- FTX has unlocked $1.57 billion in Solana as part of its ongoing reimbursement process.

- Alameda Research transferred $23 million in unstaked SOL to 38 addresses linked to FTX.

- Despite the large asset movement, Solana’s price remained mostly unaffected due to bearish market conditions.

FTX has now commenced its payment process, with the defunct exchange releasing a huge $1.57 billion worth of Solana (SOL). But the most recent asset movement from Alameda Research, the brokerage firm most directly linked with the collapse of FTX, is occurring against the background of bear market conditions that have severely dented demand.

According to on-chain data from Arkham Intelligence, Alameda Research recently distributed $23 million worth of unstaked SOL to 38 addresses linked to FTX. This move is part of a larger pattern of asset movements that have occurred since Alameda’s downfall.

“An Alameda address just unstaked $23 million SOL to 38 new addresses. An FTX/Alameda staking address received $22.9 million SOL from a staking address unlock and has just distributed these funds to 37 addresses that have previously received SOL from this address. These addresses currently hold $178.82 million SOL,” Arkham Intelligence reported.

ARKHAM ALERT: ALAMEDA ADDRESS JUST UNSTAKED $23M SOL TO 38 NEW ADDRESSES

— Arkham (@arkham) March 12, 2025

An FTX/Alameda Staking address received $22.9M SOL from a staking address unlock and has just distributed these funds to 37 addresses that have previously received SOL from this address.

These addresses… pic.twitter.com/9eWuKAY4na

It is not the first time Alameda has transferred huge amounts in tokens after the collapse. In the later part of 2023, bankruptcy addresses belonging to the company staked MATIC worth $10 million. Later, in early 2024, it transferred Ethereum worth $14.75 million. Importantly, the previous trades prompted a huge price volatility in the concerned asset.

Alameda Moves Solana but Market Stays Flat

surprisingly, even with the huge SOL unlock, the price of the altcoin has been little changed. Contrarily, when Alameda shifted $14.75 million worth of Ethereum earlier this year, ETH increased by 10%. However, even with today’s much bigger SOL movement, the token price did not record a strong reaction.

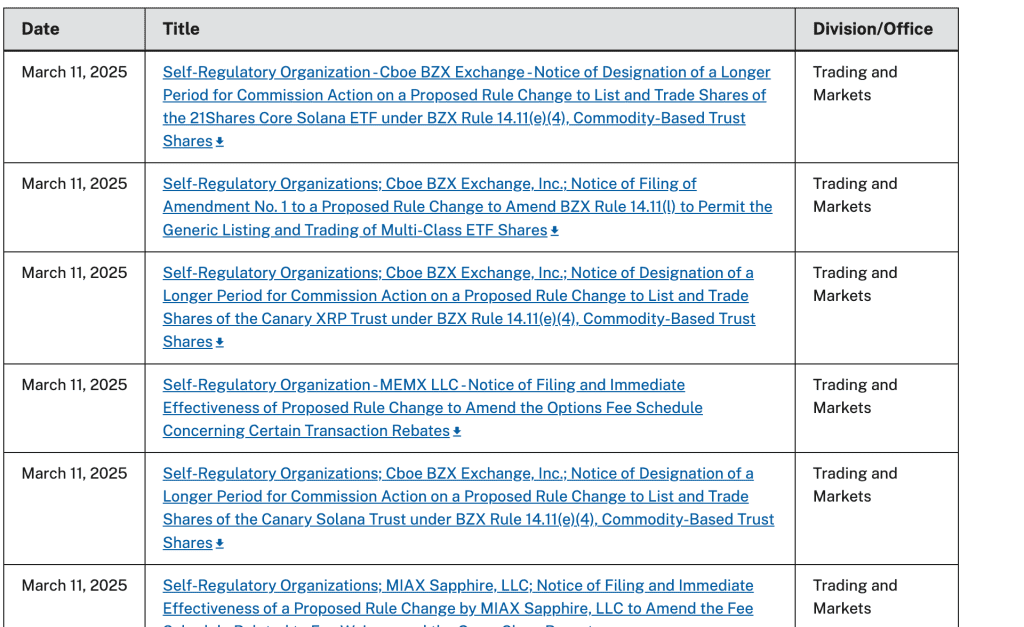

This lack of impact may be linked to the broader market sentiment. The SEC recently delayed multiple Solana ETF applications, which contributed to minor bearish pressure on the asset. Additionally, the entire crypto market is experiencing heightened selling pressure, with investor sentiment currently in a state of “Extreme Fear.”

It is yet unclear what Alameda intends to do with these unlocked tokens, but speculation is growing that the funds could be used as part of FTX’s ongoing creditor repayment process. FTX unlocked the same $1.57 billion worth of Solana earlier this month, something that is in accordance with the company’s gradual repayment process.

Despite such big asset flows, Solana demand seems unchanged, and the general bearishness in the market is eclipsing any possible bullish drivers. Alameda’s moves for now are just one among many that influence the volatile crypto market.

Related | U.S. House Overturns IRS DeFi Broker Rule in Landmark Crypto Victory

How would you rate your experience?