- DOGE drops 7.44% in 24 hours but posts a 14.24% weekly gain, signaling resilience despite short-term loss.

- Strong support holds above the 50-day MA, with resistance targets at $0.35, $0.45, $0.60, $0.75, and $1.00.

- RSI at 60.88 and MACD positive, but falling volume and open interest point to weakening market momentum.

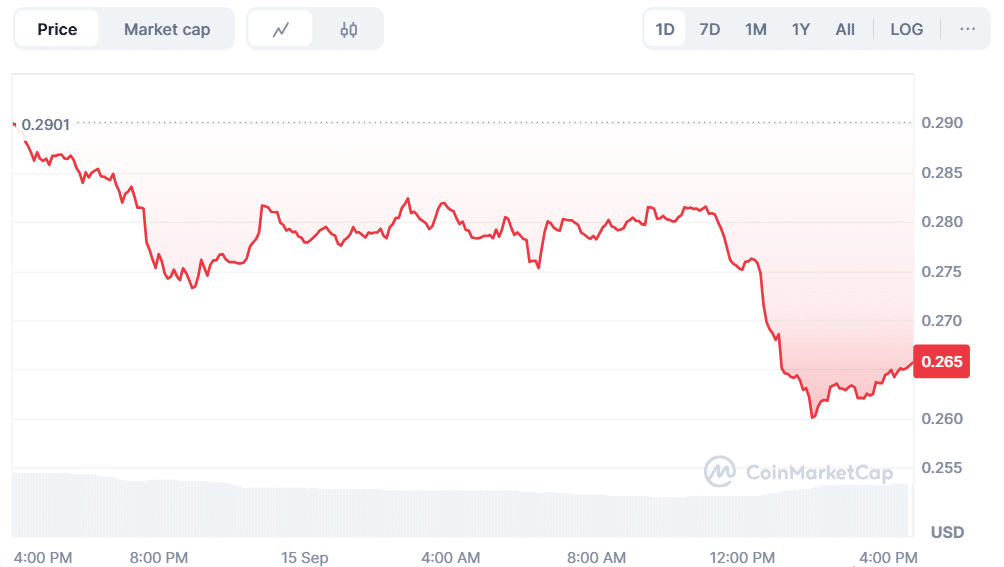

Dogecoin (DOGE) is currently trading at $0.2657, declining by 7.44% in the past 24 hours. The trading volume is decreased by 17.82% to reach $6.45 billion, indicating less activity in the market. Nevertheless, the token has soared by 14.24% in the week. Analysts observe that DOGE is rounding a bottom on the weekly chart, which indicates the establishment of a new long-term recovery.

Source: CoinMarketCap

DOGE Consolidates with Targets Up to $1.00

Analyst Jonathan Carter highlighted that DOGE is completing its bottom rounding form following the months of flat trading. The price remains high above the 50-day moving average that shows unwavering buyer pressure and the base. This level has served as a defensive line, which serves to support the larger bullish formation that occurs in the weekly chart.

Such a technical foundation might pave the way to additional positive momentum in case market demand improves. Resistance levels are being closely monitored at $0.35, $0.45, $0.60, $0.75 and $1.00. These checkpoints mark out the subsequent growth steps, and these are also significant challenges that DOGE must overcome to verify a sustainable rally.

Source: X

Also Read: Gemini’s Nasdaq Debut Signals Growing Institutional Interest in Crypto

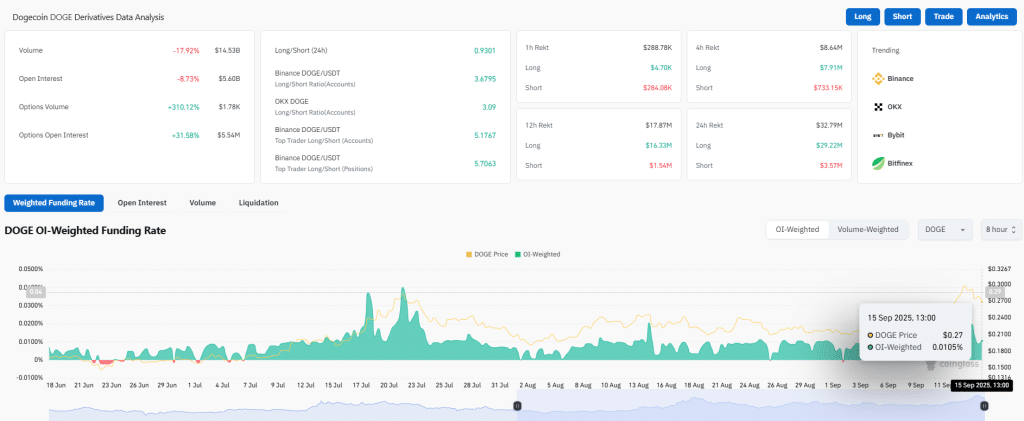

Open Interest and Volume Drop

According to CoinGlass data, open interest has declined 8.73% to $5.60 billion. The trading volume fell by 17.92% to $14.53 billion. The OI-weighted rate of funding currently stands at 0.0105%, implying a more balanced positioning.

Source: CoinGlass

RSI and MACD Indicate Neutral to Bullish Trend

The Relative Strength Index (RSI) stands at 60.88, and the signal line stands at 58.22. This places DOGE in a neutral to bullish range, while still permitting areas that are not overbought. Nonetheless, a decline of less than 50 would signal sentiment weakness and loss of momentum.

The MACD indicator shows a positive alignment. The MACD line is 0.01378, and the signal line is 0.00809. The current reading on the histogram is 0.00570. The rising positive spread shows the drive of the bull market, but the closing gap is a sign of weakening power.

Source: TradingView

Although recent declines are observed, the big picture is still favorable on the side of DOGE. Buyers are still above critical averages, which is consolidating the long-term perspective. In the short run, market conditions are still quiet, yet DOGE may be trying to test higher resistance once the demand revitalizes.

Also Read: Bill Morgan Shifts Focus: Why It’s Hard to Stay Angry at Coinbase Over XRP Delisting

How would you rate your experience?