- Ethereum is moving toward low-risk defi as a sustainable revenue source.

- Secure defi applications now attract global users beyond speculation.

- This shift could align economic growth with Ethereum’s cultural goals.

According to the report, For years, the Ethereum community wrestled with a difficult balance. On one side stood the need for applications that generate enough revenue to sustain the ecosystem. On the other side were projects built to fulfill the original goals of decentralization and open access.

These two streams rarely intersected. Speculative phases were responsible for most revenue in Ethereum. Memecoins, non-fungible tokens, and participatory lending schemes fueled participation.

The non-monetary projects such as Lens, Farcaster, ENS, and privacy tools also became prominent but could not take in large economic demands. This shortage put pressure in the community, as people were expecting this breakthrough to do both jobs.

Low-Risk DeFi Gains Ground in Ethereum

That paradigm shift may have arrived. The trajectory of the ecosystem is veering to low-risk decentralized finance. Their applications center on stable abilities such as payments, savings, synthetic assets, and collateralized lending. Since unlike earlier models of speculation, they operate on increased security and lower risk these days.

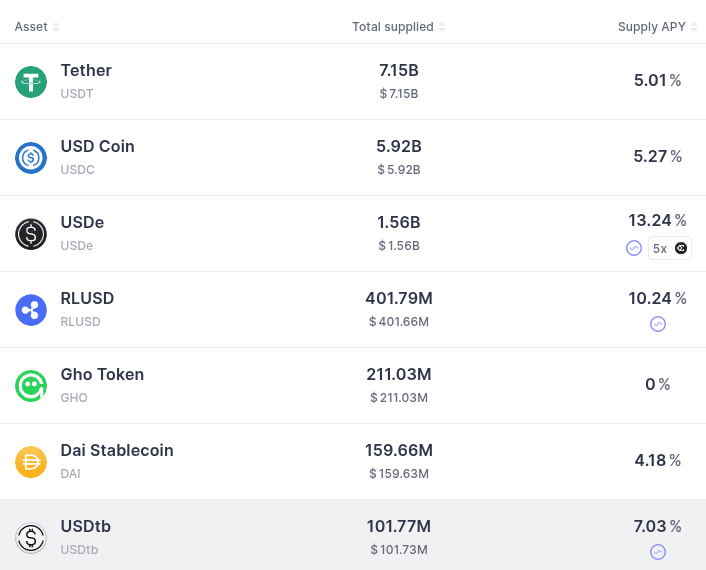

Exchange rates for stablecoins like those of Aave show the expansion of this market. High-yield farming was fashionable in the past, but today people want safe and sure services. Customers and merchants want access to assets like major currencies, stocks, and bonds in an international, unrestricted marketplace.

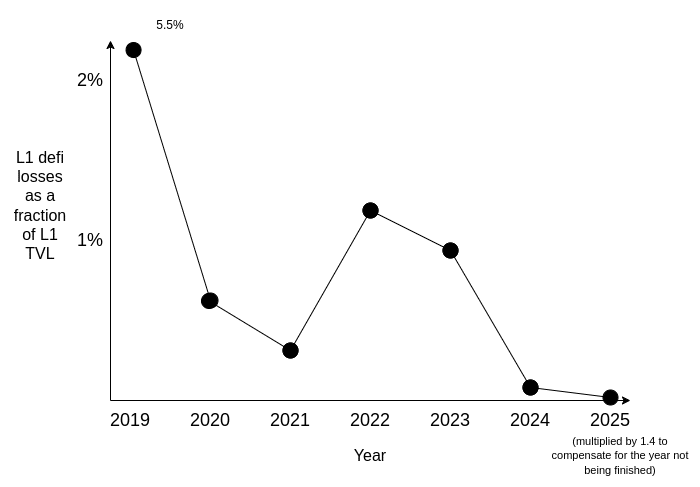

Regulatory and first technical risks once limited defi. Hacks, oracle failures, and unrecognized bugs kept eco-friendly initiatives from increasing in popularity. Greater security and proven protocols have, though, changed this scene. Gains still occur, but they often do so in riskier areas of the marketplace. We have an emerging stable core of low-risk programs at the heart of Ethereum.

Low-Risk DeFi Could Become Ethereum’s Economic Base

De-fi can be search for Google for Ethereum at low risk. Search generates most of Google’s income, and other initiatives remain culturally relevant as well. In the same way, defi can fund Ethereum’s ecosystem and support broader innovation.

Notably, low-risk defi shares the value of the community. It provides practical access to finance without exploitative intent. It strengthens ETH as security, drives transaction fees, and maintains intact the decentralized spirit of Ethereum.

This is a long-term direction, which neither breaches trust nor distracts from cultural targets. The prospects do not stop there. Defi might further proceed in low-risk format and evolve as undercollateralized lending based upon onchain reputation. Prediction markets can grow as hedging tools.

What new stable value, maybe basket currency or flatcoins, can it bring after that? The biggest issue for Ethereum has been finding an economic foundation to parallel its ideals. Defi of low-risk blends stability and purpose. It could define its future chapter as a decentralized network pursuing global reach.

Related Reading: Metaplanet Expands Into U.S. and Japan as Bitcoin Holdings Hit $2.3 Billion

How would you rate your experience?