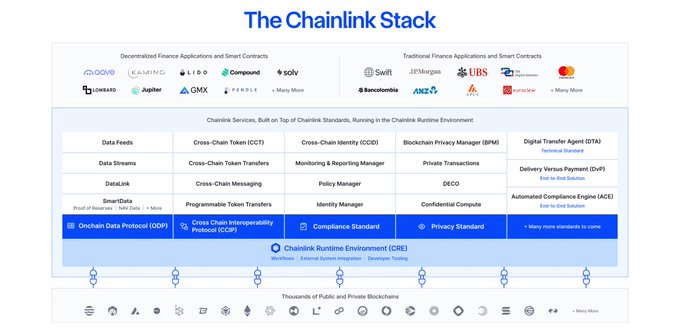

- Chainlink is emerging as the central infrastructure for onchain finance, supporting data, compliance, interoperability, and privacy.

- Leading financial institutions and DeFi protocols use Chainlink to manage multi-chain, multi-asset, and multi-jurisdictional workflows.

- Chainlink’s platform and CRE simplify complex transactions like PvP, DvP, and tokenized asset operations with secure, end-to-end automation.

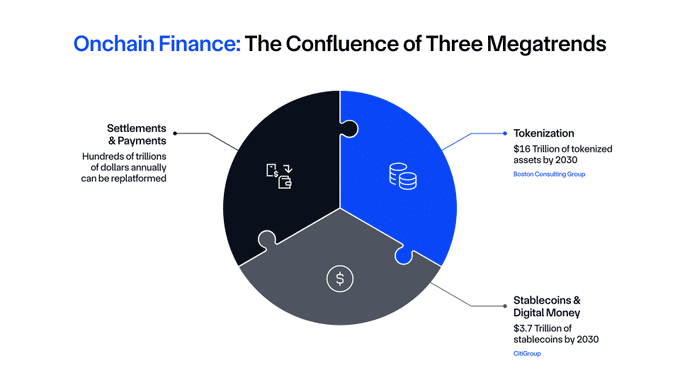

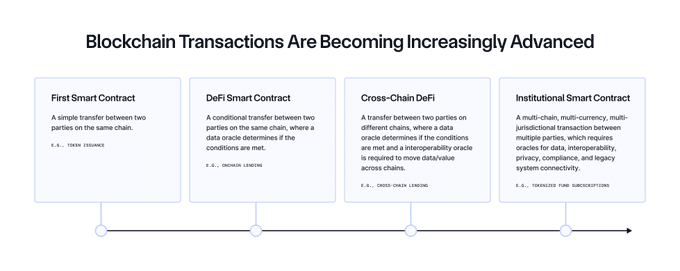

According to the report, the blockchain industry is evolving rapidly. Institutions now require workflows that match the complexity of global finance. Managing multiple vendors or building systems in-house slows growth and increases risk. Solutions like Chainlink help by providing secure and reliable data feeds, simplifying integration, and reducing operational challenges.

The Chainlink platform combines data delivery, compliance, privacy, interoperability, and orchestration in one solution. Large banks, governments, and DeFi platforms already trust Chainlink. They use the platform to move their traditional financial infrastructure to the blockchain.

This makes possible faster, cheaper, and more transparent services. It is a source of revenue for the Chainlink Reserve, which is an on-chain reserve for LINK tokens. LINK positions itself as the infrastructure for trillions of dollars in tokenized assets by 2030.

Chainlink Cross-Chain Token Transfers with Zero Slippage

Its infrastructure supports multi-chain, multi-assets, and multi-jurisdictions. Some of the services are ISO 27001 compliant and SOC 2 Type 1 attested, which indicates preparedness for production-level financial scenarios.

Cross-chain communication is very important. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables the safe transfer of data and tokens between blockchains. It comprises the Cross-Chain Token standard, making possible the safe, programmable, and zero-slippage transfer of tokens.

Compliance is also integrated by LINK. Through its Onchain Compliance Protocol (OCP) and Automated Compliance Engine (ACE), LINK enables institutions to implement compliance measures such as KYC/AML on smart contracts. Privacy oracles are used for maintaining the secrecy of personal information while facilitating cross-chain and offchain activities.

The LINK Runtime Environment (CRE) manages complex processes. It combines data, compliance, privacy, and interoperability to build reusable applications. CRE manages Payment-vs-Payment (PvP) and Delivery-vs-Payment (DvP) transactions to perform operations on more than one blockchain and legacy system.

Real-World Adoption and Advanced Use Cases

These institutions include ANZ Bank, Fidelity International, UBS, and J.P. Morgan, and they use LINK to support tokenized funds, cross-chain settlements, and CBDC integration. DeFi applications like Aave and Lido use Chainlink to secure market data, asset pricing, and cross-chain messaging.

It has handled transaction volumes of over tens of trillions of dollars and more than 18 billion verified messages. Its solution supports the accurate pricing of tokenized assets, automates the fund life cycle, and connects to existing systems in real-time.

Through the integration of disparate infrastructure, Chainlink represents the global standard in modern finance onchain. Chainlink combines data, interoperability, compliance, and privacy to allow institutions and developers to scale complex blockchain applications and build sophisticated, secure, efficient, and compliant workflow solutions.

Related Reading: Bitcoin Open Interest Plummets as Binance Dominates – What’s Behind the Shift?

How would you rate your experience?