- Ethereum staking strengthened as Sun shifts 45k ETH into Lido, reinforcing long-term institutional conviction.

- Sun’s ETH holdings briefly surpass TRX in value, indicating a strategic reweighting that drew trader attention.

- Market reaction turns bullish as the move signals confidence in ETH’s future performance during price weakness.

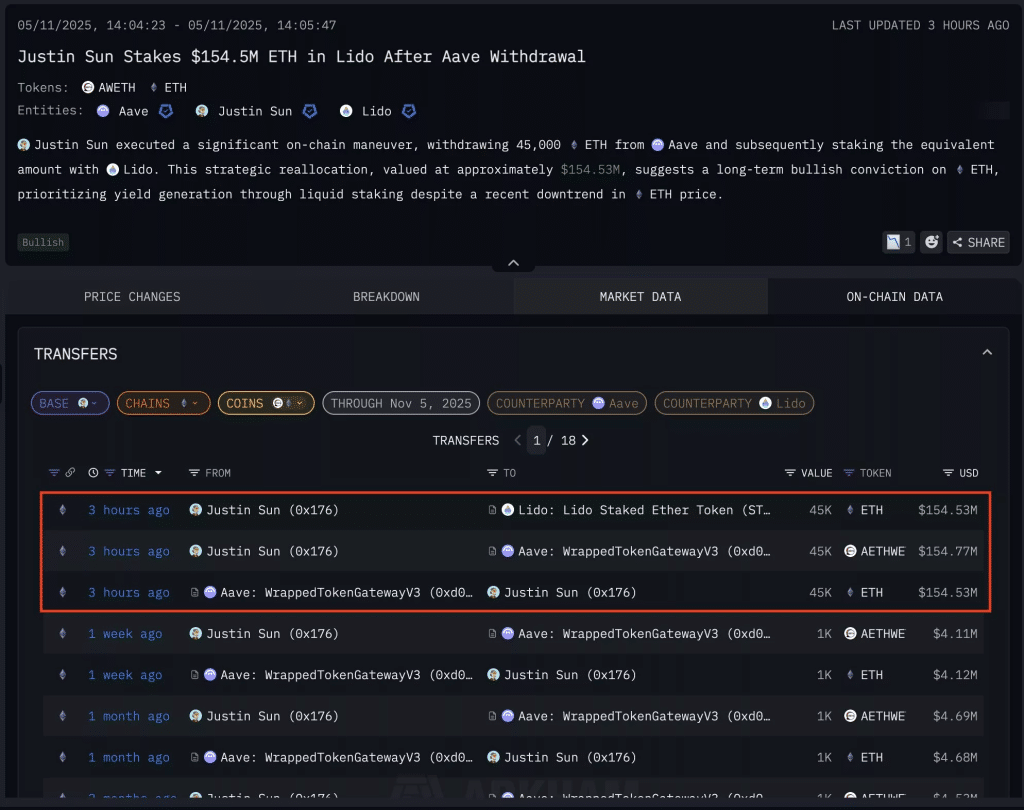

Tron founder Justin Sun has transferred a significant part of his crypto-assets into staked Ethereum. He sold 45,000 ETH of AAVE and staked the assets on Lido. The sale took place on Nov. 6. The acquisition was estimated at $154.5 million using current on-chain pricing. Staking rewards were selected by Sun compared to liquidation in a time of lower ETH prices.

Arkham Intelligence traced money movement within the blockchain. Its monitoring system verified that the assets were placed into Lido as stETH, a token that is a representation of staked Ethereum. The AI Agent used at Arkham realized that Sun looped ETH to AWETH and sent it back to AAVE during the last shift. The system explained the deal by a systematic internal rebalancing.

JUSTIN SUN JUST STAKED OVER $150M OF ETH [ARKHAM INSIGHTS]

— Arkham (@arkham) November 5, 2025

Justin Sun just withdrew $154.5M of ETH (45,000 ETH) from AAVE and deposited it to Lido Staking. He currently holds $534M of ETH in his public wallets, even more than he holds in TRX ($519M).

We found this through… pic.twitter.com/rwU3H5uIKu

Justin Sun’s Wallet Shows Temporary Shift in Asset Dominance

The wallet movement caused a short-lived shift in the hierarchy of assets in the case of Justin Sun. His Ethereum stake was estimated at $534 million. During the same period, his TRX holdings were valued at approximately $519 million.

At one point, Ethereum was the most significant asset in his wallet. The event created quick curiosity among the traders who examined the influential whale distributions.

The most recent portfolio image has changed once more. According to Nansen data, Sun has about $2.57 billion in his public wallet comprised of crypto at the moment. TRX again is the dominant position. Sun owns approximately 2.4 billion TRX.

Also Read: Chainlink Powers the Future of Onchain Finance with CRE and UBS Tokenized Fund Milestone

This investment is worth $702.2 million. The value of his staked Ethereum is approximately $483.7 million. He also holds $400 million in USDT. The rest is diversified in AETHWETH, STRX, STEAKUSDC, AETHUSDT, WLFI, and a number of other holdings.

Source: Arkham Intelligence

The information about the transactions provoked a response among traders. The move was seen as a bullish move on Ethereum by various comments on the social networks. Other users pointed out that Sun favored the accumulation of ETH during a recession.

One comment stated that Justin is more ETH-pilled than the ETH foundation. Another one claimed that “Justin Sun staking 45k eth in Lido? Bullish signal for ETH long term.” The mood was to remain optimistic on the future performance of the token.

Ethereum Outlook Strengthens as Sun Continues Strategic Accumulation

The interpretation of the community was supported by an AI analysis of Arkham. The sentiments indicated that the drop in ETH from 4,100 to approximately 3,400 influenced the decision to stake rather than sell. The AI-based analysis mentioned that this shows there was a belief in the value increase of Ethereum in the long term. This shows that it is focused on yield without diminishing core exposure.

In July, he transferred 50,600 ETH, estimated to be worth approximately $181 million ETH, out of HTX to Binance. The payment was a redemption of AAVE managed by the HTX recovery wallet. It was the same way that he had been making acquisitions and repositioning ETH whenever the price was weak.

However, the positions of the staggered ETH are displayed by Sun, which are constantly opportunistic. His latest staking reinforces the story of the belief of big players in the industry in Ethereum. The extension will benefit a more positive market view because staking keeps increasing.

Also Read: Ripple Raises $500 Million to Reach $40 Billion Valuation as It Expands Beyond Payments

How would you rate your experience?