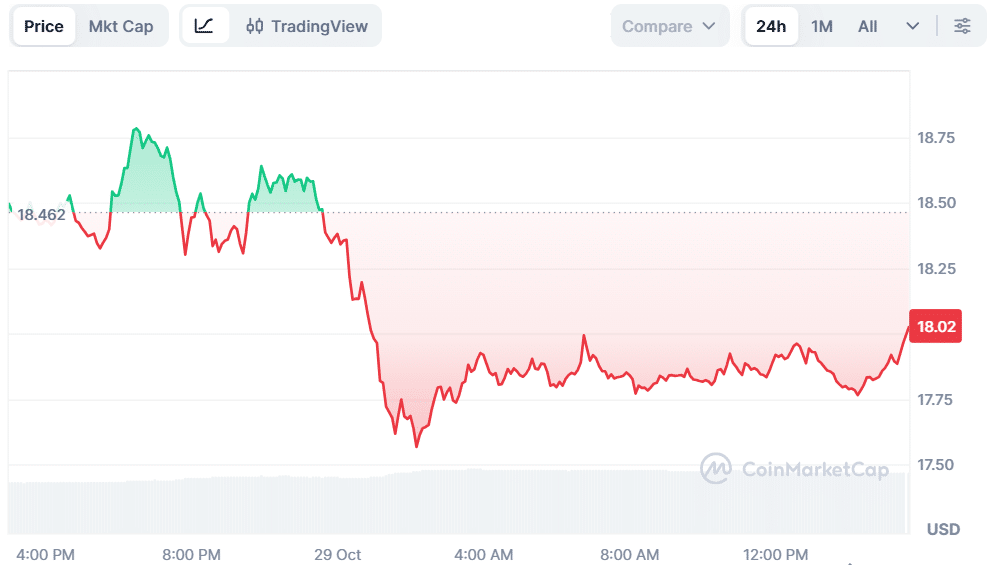

- Chainlink (LINK) trades at $18.01, down 2.4%, while trading volume surges 18.04% to $843.98 million, showing activity.

- Analysts highlight $17.17 support and $19.60 resistance; a breakout beyond these levels may shape LINK’s next trend.

- The market stays neutral with weak momentum as traders await FOMC signals and broader crypto market direction.

Chainlink (LINK) is currently trading at $18.01, decreasing by 2.4% over the last 24 hours. Trading activity remained strong despite the decrease in price. The trading volume increased by 18.04% and is currently at $843.98 million, which is an indicator of active market participation. Over the past week, LINK increased by 3.32%, with moderate positive gain amid the general uncertainty.

Source: CoinMarketCap

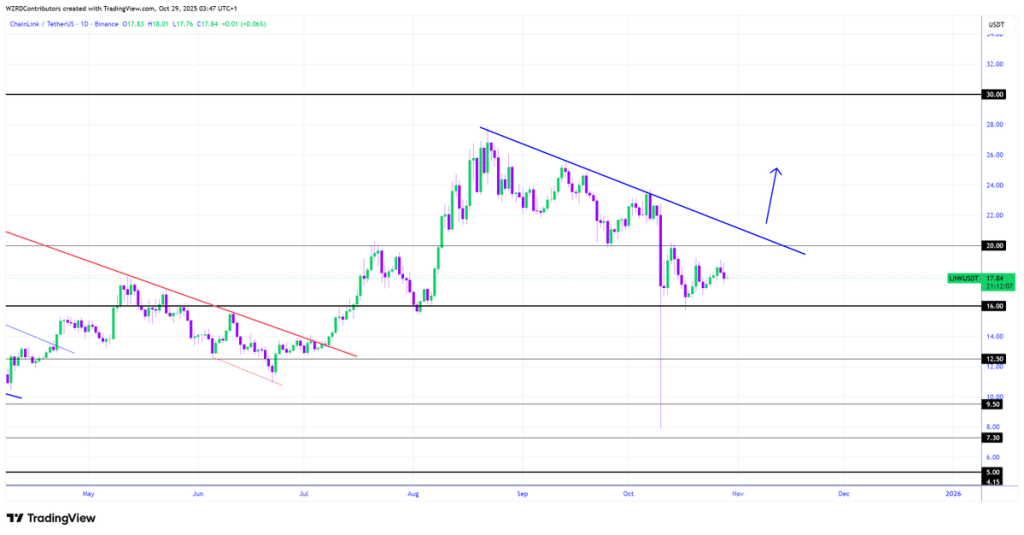

LINK Holds Between $17.17 Support and $19.60 Resistance

Joe Swanson, a prominent analyst, highlighted that LINK remains in a declining trend channel. He observed poor movement and diminished investor confidence. He says that support is around $17.17 and resistance is around $19.60. Any breakout beyond either of the levels may constitute a defining trend of LINK.

Source: X

Currently, LINK seems to be technically impartial. There is no intense purchasing or selling pressure in the market. The traders are waiting to take new positions. Price behavior suggests a consolidation period but not a directional trend.

Furthermore, another analyst, CryptoWZRD, mentioned that LINK ended in an indecisive state on the daily chart. He stated that the next move of LINK would depend on the result of the U.S. Federal Open Market Committee (FOMC) meeting. A breakoutabove $19.00 may proceed to an early long position. A drop beneath support can attract sellers.

Source: X

Also Read: Chainlink Powers Streamex Partnership to Deliver Real-Time Gold-Backed Token Transparency

Trading Activity Increases While Market Confidence Weakens

According to CoinGlass data, the trade volume grew by 10.95% to reach $1.44 billion. Meanwhile, the Open Interest dropped by 1.53% to $707.69 million, which indicates less leverage of traders. The OI-weighted funding rate was -0.0012%, which displayed weak bearish sentiment.

Source: CoinGlass

The market is currently demonstrating reserved trading patterns. An increase in volume and decline in open interest indicate a short-term uncertainty. Investors are on high alert, awaiting outside indicators like FOMC updates or Bitcoin movement to turn the tide.

In the short term, resistance at $19.60 will be significant. The move above it may alter the mood to become bullish. A decline below $17.17 may extend the correction period. Technical charts are still indicating tight consolidation and low volatility.

However, LINK is equitable between the sellers and buyers. The market evidence suggests a lack of strength rather than an absence of confidence. Traders are closely monitoring price levels that could indicate the emergence of a new trend. As long as there is no evident breakout, LINK will be trading in a horizontal manner with no significant momentum.

Also Read: TeraWulf Expands into AI with $1.3B Data Center Project Backed by Google Lease

How would you rate your experience?