- Dogecoin hit a low of $0.13 on April 7, its lowest point since October 2024, reflecting broader market struggles and investor uncertainty.

- Large investors (whales) have offloaded 1.32 billion DOGE, intensifying the downward price pressure as they control around 47% of the total supply.

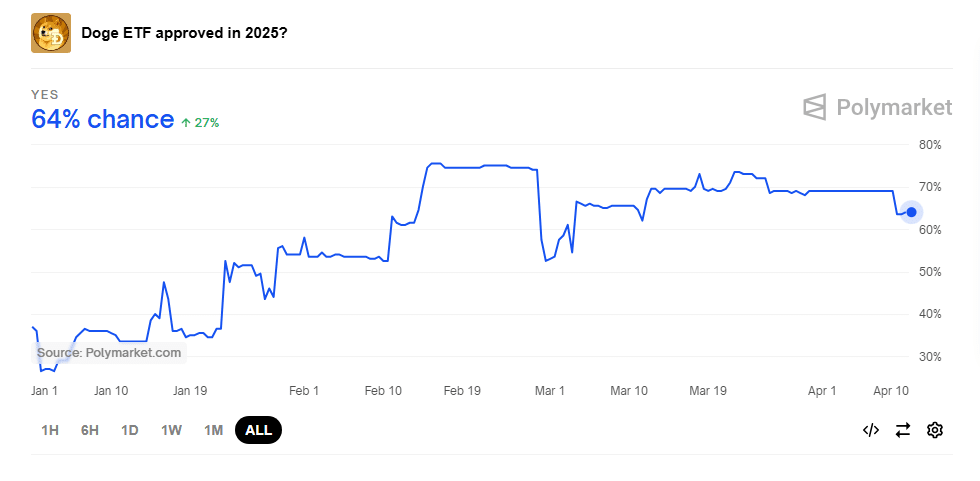

- A 64% likelihood exists that a Dogecoin spot ETF could gain approval by 2025, which may have a more significant impact on price movements.

Doge has not been spared from the recent downturn in the cryptocurrency market. On April 7, the price of Dogecoin (DOGE) dropped to a low of $0.13, its lowest level since October 2024. This sharp decline mirrors the broader struggles faced by many cryptocurrencies, as the volatile nature of digital assets continues to impact investor confidence and market sentiment.

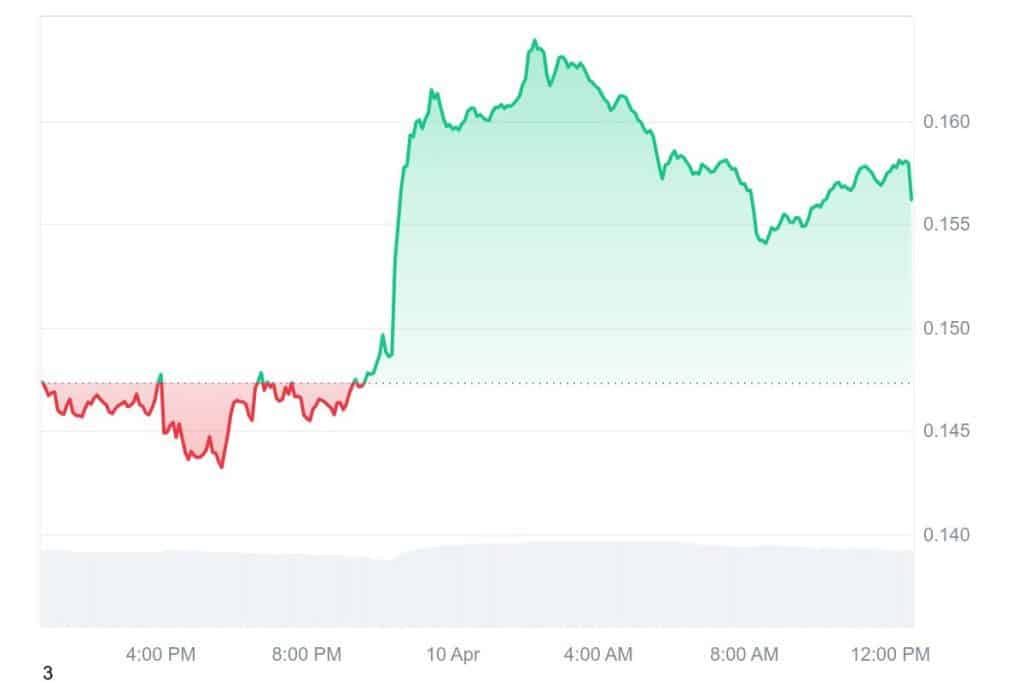

In the days following the crash, Dogecoin experienced a slight recovery, with its price hovering around $0.1556, according to CoinMarketCap. However, this still represents a 4.75% drop in value over the past week. The price fluctuation reflects the ongoing volatility in the market, as investors continue to react to shifting conditions and external pressures.

A key factor driving Dogecoin’s recent decline has been the actions of large investors, or “whales,” who control significant portions of the token’s circulating supply. According to Ali Martinez, in the past 48 hours, these whales have offloaded a staggering 1.32 billion DOGE, worth more than $190 million at current prices. This massive sell-off has increased the overall supply of Dogecoin in circulation, further pushing the price down.

Whales sold over 1.32 billion #Dogecoin $DOGE in the last 48 hours, as shown by data from @santimentfeed! pic.twitter.com/K3n6sD03Kl

— Ali (@ali_charts) April 9, 2025

Dogecoin Slips as Whales Control 70 Billion Tokens

As of now, whales control approximately 47% of the total Dogecoin supply, holding around 70.5 billion tokens. These large investors wield significant influence over the market. Their actions can have a ripple effect, with the influx of tokens into the market potentially putting more downward pressure on Dogecoin’s price.

If demand remains stagnant or continues to weaken, the price could face additional declines. Furthermore, the sight of large sell-offs could lead to panic among smaller investors, causing them to sell in fear of further losses, which would only intensify the negative price momentum.

Despite the challenging market conditions, there are still efforts to integrate Dogecoin into traditional financial markets. On April 9, 21Shares, a leading issuer of crypto exchange-traded products (ETPs), announced the launch of a Dogecoin ETP on the SIX Swiss Exchange, under the ticker DOGE.

This move comes after a strategic partnership with the House of Doge, a key figure in the Dogecoin ecosystem. The ETP is 100% physically backed, offering investors a transparent and regulated way to gain exposure to Dogecoin through conventional financial channels.

64% Chance of Dogecoin ETF Approval by 2025

However, the market response to the news has been muted, with Dogecoin’s price showing little movement in the aftermath of the announcement. This lack of price action suggests that the ETP launch may not be enough to reverse the current trend or provide significant bullish momentum for the meme coin in the short term.

Looking ahead, the introduction of a spot Dogecoin exchange-traded fund (ETF) could potentially have a more pronounced effect. Prominent investment firms such as Bitwise and Grayscale have expressed intentions to launch their own Dogecoin ETFs, and according to predictions from Polymarket, there is a 64% likelihood that one of these ETFs will receive approval by the end of 2025.

Related | XRP Price Drops as Investor Sentiment Hits Extreme Fear

How would you rate your experience?