- After Trump’s tariff threats caused market jitters, Bitcoin regained its $83K price, signaling its resilience as a potential safe-haven asset.

- Ethereum price dropped 13%, raising concerns about its long-term prospects amid competition.

- Solana is eyeing a breakout towards $200, with ETF approval rumors adding to its bullish outlook.

The global financial markets were on edge this week as former U.S. President Donald Trump’s tariff threats sent shockwaves through stocks and digital assets. Both equities and cryptocurrencies witnessed steep sell-offs early in the week amid uncertainty around new tariffs. However, a sudden announcement of a 90-day pause in the tariff rollout excluding China led to a dramatic market recovery, with Bitcoin reclaiming its $83,000 price level.

The initial wave of fear triggered a risk-off sentiment across markets, but the partial tariff suspension quickly restored investor confidence. Bitcoin’s bounce back from the dip highlighted its growing appeal as a resilient asset. While traditional safe havens like gold rallied in response to China’s 125% retaliatory tariff.

According to market intelligence platform Santiment, these trending tokens are leading the charge as crypto discussions heat up. Bitcoin remained steady, showing that it might be maturing into a hedge against macroeconomic instability.

🗣️ As the weekend kicks off, the top trending tokens seeing an uptick from their usual discussion levels of social media are:

— Santiment (@santimentfeed) April 12, 2025

🪙 Ethereum $ETH: Discussions have spiked revolving around Ethereum's performance compared to Bitcoin and other cryptocurrencies. Many users express… pic.twitter.com/IkdSpXET20

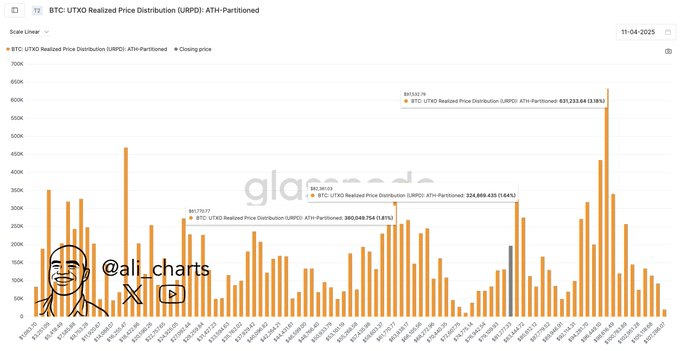

Bitcoin’s recent price action has sparked renewed debate about its role in investor portfolios. Is it a safe-haven asset like gold or just another volatile speculative play? While analysts are divided, the data shows Bitcoin held firmer than equities during the tariff-driven volatility. According to analyst Ali Martinez, Bitcoin has now broken above a crucial resistance level of $82,360. If upward momentum continues, BTC could target $91,500 in the near term.

Online discussions have also picked up around investment strategies such as dollar-cost averaging (DCA) and long-term holding (HODL). Many investors are emphasizing the importance of holding Bitcoin as a shield against market turbulence, especially when compared to other digital assets like Ethereum.

Ethereum dips 13 % despite crypto whale surge

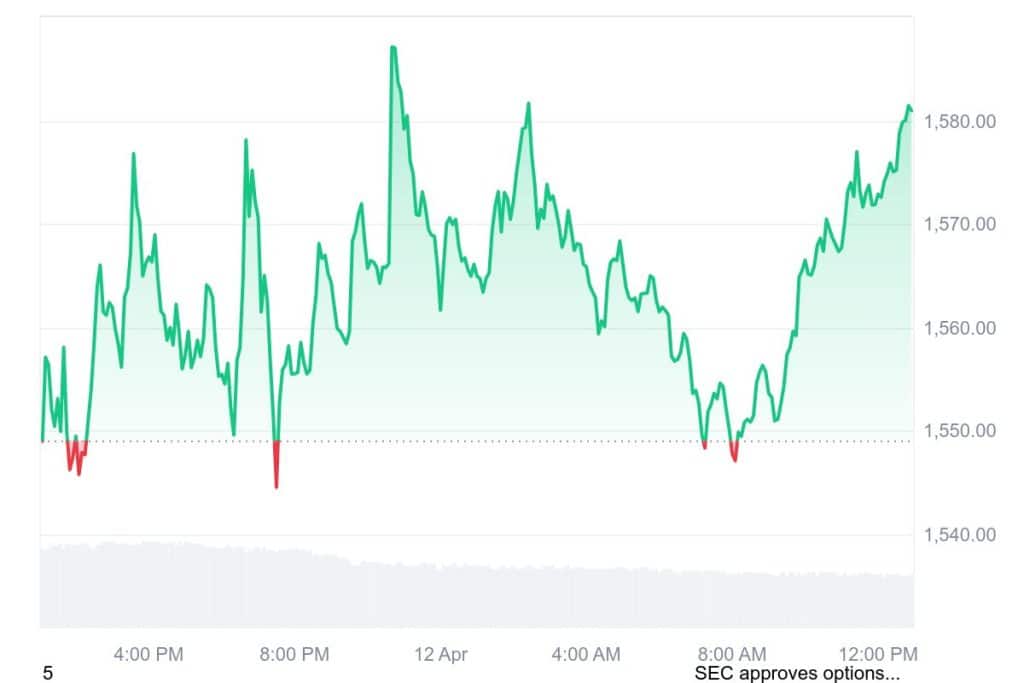

Ethereum is also trending, though with mixed sentiment. On-chain data from Santiment reveals a sharp increase in whale activity. Between April 9 and 10, ETH addresses holding between 1,000 and 10,000 coins rose from 5,376 to 5,417, the highest count since September 2023. This surge in whale accumulation typically signals long-term confidence in the asset.

However, Ethereum’s price performance hasn’t matched the optimism. ETH is currently trading at $1,581, down over 13% in the past week. The decline has sparked concerns about Ethereum’s long-term viability, especially amid rising competition from newer Layer 1 networks and its decreasing market dominance.

Altcoin ONDO has gained significant traction after being listed on Binance, the world’s leading crypto exchange by volume. The listing was approved via a community vote, further adding to the token’s credibility and investor appeal. ONDO trading officially begins on April 11, 2025, and anticipation is already high among retail and institutional investors.

The Binance listing could serve as a major catalyst for ONDO’s price performance and adoption. Many investors are optimistic about the token’s utility and future roadmap, especially within the DeFi and tokenization sectors.

Crypto Breakout as Solana Eyes $200 with ETF Hype

Solana continues to draw attention as analysts monitor its price action closely. SOL is currently testing a key breakout level and, if successful, could rally toward the $200 mark. The altcoin is also benefiting from rumors surrounding a potential Solana ETF approval in the U.S.

$Sol Receiving So Many Requests For #Sol Analysis, Solana Testing Crucial Resistances, I Will Try To Catch Some On Successful Breakout, It Can Easily Hit 200$ Area After Successful Breakout. pic.twitter.com/nzCy0w9Zfj

— World Of Charts (@WorldOfCharts1) April 11, 2025

Bloomberg’s James Seyffart confirmed that the final deadline for a decision is set for October 10, although there is speculation that the SEC could act sooner. With both technical and fundamental catalysts in play, Solana remains one of the most-watched altcoins on the market.

Beyond the major players, several smaller altcoins are also making waves. ORCA has emerged as one of the top daily gainers, catching the attention of traders looking for short-term opportunities. Its recent price spike has placed it firmly on the radar of momentum-driven investors.

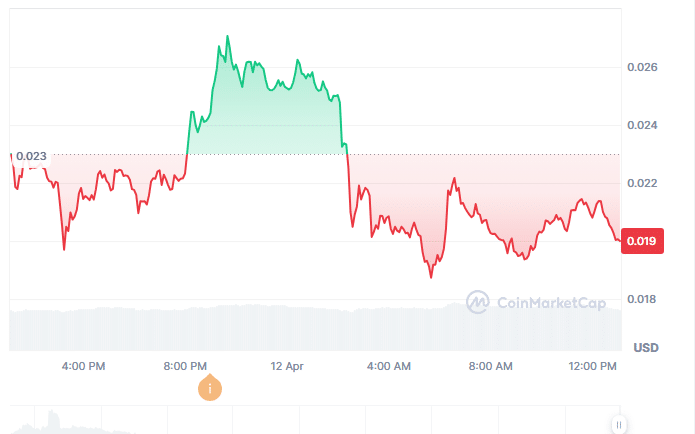

Onyxcoin (XCN) is also trending, with a 13% price increase in the past 24 hours, pushing it to $0.01999. Crypto communities are abuzz with bullish calls on XCN, with many traders highlighting its strong upside potential. As speculation grows, the token is drawing interest from both retail and institutional investors.

Related | FTX Unstakes 21 Million in Solana Triggering Market Concerns

How would you rate your experience?