- The SEC approved options trading for spot Ethereum ETFs, including BlackRock’s iShares Ethereum Trust and Grayscale’s Ethereum Trust.

- This approval offers new investment strategies and hedging opportunities for Ethereum-based products.

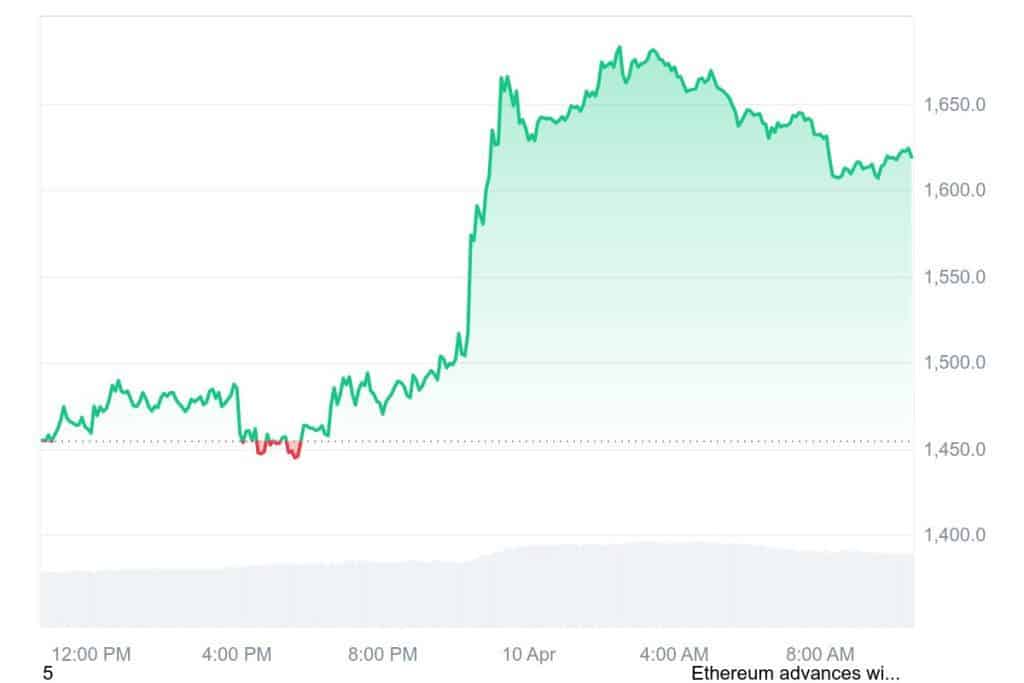

- Ethereum’s price surged 12% following the news, reaching $1,618, boosted by market sentiment and regulatory decisions.

The U.S. Securities and Exchange Commission (SEC) has given the green light for the listing and trading of options on several spot Ethereum exchange-traded funds (ETFs). This approval, granted on Wednesday, marks a key step forward in making Ethereum-based investment products more accessible and providing additional hedging opportunities for investors.

According to SEC filings, investors can now trade options tied to major Ethereum ETFs, including BlackRock’s iShares Ethereum Trust (ETHA), the Bitwise Ethereum ETF, Grayscale’s Ethereum Trust, and the Ethereum Mini Trust. Options, which are financial derivatives, offer buyers the right to buy or sell the underlying asset in this case, Ether (ETH) at a predetermined price within a set period.

This move is expected to pave the way for a range of new strategies in the cryptocurrency investment landscape. James Seyffart, an ETF analyst at Bloomberg Intelligence, commented that the approval of these options was “100% expected,” noting that the SEC had until April 9 to decide on the matter.

Good news. Ethereum ETF options approved. Was 100% expected. Today was final deadline. I personally don't see it on the SEC website yet but id be shocked if it weren't true. https://t.co/XjOxE0ZqUt

— James Seyffart (@JSeyff) April 9, 2025

SEC Approves Ethereum ETF Options for More Investment

Nate Geraci, president of the ETF Store, shared his insight on social media, indicating that the approval could signal the start of many more launches in the coming months. “Like with Bitcoin ETFs, expect to see a bunch of new launches from issuers,” he stated on X (formerly Twitter). “Covered call strategy ETH ETFs, buffer ETH ETFs, etc.” This hints at the growing variety of ETH-based investment products that could soon hit the market.

SEC has approved options trading on spot eth ETFs…

— Nate Geraci (@NateGeraci) April 9, 2025

Like w/ btc ETFs, expect to see a bunch of new launches from issuers.

Covered call strategy eth ETFs, buffer eth ETFs, etc. https://t.co/Ndqz4cEBQ2

The approval of these options comes after a period of uncertainty and delays. Initially, the SEC had postponed its decision on whether to allow options trading for spot Bitcoin and Ethereum ETFs, with Nasdaq ISE first filing for the options on July 22, 2024. A letter from Better Markets, an advocacy group, had raised concerns about the high volatility of these assets, urging the SEC to tread carefully before greenlighting options trading for Ethereum and Bitcoin ETFs.

The SEC’s decision follows its previous approval of options trading on 11 Bitcoin ETFs for the NYSE American, Nasdaq, and Cboe Exchange in October of last year. The regulatory body emphasized that these new options would provide investors with a relatively low-cost tool to gain exposure to Ether prices and effectively hedge their positions.

In the official approval note, the Commission stated, “The Exchange believes that offering options on Ether Funds will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to the price of Ether.” This move seeks to provide a more diversified and dynamic way for investors to engage with the growing Ethereum market.

Ethereum Price Soars 12% After SEC ETH Options Approval

Following the SEC’s approval of ETH options, Ethereum’s price saw a significant spike. Over the past 24 hours, the cryptocurrency surged by 12%, with Ethereum now trading at $1,618 at press time, according to data from CoinMarketCap. This sudden price surge is also attributed to other factors, such as the recent 90-day Trump tariff pause, which has boosted market sentiment in general.

Despite the positive movement in Ethereum’s price, data from Farside Investors indicates that ETH ETF holders are currently facing some challenges. These funds are down over 50% year-to-date (YTD), with the trend contributing to reduced ETF inflows. Since February 20, only four days have seen inflows into these funds.

However, some Ethereum products are performing better than others. According to Bloomberg’s Eric Balchunas, two -2x ETH ETFs, which represent a leveraged short positioning on Ethereum, are currently the top-performing ETFs of 2025.

The best performing ETF this year is the -2x Ether ETF $ETHD, up 247%. #2 is the other -2x Ether ETF. I was sure it would be $UVIX (2x VIX), but that's #3. Brutal. pic.twitter.com/e49QOPtgmb

— Eric Balchunas (@EricBalchunas) April 9, 2025

Related | XRP Price Drops as Investor Sentiment Hits Extreme Fear

How would you rate your experience?