- Dogecoin investor sentiment plunges to a yearly low, signaling strong market bearishness.

- TD Sequential indicator triggers bullish signal; analysts eye a bounce from $0.16 support level.

- Whales aggressively buying DOGE amid bearish sentiment, hinting at potential price rebound.

Dogecoins investors’ optimism has hit a one-year low which shows that a bearish attitude prevails in the market. According to the Santiment Feed shared by the noted analyst, Ali Martinez on 11th of March, indicated that Dogecoin hit an extremely bearish region signified by a reading of -0.935 down from the bullish 3.861 achieved in November 2024. Thus, social mentions of DOGE have dramatically fallen from 3,206 to 212, expressing the public’s waning interest and engagement in it.

Rebound Ahead for Dogecoin

Nevertheless, analysts contribute this bearish view in terms of sentiment analysis as signaling the potential for a significant price rebound for the same reasons that very bearish indicators may point to an improvement. Analyzing the past price changes, negative sentiment was always at the limit and could definitely mean that Dogecoin would rebound its price in a near future.

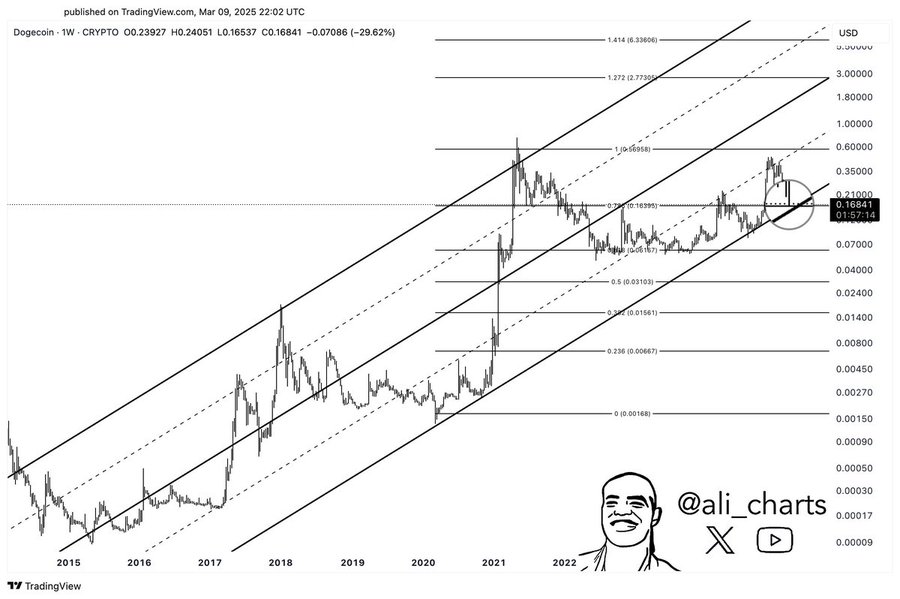

Backing this positive outlook is the TD Sequential indicator which is a popular technical analysis indicator that has given a buy signal on the daily price chart of Dogecoin. In an X post on Tuesday, Ali reveals that the level $0.16 as a crucial level; its penetration could result in a bounce. If DOGE does stay above this level, it is expected to bounce up significantly, according to Martinez with expectations of the DOGE to reach as high as $2 in the short term if the bulls gain more support.

Whales Drive DOGE Momentum

Adding to this bulls’ narrative, it is worth noting that the weighted large investors in Dogecoins are ramping up their positioning. On March 10, address with 100M – 1B DOGE each, purchased an additional 1.4B DOGE, around $224M in value. This massive purchase came only a day after another group of whales bought around $1.7 billion DOGE which is over $300 million on March 9th.

Aggressive whale activity to this extent often long signals an upswing which means insiders expect a turnaround in the price soon. Market technicians typically consider whale buying during the bearish times as a clear signal of potential bullish price actions.

Investors are all eyes on Dogecoin channel, with the critical support level that stands at $0.16. Sustaining and regaining this trend would go further in support of the speculations of a rally in the near future. Due to the bearish sentiment being rather persistent, history, technical analysis, and large whale accumulation supports the notion that Dogecoin could see a sharp bounce in the near term.

How would you rate your experience?