- GDP growth slowed to 2.3%, with inflation showing persistence at 2.4%. Jobless claims are also ticking up.

- Strong earnings but slowing growth projections led to a stock pullback, adding to broader market uncertainty.

- TradFi markets are shifting towards safety, impacting ETF flows and triggering a crypto downturn.

Weekly statistics yielded a mixed landscape and sent warning signals about market trends. The economy hit a peak in growth at 2.3%, down dramatically compared to the previous read at 3.1%, while Crypto markets mirrored the uncertainty, showing heightened volatility amid shifting investor sentiment.

Market update: https://t.co/yDkyKwtQGc

— Cryptonary (@cryptonary) February 28, 2025

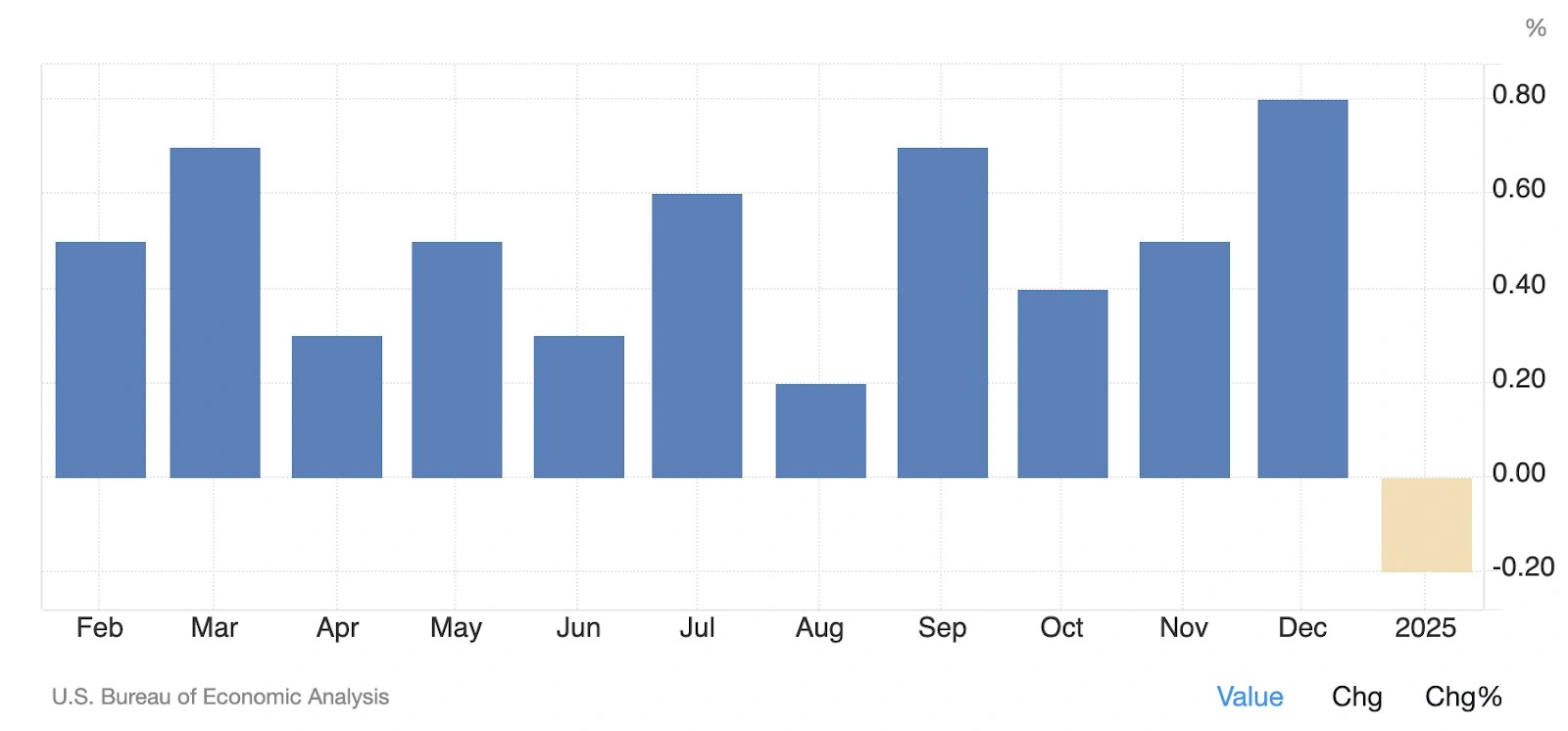

GDP’s prices component increased to 2.4%, better than expected. However, on Friday, we saw Core PCE Price Index at 0.3%, as expected, hinting at sticky inflation.

Economic Data Raises Market Concerns

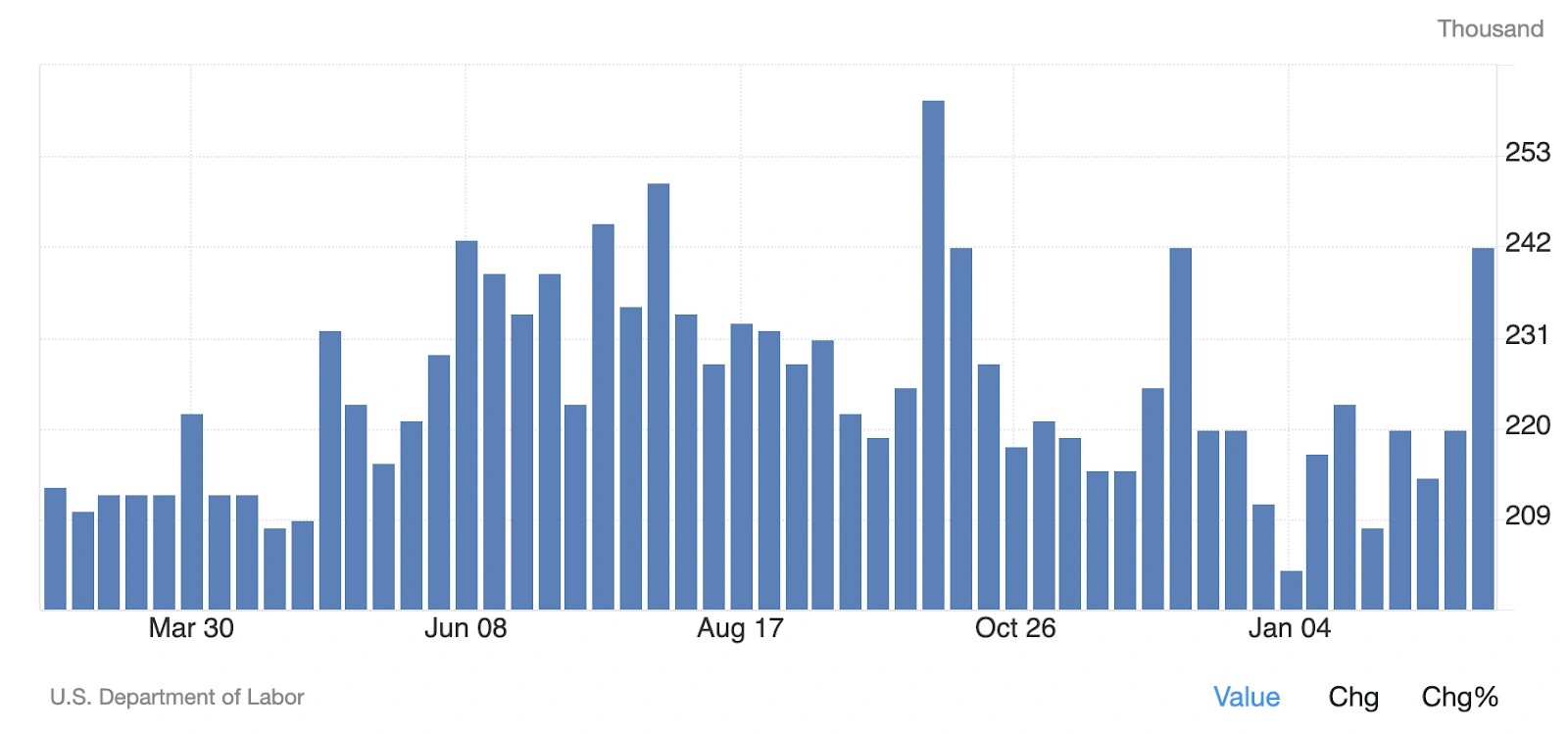

A key source of anxiety is slowing down growth in conjunction with persisting inflation, raising concerns about a state of stagflation. Personal expenditures figures fell steeply, down from +0.8% in the previous month to -0.2%, perhaps indicative of cautious consumer behavior in anticipation of tariffs. Also, unemployment claims have risen for the first time since December, hinting at early warning signals for a slowing in the labour market.

Personal Spending MoM:

Jobless claims are being observed in the market as a potential leading indicator for rising economic slowdown. It may be a warning for severe issues in mainstream markets and riskier assets such as crypto if this trend is prolonged.

Initial Jobless Claims:

Nvidia’s Earnings and Market Impact

Nvidia recorded record quarterly and annual revenue on Wednesday but warned about slower expansion in the period up to 2026. The share in the company increased before closing at new local bottoms on Thursday, echoing broader market unease.

Even as Nvidia posts good performance, failure to improve market sentiment illustrates how investor confidence is affected by uncertainty in fiscal policies and economic conditions and affects not just tech stocks but crypto as well.

Nvidia 1D Chart:

TradFi Flight to Safety and Crypto’s Struggles

Traditional financial markets have shifted towards safety this week as the US dollar index ($DXY) rose and yields for 10-year Treasuries fell. The major indexes, such as the S&P 500 and Nasdaq, dropped as well, indicative of a general risk-off sentiment.

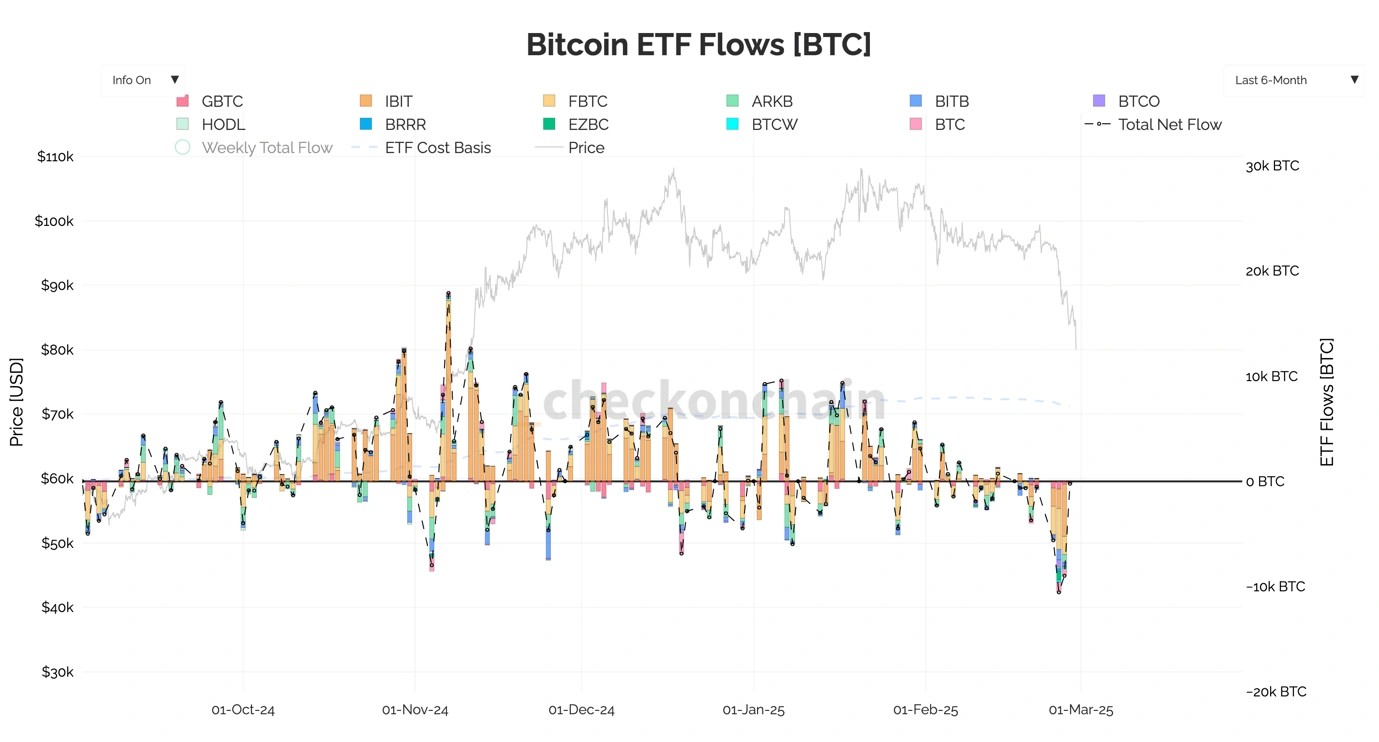

Cryptocurrency trends have mirrored this trend, as Bitcoin dropped some 17% since Monday. ETF withdrawals have risen, especially for funds like IBIT and FBTC, as a reflection that institutional players are second-guessing longer-term investments in a period of ongoing financial uncertainty.

Cryptonary’s Outlook

Uncertainty in the macroeconomic prospects exists as slowing down in growth, lingering inflation, and indecisiveness in policies in the new regime continue to destabilize investors.

Despite concerns being identified at the Federal Reserve, market players still keep in mind how policies in the future, including tariffs, may impact the economy. The situation is unfavorable for risk assets like crypto.

ETF Flows – larger net outflow:

Bitcoin and top cryptocurrencies have quickly oversold and can potentially experience a relief rally. The general expectation is still lower prices in the next few months, though, and in particular for altcoins.

Even though prices have fallen in recent times, Cryptonary is cautious about entering back in the market. Unlike being responsive to prices drops, there is focus on waiting for improved macroeconomic signals before undertaking increased risk.

Related Reading:Bitcoin’s (BTC) Bearish Trend: Opportunity or Warning Sign?

How would you rate your experience?