- Injective (INJ) drops 3.28% in 24 hours with trading volume down 22.2%, signaling reduced market activity.

- INJ has dropped 7.82% over the past week, reflecting a sustained downtrend and ongoing market weakness.

- Testing key support in an ascending triangle pattern, INJ may see a rebound if the support level holds firm.

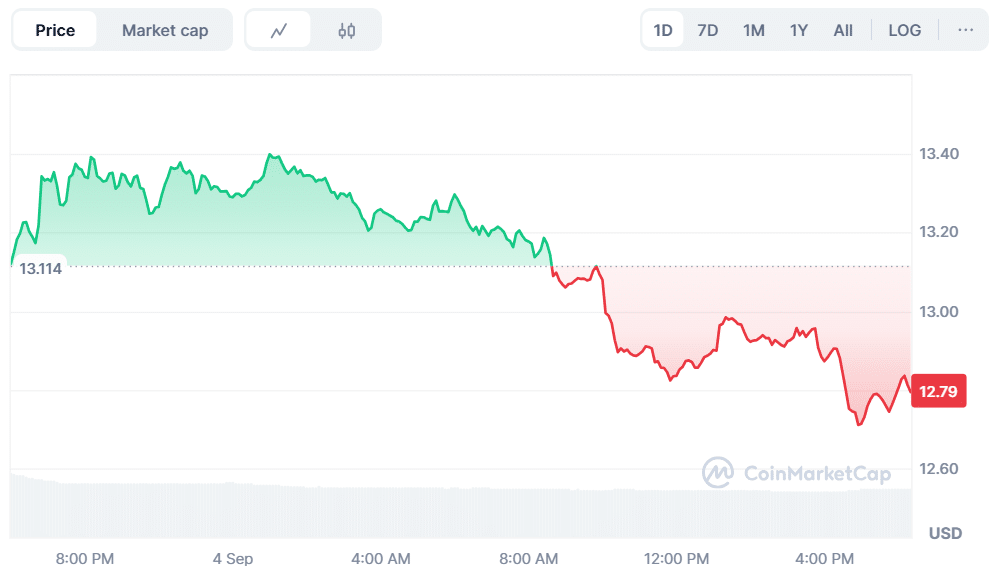

Injective (INJ) is currently trading at $12.79 and is down by 3.28% over the past day. The volume of trading has also dropped by 22.2% and is currently at $94.05 million. This decline in volume is an indication of decreased market activity and even less investment in the token.

Source: CoinMarketCap

INJ has been on a downward trend over the last week, declining by 7.82%. The coin is currently experiencing a challenging period, as evidenced by its downward-trending market performance.

Injective Tests Key Support, Bullish Rebound Possible

Analyst Jonathan Carter has mentioned that Injective is probing the lower side of an ascending triangle formation in the day chart. This trend implies that there can be a rebound in the prices as long as the support level remains constant. The direction of the token in this pattern is very critical, since it might determine its future significant price movement.

Besides the trend towards the increasing triangle, there are also the appearances of bullish divergence signals, which suggest that INJ may soon see a rise. According to analysts, in case of a bounce, the price may go up to levels of between $15.70 and $20.00 and maybe even $26.00, depending on the market conditions.

Source: X

Volume and Open Interest Drop, Sentiment Steady

According to CoinGlass data, the trading volume has dropped by 19.53% and is currently at $283.84 million. Open interest has also decreased by 4.56% and is currently at $159.48 million. With these declines, the INJ OI-weighted funding rate stands at 0.0108%, implying a balanced market sentiment in the short term.

Source: CoinGlass

Also Read: Ripple Expands RLUSD Stablecoin Across Africa with Chipper Cash, VALR, and Yellow Card

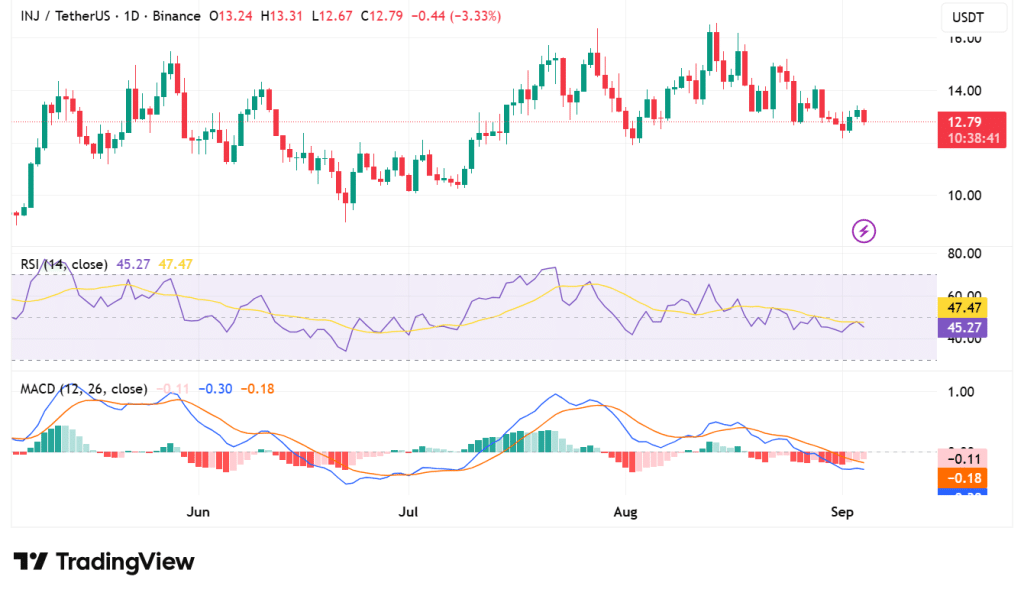

RSI Shows Balance, MACD Suggests Bearish Outlook

The Relative Strength Index (RSI) of INJ is 45.27, which is slightly lower than the neutral mark of 50. This implies that the token is neither overbought nor undersold, and thus the market is in a state of indecision. The recent bullish trend of the RSI does indicate the probability of an upward trend in case the market turns in favor of buyers.

The Moving Average Convergence Divergence (MACD) is bearish. The MACD line is positioned below the signal line, indicating a downward trend. The histogram is red, which strengthens the downward force on the token. Injective, with a current MACD of -0.11, is still struggling to recover.

Source: TradingView

Injective is struggling, as both volume and price have been decreasing constantly. Technical indicators are slightly optimistic in regard to a recovery, but the market mood is still guarded. Investors are advised to closely monitor areas of support in order to determine whether or not a recovery is imminent.

Also Read: AlphaTON Capital Brings Toncoin to Nasdaq With Telegram’s Billion-User Ecosystem

How would you rate your experience?