- Jasmy Coin (JASMY) drops 4.21% in 24 hours, signaling reduced market activity and investor concerns.

- Analysts predict JASMY breakout potential, targeting $0.019, $0.023, and $0.032 with strong volume support.

- Oversold conditions and negative MACD momentum indicate continued bearish pressure unless the market shifts.

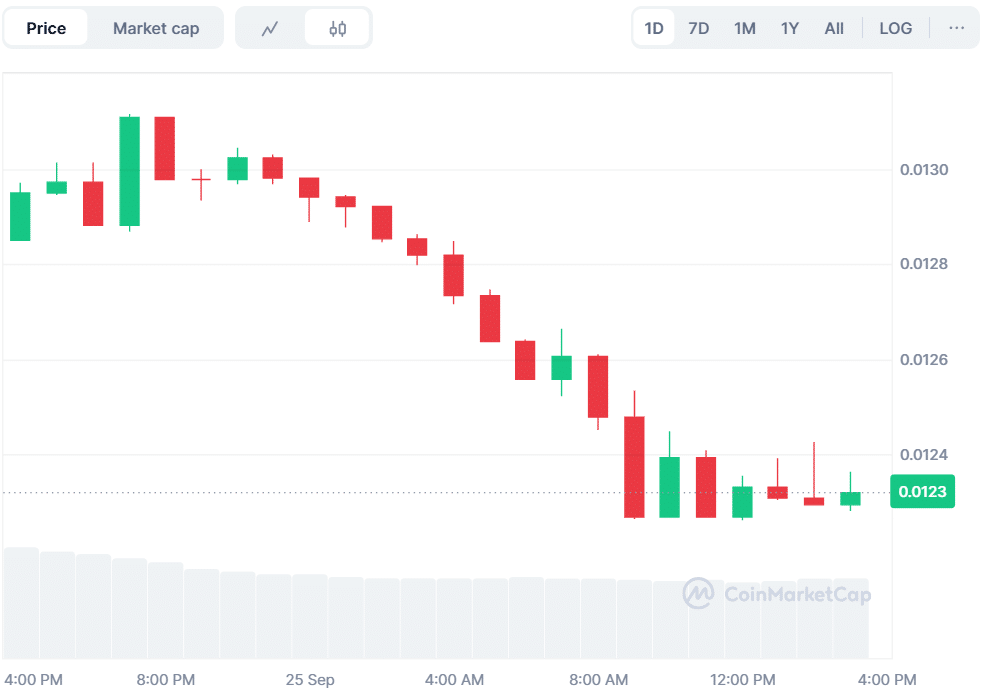

Jasmy Coin (JASMY) is currently trading at $0.01232, representing a decrease of 4.21% per 24 hours. The trading volume has decreased by 29.14% and is currently standing at $30.17 million. The fall in price and volume is an indication that the coin has reduced market activity.

Over the past week, JASMY has declined in price by 17.21%. This downward trend is an indication that the cryptocurrency faces continuous challenges. The recent performance of the coin causes concern to the investors about its future prospects in the short run.

Source: CoinMarketCap

JASMY Poised for Major Surge if Resistance Breaks

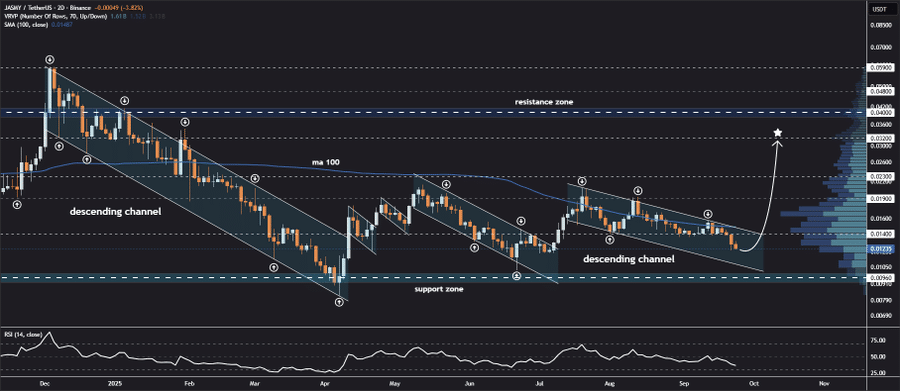

Crypto analyst Jonathan Carter highlighted that JASMY is currently trading at a level that is lower than the 100-period moving average (MA 100) resistance level. He opined that in case the coin could get out of its falling channel, it may experience a rapid climb. Carter established breakout-level targets of $0.019, $0.023, and $0.032, depending on robust volume. In case of a successful breakout, a major change in momentum could occur.

Source: X

Another analyst, Javon Marks, mentioned a confirmed bullish divergence in the price action of JASMY. This may be an indicator of a bullish extension and a possible price explosion to $0.2785. Such action would involve a minimum increase of 300%. Analysts anticipate that the more significant shift is indeed aligned with forecasts indicating a long-term growth exceeding 2,022%.

Source: X

Also Read: Canton Network Joins Chainlink to Revolutionize Institutional Blockchain Finance

RSI and MACD Indicate Continued Bearish Momentum

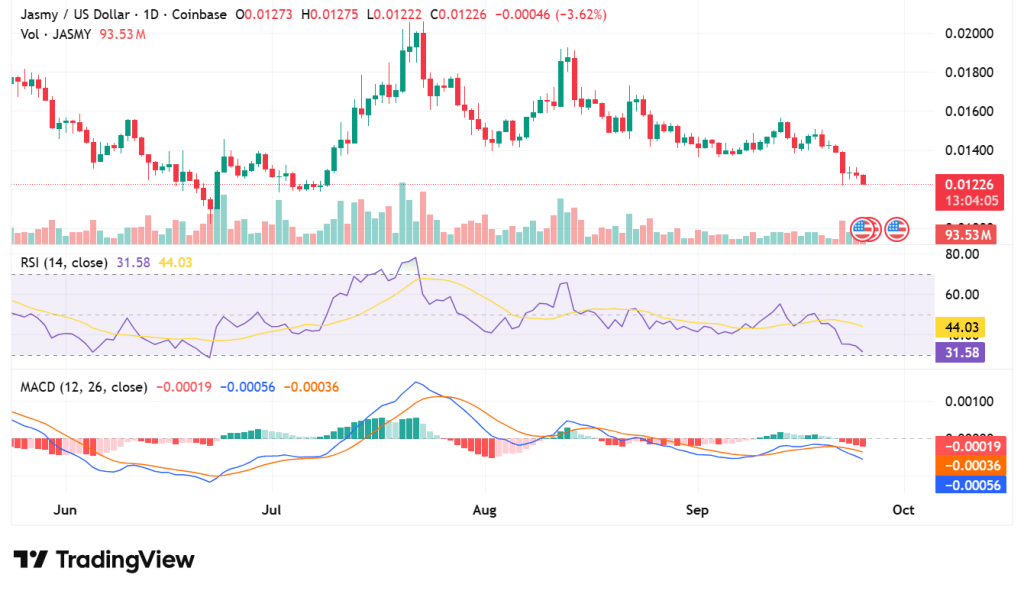

The Relative Strength Index (RSI) stands at 31.58, indicating that the coin is currently oversold. This implies more of a downside probability unless the level of RSI goes beyond the 40-50 level. An increase in the RSI may signal the move towards a more favorable market tone and a possible restoration.

Moving Average Convergence Divergence (MACD) is also negative on JASMY. The MACD line is at -0.00019 and the signal line at -0.00056, and this indicates that there is still selling pressure. The MACD histogram also validates the bearish trend, with negative momentum.

Source: TradingView

Increased Volume, Falling Open Interest Signal Market Uncertainty

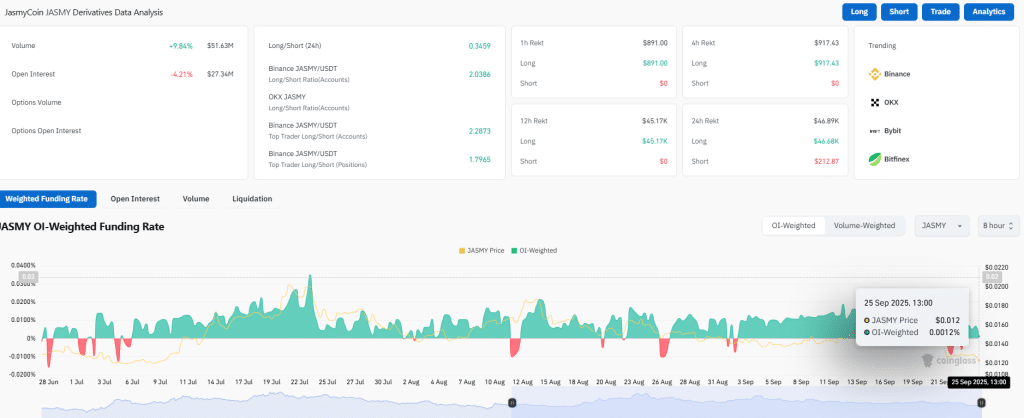

Coinglass data shows that there is a slight increase in the trading volume of JASMY, which has risen by 9.84 percent to $51.63 million. Open interest has fallen by 4.21% to levels of $27.34 million, indicating that there is diminished confidence among the traders. The OI-weighted funding rate of the coin stands at 0.0012%.

Source: CoinGlass

The current market performance of JASMY encapsulates its risks and opportunities. Technical indicators point to bearishness, but analysts show the possibility of a bullish reversal. To determine the future direction of the coin, investors will need to monitor a breakout or change in market sentiment.

Also Read: ReserveOne Submits Draft Registration Statement for Business Combination with M3-Brigade

How would you rate your experience?