- CRV drops 0.91% in the last 24 hours, with trading volume decreasing by 12.42% to $104.79 million.

- The price has fallen by 5.81% over the past week, highlighting ongoing challenges in the market for the token.

- RSI at 41.76 and MACD at -0.0066 strengthen the bearish outlook for CRV, indicating further potential downside.

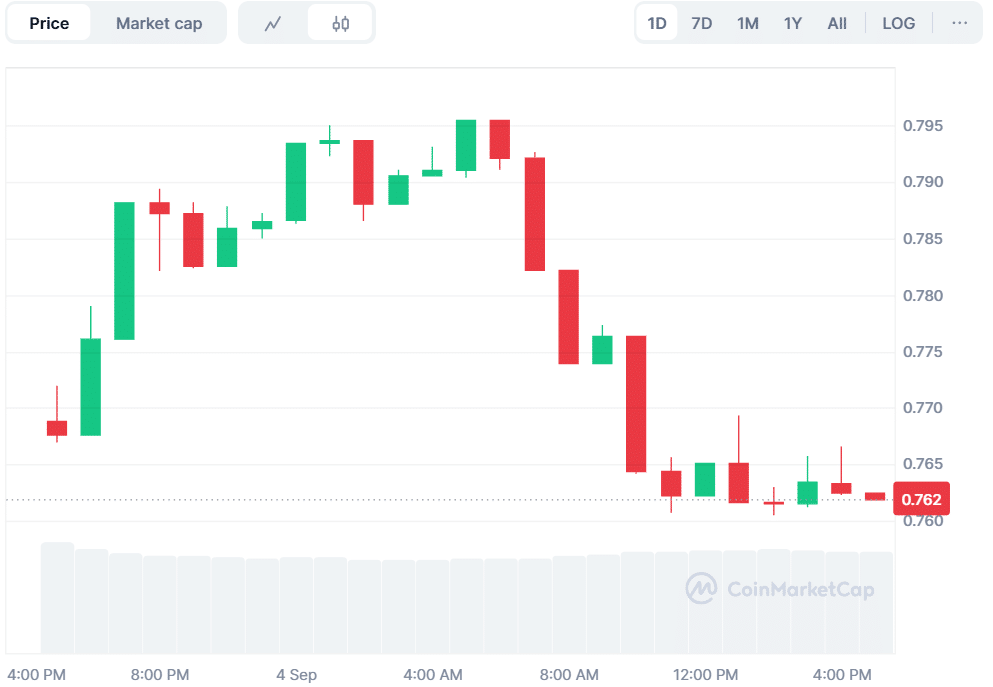

The Curve DAO (CRV) is currently trading at $0.7619, marking a 0.91% decline in the past 24 hours. The trading volume has declined by 12.42% and is currently standing at $104.79 million. This shows that there is a significant slowdown in the market activity.

Source: CoinMarketCap

CRV has declined by 5.81% in price over the last week. This steady decline indicates the difficulties that the token has experienced. The downward trend of price and volume indicates that Curve DAO continues to face challenges in the market.

CRV Faces Bearish Pressure from Falling Wedge

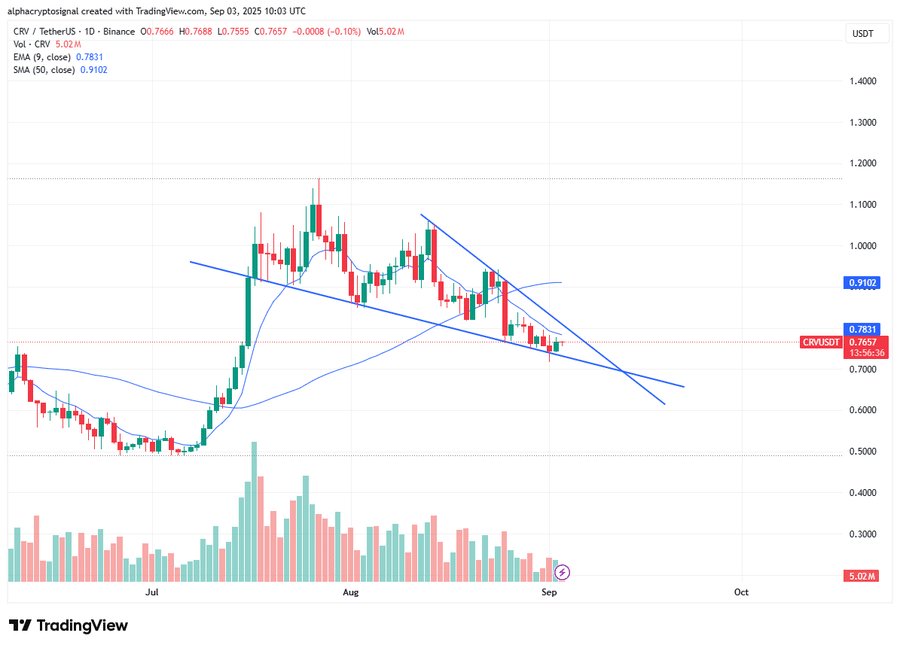

Crypto analyst Alpha Crypto Signal has highlighted that CRV is trading within a falling wedge. The falling wedges tend to shatter upwards, but CRV does not perform well under the 9-day EMA and the 50-day SMA. This shows a lack of bullish strength. The token has not taken off, indicating additional downside risks.

When CRV falls below the support of the wedge, then the market might decline to a level of $0.70 to 0.65. This would contribute to a bearish sentiment surrounding the token. The bearish outlook must be reversed by a recovery of $0.80 to $0.82. Nevertheless, CRV will probably be under pressure unless it breaks out.

Source: X

Also Read: SUI Group Crosses 100 Million SUI Tokens; Treasury Now Valued at $332 Million

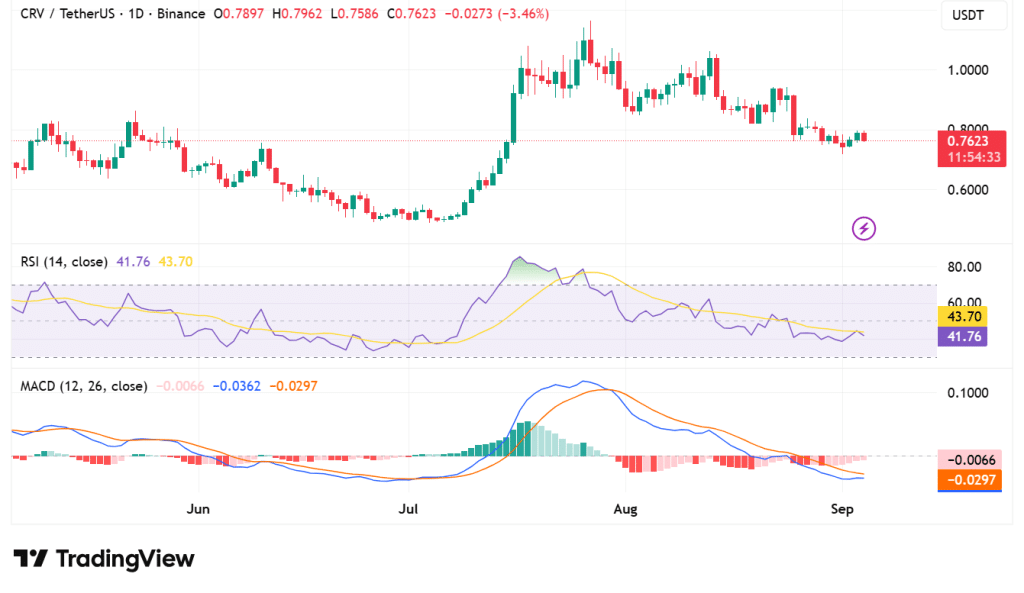

RSI and MACD Point to Low Momentum

The Relative Strength Index (RSI) is at 41.76, which is not yet oversold. The RSI value is lower than the 50 line, which indicates that buying momentum is low. The Moving Average Convergence Divergence (MACD) is currently at -0.0066. This is reinforcing the bearish stance, as the MACD is suggesting additional downward movement.

Source: TradingView

Bearish Trend Continues as CRV Volume Drops

According to CoinGlass data, the trading volume has dropped by 13.58% and currently stands at $248.79 million. The open interest has also fallen by 2.00% to $274.33 million. The OI-weighted funding rate is at 0.0039%, though this might change as the bearish trend may persist. These indicators indicate that the short-term outlook of CRV is not so bright.

Source: CoinGlass

CRV is struggling with a challenging market environment. The token itself is grappling with downward price and volume changes. Major support is between $0.70 and $0.65. In case CRV fails to regain $0.80 to $0.82, the predicted bearish tendency will persist. The subsequent course of action should be determined by investors by monitoring additional price fluctuations.

Also Read: Ripple Expands RLUSD Stablecoin Across Africa with Chipper Cash, VALR, and Yellow Card

How would you rate your experience?