- Swift introduces a blockchain-based ledger at Sibos 2025.

- Chainlink partnership strengthens institutional blockchain adoption.

- Global banks gain tools to connect existing systems with digital assets.

The global financial system is witnessing a major milestone. At Sibos 2025, Swift confirmed it will launch a blockchain-based ledger in collaboration with Chainlink. This marks the company’s most significant move yet toward digital assets.

It has, for many years, been the foundation of cross-border financial messaging. It is now, along with Chainlink’s oracle protocols, applying that same trust to a new generation of technology.

The new journal follows years of experimentation and pilot implementations. Tokenization, interoperability, and secure digital processes have been experimented on by Swift, among the globe’s largest banks. The journal will complement, rather than replace, the services it already offers.

By retaining current standards, blockchain enters the market, making it easier for institutes coming into blockchain. It is not merely the next set of tools. It would be a paradigm shift why the financial sector perceives blockchain. Blockchain no longer serves as an experimental domain; it now forms the basis of international finance.

Swift and Chainlink Strengthen Blockchain Partnership

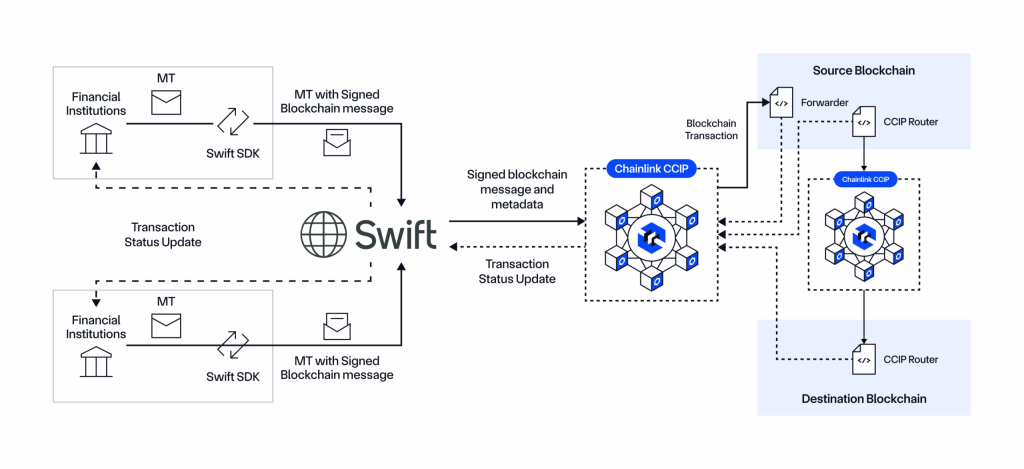

It features the long-time collaboration between Chainlink and Swift. Since over seven years, the latter has collaborated on initiatives that bring banks together with blockchain without compelling them to redesign their infrastructure. Chainlink, a pioneer in oracle networks, offers the necessary connection between blockcheser and external-world data.

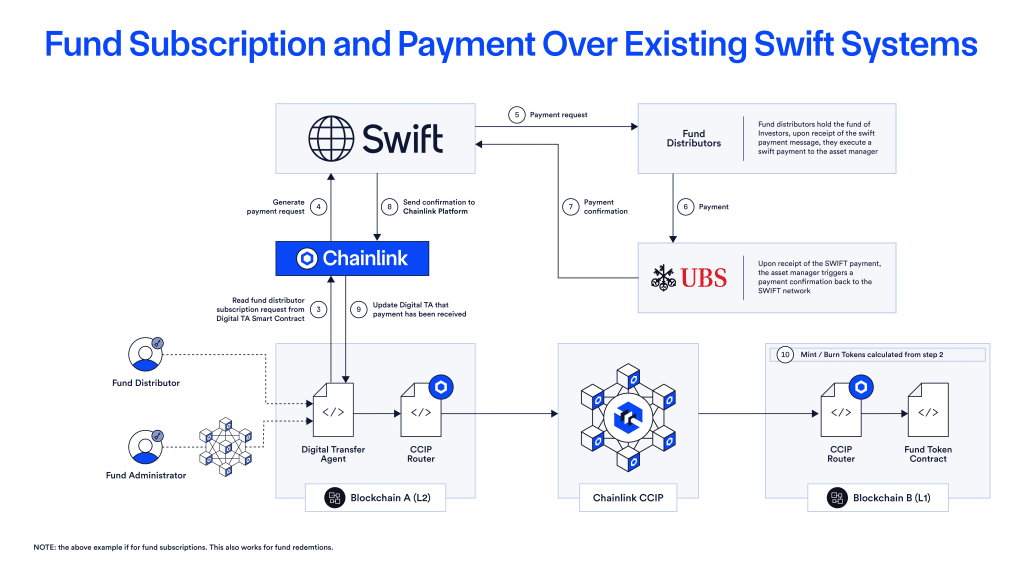

Alongside Chainlink, Swift has shown cross-chain transfers, fund transactions tokenized, as well as corporate action automation. In each instance, Swift’s conventional infrastructure bore messages as Chainlink provided blockchain connectivity. This combination provided institutions reason to play around with digital assets based on systems they trust.

At Sibos 2024, the collaboration launched a pre-production version of banks directly connecting to blockchains. That product is ripening into Swift’s blockchain ledger. The collaboration demonstrates that blockchain is capable of fitting into current constructs, easing adoption as well as the cost.

Institutions Find Trusted Path to Blockchain Integration

It has wider implications beyond a single network. Through the standards of interoperability, Swift allows common entry points among banks as well as among asset managers. Institutions are able to subscribe to tokenized funds, move assets between chains, as well as settle transactions, albeit still making use of Swift messages.

Leading companies such as UBS, Citi, and Franklin Templeton already experimented with these solutions. It is their engagement that reveals that tokenized finance is no future dream, but an active agenda. This is the industry that, through Swift’s new ledger, gets a reliable road map to scale up these initiatives.

It also substantiates that the financial infrastructure is converging on a hybrid approach. Classical rails are retained, but blockchain layers are being introduced to provide speed, clarity, and new services. Swift’s Sibos decision in 2025 is both ratification and catalyst of this movement.

The future chapter of finance is going to blotch the past. It combines time-tested infrastructure with blockchain innovation, enabling institutions across the globe to join the digital transformation.

Related Reading: Bitcoin Adoption Accelerates: Samson Mow Predicts Nation-State Shift

How would you rate your experience?