- Chainlink partners with World Liberty Financial (WLFI) to enable cross-chain transfers of the USD1 stablecoin using its Cross-Chain Interoperability Protocol (CCIP).

- The collaboration aims to boost mainstream adoption of USD1 by enhancing its utility across multiple blockchain networks.

- WLFI co-founder hails Chainlink’s infrastructure as key to bringing USD1 into broader DeFi and traditional finance use cases. He emphasizes its particular importance for cross-border payments.

Chainlink (LINK), the leading decentralized oracle network, has announced a strategic partnership with World Liberty Financial (WLFI). WLFI is a well-capitalized DeFi protocol backed by U.S. President Donald Trump. This collaboration aims to accelerate the mainstream adoption and cross-chain functionality of WLFI’s recently launched stablecoin, USD1.

🚨 WORLD LIBERTY FINANCIAL SAYS ITS "USD1" STABLECOIN WILL BE BACKED BY U.S. TREASURIES, DOLLAR DEPOSITS AND CASH EQUIVALENTS https://t.co/nCHzbCGre8

— *Walter Bloomberg (@DeItaone) March 25, 2025

However, at the heart of this partnership is Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This breakthrough technology is designed to enable seamless and secure transfers of assets across multiple blockchain networks. By integrating CCIP, World Liberty Financial will empower USD1 to move effortlessly between different chains. It will increase its accessibility and utility for users worldwide.

Zach Witkoff, co-founder of World Liberty Financial, emphasized the significance of the collaboration: “Chainlink’s battle-tested infrastructure delivers the institutional-grade security and extensive reach needed to bring USD1 into the hands of millions across a growing number of active, on-chain ecosystems. This partnership will enhance USD1’s role in cross-border payments and drive innovative applications bridging DeFi and traditional finance.”

Furthermore, this deal builds on WLFI’s prior use of Chainlink’s reliable data feeds for its AAVE V3 platform. It is now evolving to adopt Chainlink’s advanced cross-chain capabilities to broaden USD1’s ecosystem.

Chainlink Drives LINK Token Surge with New Integrations

The partnership will also bolster the adoption of Chainlink’s native LINK token by making it more relevant to institutional investors. It will expand Chainlink’s reputation as a critical infrastructure provider for secure, interoperable blockchain solutions.

Moreover, adding further momentum to Chainlink’s growth, the network recently revealed that the Fluid protocol has integrated CCIP and the cross-chain token (CCT) standard, enabling smooth asset transfers across Ethereum and Layer-2 solutions such as Base and Arbitrum.

Fluid (@0xfluid)—a decentralized lending protocol and DEX with $1.8B+ in Market Size—has adopted Chainlink CCIP and the Cross-Chain Token (CCT) standard to enable highly secure transfers of its FLUID token across @arbitrum, @base, and @ethereum.

— Chainlink (@chainlink) May 16, 2025

The Fluid community chose CCIP in… pic.twitter.com/MwwpLuvfVV

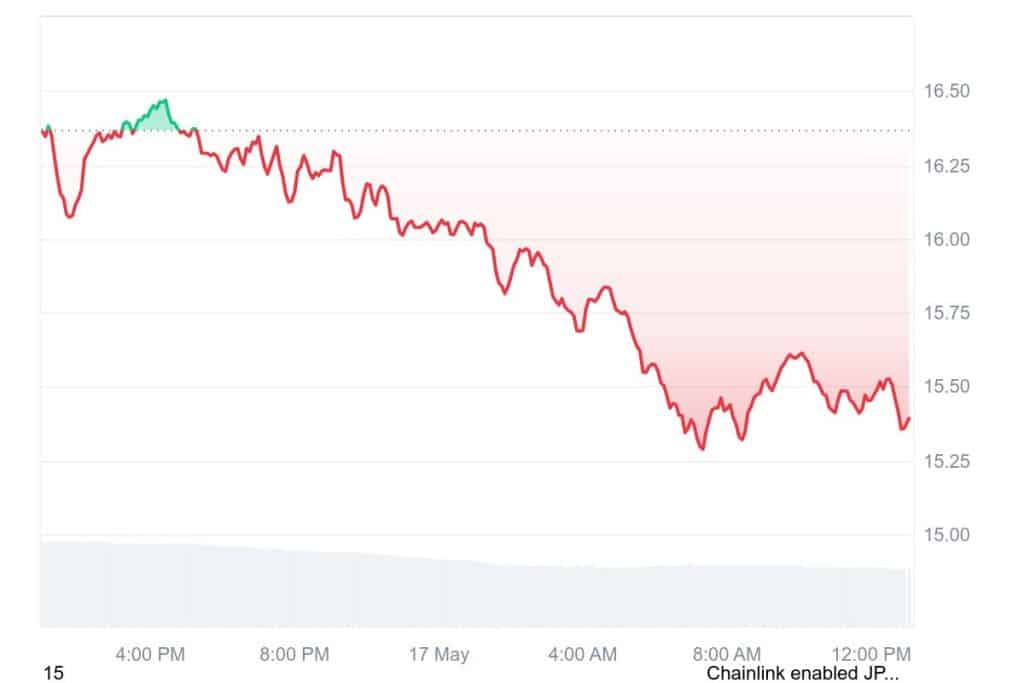

The rising adoption of Chainlink’s technologies has positively influenced LINK’s market performance. The token, which holds a market capitalization close to $15.9 billion and trades with a daily volume of approximately $477 million, surged more than 30% in the past month, reaching around $15.39 during the late trading session on May 17.

Furthermore, with Chainlink’s expanding role in powering secure, interoperable DeFi ecosystems, its partnership with World Liberty Financial marks a pivotal milestone in making stablecoins like USD1 truly cross-chain and globally accessible.

Related | Bitstamp Secures MiCA License for EU Crypto Expansion

How would you rate your experience?