- Spikes in borrowing rates above 10-15% often signal market tops, while extended low rates (3-4%) suggest potential bottoms.

- Large-scale liquidations and total debt reductions have historically marked market bottoms and created strong support zones.

- High open interest levels indicate excessive leverage, while negative funding rates can precede price rebounds due to short liquidations.

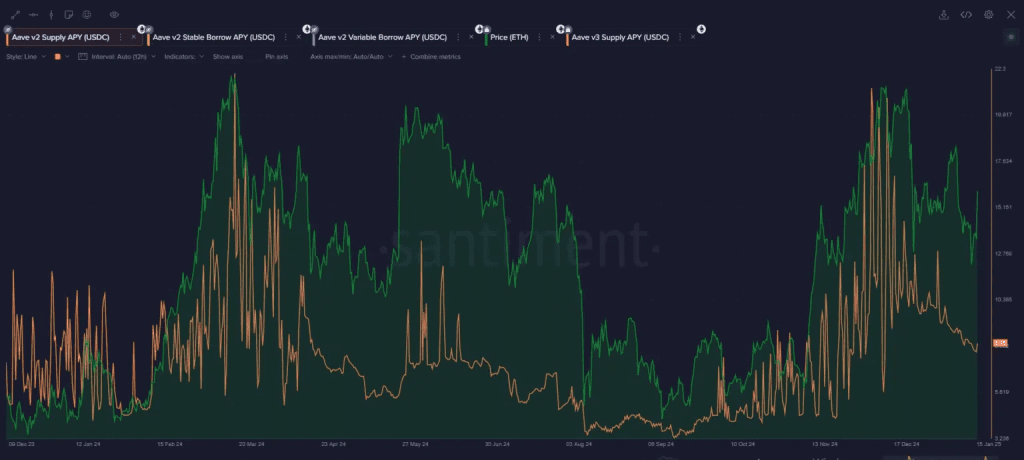

Santiment, an on-chain analytics platform, suggests through borrowing rates and liquidation patterns that they offer valuable insights on crypto market direction. As per the analysis done by the company, when the borrowing rate increases above 10-15%, it can be a sign of a market top as there is a lot of demand for leverage. Conversely, low and flat borrowing rates continuously for several weeks can be a sign of a market bottom and allow re-entry for investors.

Sentiment stresses the role of lending and borrowing data in crypto market cycles beyond price and social sentiment. The firm calls the idea the “value of money,” wherein borrowing rates on DeFi platforms Aave and Compound indicate the demand and supply of capital.

When the demand for loans rises, interest rises and the market overheats. Traditionally, increases in interest above 10-15% have accompanied market tops and long periods of 3-4% flat interest suggest reduced speculation and potential bottoms. The firm feels that the indicators may be used to decide when to be careful or to search for the opportunity to enter the market.

Additionally, Santiment highlights that the most reliable signal occurs when rates rapidly surge above their baseline, followed by an extended period of stable, low rates for 2-4 weeks, completing the bottoming process.

🤑 The crypto market moves in cycles, and one of the more overlooked methods to analyze these cycles is through DeFi lending and borrowing data. Instead of just watching price action or social sentiment, this article highlights how interest rates, debt levels, and liquidation… pic.twitter.com/4dZ8ZTriOh

— Santiment (@santimentfeed) March 26, 2025

Crypto Capitulation as Liquidation Trends Unfold

Apart from interest rates, Santiment introduced its “Blood on the Streets” indicator to analyze liquidations within the market, a factor in identifying capitulation events and cycle bottoms. The firm defines liquidations as occurring when the worth of a borrower’s collateral drops below the minimum threshold, triggering forced selling of assets.

Large-scale liquidations, together with declining overall debt levels, have historically signaled market bottoms. The primary indicators are overall liquidations, which represent the dollar value of forcibly closed positions; overall debt changes, which represent the change in borrowed amounts; and repayments, which represent voluntary debt reductions and potential trend reversals.

Santiment further added that most liquidations are caused by long leverage positions, where traders take stablecoins against crypto assets in order to purchase additional crypto. Short liquidations, where investors take crypto against stablecoins in order to bet on declining prices, occur less frequently but trigger rapid price rallies when they happen.

The analytics platform claims big liquidation events often mark local market bottoms. Where big liquidations occur in conjunction with a total reduction in debt, it reinforces a potential bottom signal. Aside from this, price levels where liquidations occur on a frequent basis become zones of support in the event of range-bound markets.

Sentiment suggests that traders watch for a combination of high liquidations and significant debt reductions to identify optimal trade entry points.

Open Interest & Funding Rates Signal Crypto Trends

Sentiment also emphasizes open interest figures—which measure the aggregate value of outstanding futures contracts—as another market indicator of value. A rise in open interest in a price advance frequently indicates too much leverage and hence a greater possibility for a correction.

In addition to the above indicators, the funding rates measuring the premium on perpetual futures relative to spot prices may provide valuable insights too. Long paying short and positive funding rates are indicative of bullishness, and short paying long and negative rates are indicative of bearishness. However, Santiment observes that negative funding rates have preceded price bounces because short liquidations contribute to upward momentum.

Related | Mt Gox Moves $1B in Bitcoin as Creditor Payouts Loom

How would you rate your experience?