- Crypto ETPs saw a record $2.9 billion in weekly outflows.

- Bitcoin and Ethereum faced the biggest withdrawals.

- Stablecoin reserves on Binance are shrinking, affecting market liquidity.

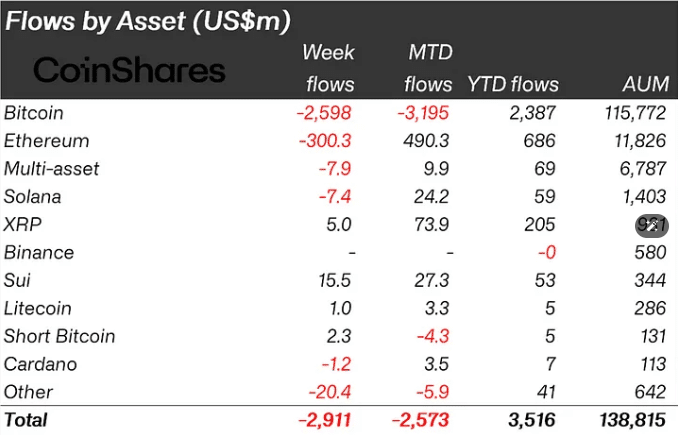

Crypto exchange-traded products (ETPs) faced an unprecedented sell-off. Investors pulled $2.9 billion from digital asset funds last week, marking the largest weekly outflow ever recorded. In the last three weeks, total outflows hit $3.8 billion, according to CoinShares.

Several factors drove this downturn. A recent security breach at Bybit, coupled with a hawkish stance from the U.S. Federal Reserve, weighed on sentiment. The prolonged 19-week inflow streak before this reversal suggests profit-taking played a role as well.

Regional outflows were led by the U.S., which saw $2.87 billion leave the market. Switzerland and Canada followed, recording $73 million and $16.9 million in outflows, respectively. However, Germany bucked the trend, attracting $55.3 million in fresh investments.

Bitcoin and Ethereum Take a Hit

Bitcoin suffered the heaviest blow. The flagship cryptocurrency saw $2.59 billion in outflows, erasing gains from previous weeks. Short Bitcoin products saw modest inflows of $2.3 million, indicating some traders are betting against further declines.

Ethereum wasn’t spared. The second-largest crypto recorded $300 million in outflows, its worst weekly performance to date. Other assets, such as Solana and TON, followed the downward trajectory, losing $7.4 million and $22.6 million, respectively.

Not all cryptocurrencies faced selling pressure. Sui emerged as the top performer, attracting $15.5 million in inflows. XRP also recorded positive sentiment, with $5 million entering its funds. Despite these bright spots, overall market confidence remained weak.

Crypto Liquidity Crisis: Binance’s Stablecoin Reserves Decline

A new report from CryptoQuant highlights another concern. Binance’s stablecoin reserves, particularly USDT and USDC, have been steadily declining throughout 2025. Stablecoins are crucial for maintaining market liquidity, as they provide traders with easy access to capital.

Data shows a persistent drop in weekly stablecoin reserves since the start of the year. Lower reserves suggest weakened buying power, limiting fresh capital inflows. This aligns with Bitcoin’s failure to break key resistance levels in recent weeks.

If this trend continues, the crypto market could face further liquidity issues. However, a reversal in stablecoin reserves may signal renewed demand, potentially setting the stage for a recovery. For now, investors remain cautious amid a shifting landscape.

Blockchain Equities Feel the Pressure

The broader blockchain sector also experienced turbulence. Blockchain-related equities saw $25.3 million in outflows, reflecting investor uncertainty. The recent sell-off suggests that traders are reducing exposure to crypto-linked assets, waiting for clearer signals before re-entering the market.

With liquidity concerns mounting and major digital assets under pressure, the next few weeks will be crucial in determining the market’s direction. For now, caution prevails.

Related Reading: Bitcoin’s (BTC) Bearish Trend: Opportunity or Warning Sign?

How would you rate your experience?