day the announcement was made. The company purchased the cryptocurrency at an average price of $118,940 per coin. The decision is another indication of the faith that Strategy has in long-term Bitcoin price prospects.

Source: SEC

Bitcoin enthusiasts such as Blockstream co-founder, Adam Back opine that firms such as Strategy will enable the market valuation of Bitcoin to reach $100 trillion in the years to come. Strategy is also a leader in the rapidly expanding digital asset sector, with innovative services and Bitcoin purchases. The new stock offering is a major move by the company to facilitate institutional adoption of Bitcoin.

Also Read: Bitcoin-Focused Strategy: Sequans Adds $150M in BTC to Balance Sheet

How would you rate your experience?