- Ethereum transaction fees hit a five-year low, averaging just $0.168—signaling a significant slowdown in network activity and user engagement.

- Total value locked (TVL) in Ethereum-based DeFi has dropped 8% this month, while Solana’s TVL rose 4.4%, highlighting a shift toward faster, lower-cost alternatives.

- Major ETH holders have offloaded over 143,000 ETH, and sentiment is slipping as some traders begin to question Ethereum’s long-term role in the decentralized ecosystem.

Ethereum, the dominant force among alternative digital assets, is facing increasing pressure to retain its stronghold in the decentralized economy. A steep drop in transaction fees now at a five-year low is underscoring a deeper narrative of shifting user engagement and mounting competition.

According to the on-chain analytics platform Santiment, the average fee on the Ethereum network has plummeted to just $0.168 per transaction, a level not seen since 2019. This significant drop suggests a marked slowdown in network activity, with fewer users sending Ether or interacting with smart contracts. Though fee fluctuations are not uncommon and tend to reflect levels of congestion, the current lull indicates reduced demand across Ethereum’s ecosystem.

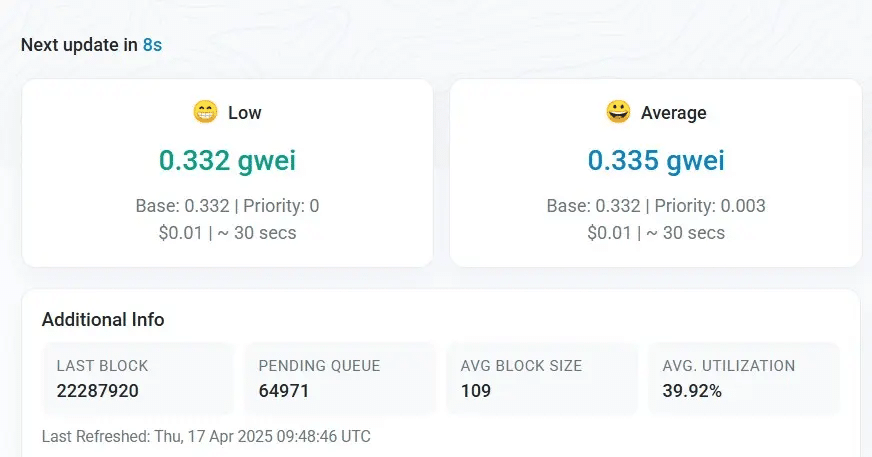

When demand spikes, users typically bid higher fees to prioritize their transactions, pushing average costs up. The opposite is now occurring: with decreased usage, the urgency to transact diminishes, and fees fall accordingly. The average gas fee currently hovers around just 0.335 gwei or approximately $0.02 hinting at a broader cooling-off period.

But seasoned builders and developers may find a silver lining in this downturn. With operational costs at rock bottom, this could be an opportune moment to develop, test, and optimize applications on the Ethereum chain without burning through budgets.

Ethereum Bleeds TVL as Solana Climbs

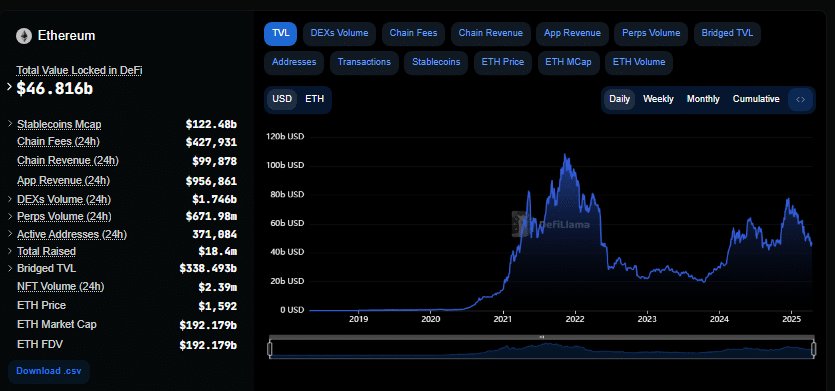

Data from DeFiLlama paints a telling picture of this momentum shift. Ethereum’s total value locked (TVL) in decentralized finance protocols has fallen by over 3% in the past week and more than 8% over the last month, now sitting at approximately $46.816 billion.

Meanwhile, rival network Solana is quietly capitalizing on Ethereum’s slip. Solana’s DeFi footprint has grown 4.4% in just the last seven days, with its TVL now at $7.07 billion. Though still a fraction of Ethereum’s scale, the consistent uptick suggests increasing developer and user interest in migrating toward faster, lower-cost alternatives.

Ether’s price action reflects its current struggles. Down 61% over the past four months, ETH is trading at an average of $1,597 as of press time despite a modest 0.80% daily gain. Its 24-hour trading volume also saw a slight 0.80% rise, totaling $13.6 billion.

Market analyst Ali reported that large holders, or “whales,” have offloaded around 143,000 ETH over the past week. He highlights $1,528.50 as a critical support level where nearly 4.82 million ETH was previously accumulated by over 2.6 million wallet addresses.

Whales have offloaded 143,000 #Ethereum $ETH over the past week! pic.twitter.com/n8cmwyUpER

— Ali (@ali_charts) April 17, 2025

As macroeconomic uncertainty continues to weigh on the broader financial landscape, many investors are opting for caution, holding steady in stablecoins rather than risking exposure. Yet history has shown that periods of ultra-low fees can precede substantial market movements—setting the stage for potential volatility ahead.

Ethereum Sentiment Slips Amid Competitive Landscape

Perhaps more concerning than the price action is the shift in sentiment. Some traders have reportedly begun to view Ethereum less as a foundational infrastructure and more through a meme-ified lens signaling waning trust in its long-term trajectory.

By contrast, other major assets such as XRP and Cardano have outperformed on a relative basis. XRP, for instance, is up year-to-date and currently at $ 2.10 with a 24-hour trading volume of $ 5.87B and a market cap of $ 123.11B. The XRP price increased 0.83% in the last 24 hours, while Ethereum has shed more than half its value over the same period.

As the digital asset landscape matures, Ethereum’s next chapter may depend not just on price recovery but on reigniting developer activity, user trust, and network momentum.

Related | Peter Schiff Declares Bitcoin Dead as Gold Smashes $3,300 Record

How would you rate your experience?