- Governments accelerate tokenization plans to digitize and unlock national assets.

- NYSE advances a new platform for trading tokenized stocks and ETFs.

- Tokenized gold markets surge as adoption strengthens across financial sectors.

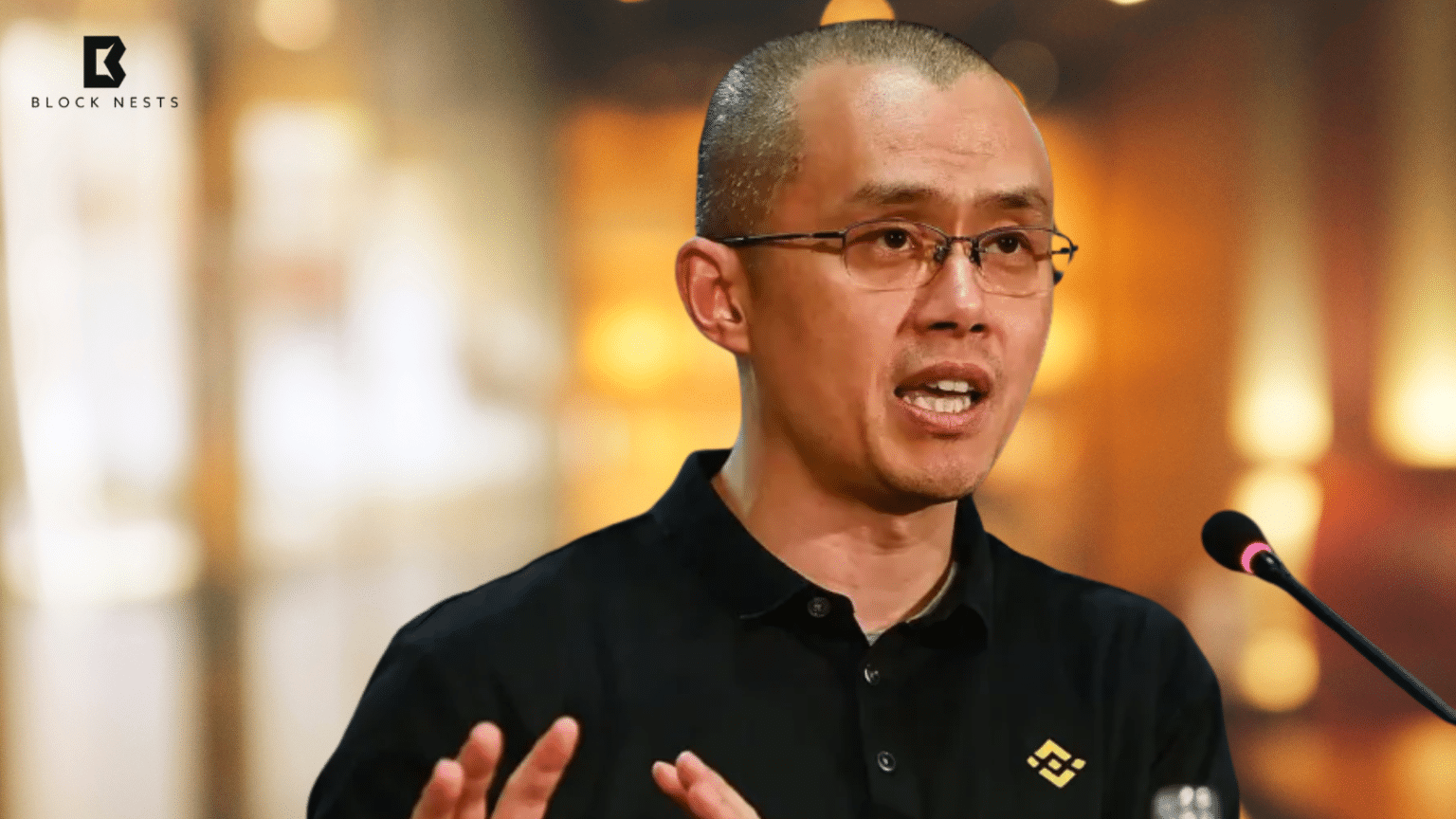

Governments are accelerating their interest in tokenization, according to Binance founder Changpeng “CZ” Zhao. He said more than a dozen states are discussing the shift of national assets onto blockchains. His remarks at Davos signal a growing institutional move toward large-scale digital transformation.

Zhao said tokenization is emerging as the next phase of crypto adoption. He described exchanges and stablecoins as the two categories already tested globally. Governments now want to advance beyond these sectors.

Zhao noted that most other crypto industries remain small. Tokenization stands apart because it targets major economic systems. He emphasized that governments want greater control and transparency over asset management.

.@cz_binance on what’s working in crypto – and what’s next – at @wef Davos 🔥

— YZi Labs (@yzilabs) January 22, 2026

What's proven at scale: exchanges & stablecoins.

The next frontier:

> State-level tokenization of assets

> Crypto as the invisible payment rail

> AI agents transacting autonomously, using crypto as… pic.twitter.com/PG3eoNBMRV

State-Led Tokenization and Its Structural Advantages

Zhao explained why states want to tokenize public assets. They aim to unlock liquidity for early financial gains. They also want to use these proceeds to support domestic markets and infrastructure.

He said government-led tokenization differs from private projects. State assets include sovereign debt, commodities, and public real estate. These can be represented as tokens that enable fractional ownership and continuous trading.

He added that tokenized structures improve settlement speed. Smart contracts can automate payments and distribution. Governments also retain visibility over issuance and circulation.

Zhao’s comments align with recent developments. Pakistan announced plans to tokenize up to $2 billion in sovereign debt. The effort aims to modernize its public debt system and widen access for retail investors.

Traditional markets are also moving toward tokenization. The New York Stock Exchange said it is building a platform for tokenized stocks and ETFs. The system will offer 24/7 trading and on-chain settlement once approved.

Also Read: Binance Listing Marks a New Era for RLUSD’s Global Expansion

Zhao welcomed the NYSE initiative. He called it positive for market evolution. He said it confirms that major institutions see value in blockchain settlement.

This is bullish for crypto, and crypto exchanges. https://t.co/zqCOlbBW7V

— CZ 🔶 BNB (@cz_binance) January 19, 2026

US Regulators Advance Controlled Tokenization Programs

Regulators in the United States have also taken a step forward. The Securities and Exchange Commission issued a no-action letter to the Depository Trust and Clearing Corporation. The letter allowed a controlled tokenization program for Treasuries, ETFs, and Russell 1000 equities.

The DTCC intends to roll out the service at the end of 2026. It will be based on approved blockchains. It claimed tokenized instruments will have the same legal coverage as traditional securities.

The market data indicate increased adoption. The total net value of tokenized gold products had nearly increased by $2.8 billion in 2025. Their market capitalization increased by 177% year-over-year.

As interest grew, trading activity improved. Volumes were comparable to large international gold vehicles. This shift solidified tokenization as increasingly large parts of financial markets.

Now, there appears to be unity among governments, institutions, and regulators. Both of the companies are developing systematic blockchain implementation programs. Their joint efforts provide an indication of the larger change with tokenization.

Also Read: Crypto Enforcement Rises as Russia Splits Legal and Illegal Mining Markets

How would you rate your experience?