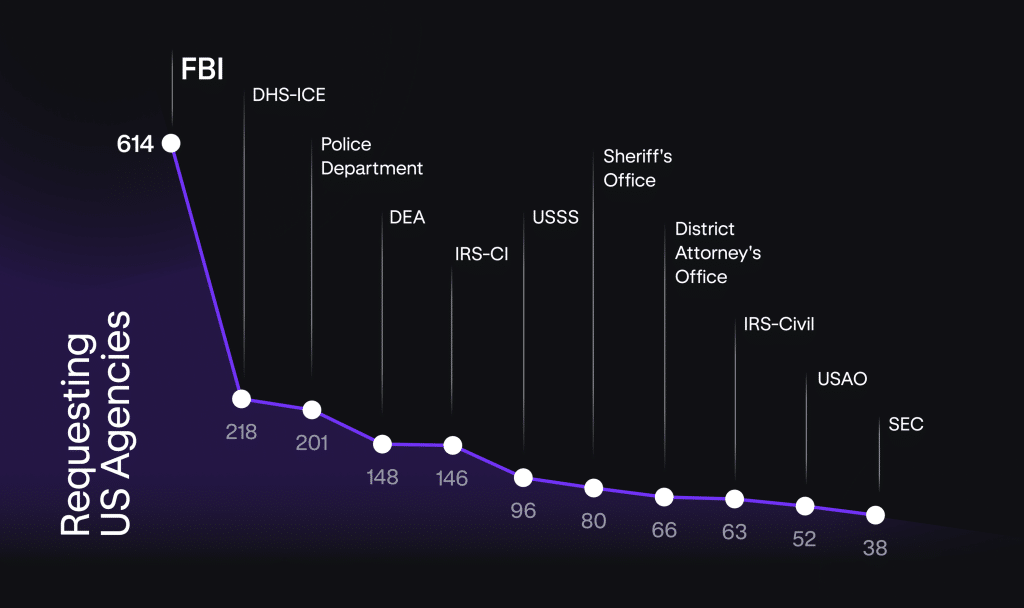

- Kraken received 6,826 global data requests in 2024, with U.S. agencies leading at 28.6% of the total.

- The FBI submitted the highest number of requests among U.S. agencies, with 614 inquiries.

- Data was provided for 57% of requests, reflecting Kraken’s commitment to compliance and client privacy.

Crypto exchange Kraken experienced a significant spike in enforcement and regulatory request activity in 2024 with a 39% year-over-year increase. The overwhelming majority of the requests were submitted by U.S.-based entities such as the FBI, illustrating the growing scrutiny of crypto sites.

U.S. Leads in Data Requests

According to Kraken’s 2024 latest transparency report, 28.6% of all 6,826 total requests were made by US agencies. Of the 1,951 made by the US, the FBI made 614 by itself. The state, federal, and local levels were the levels at which the requests were made although the law enforcement agencies were the key drivers of the requesters. SEC made 1.9% of all the US-made requests but made 37.3% of the regulator-driven queries

Kraken noted 71 jurisdictions that asked for information in 2024 with the U.K. being the highest at 8.8%, followed by Germany at 8.5%. The company pointed out that information was queried about 10,369 accounts with 34.5% of them being of U.S.-based clients. Kraken emphasized that being compliant with the protection of customer confidentiality while being compliant with the law was of the highest priority to the company.

Kraken’s Compliance Team Ensures Privacy Protection

The exchange uses a unique team of compliance specialists that incorporates the presence of AML experts, lawyers, and retired law enforcement agents. Kraken thoroughly examines all the request of information before providing information while adhering to strict policies to maintain customer information. Of all the requests made to them, information was provided in 57%, with a selective response to legal requirements.

Commitment to Strengthening Compliance

To keep pace with the growing number of queries, Kraken is constantly increasing its measures of compliance. The company credited its seasoned team of experts in compliance with being able to manage the increasing needs while staying ahead of industry best practices. The solution is a testament to Kraken’s need to remain transparent while handling complex regimes within its 190+ jurisdictions of operation

Kraken’s latest update mirrors the growing crypto sector scrutiny by the regulator with a strong US focus. With growing enforcement and regulator requests all over the world, Kraken’s commitment to confidentiality and compliance will remain key to sustaining trust among its tens of millions of customers all over the world.

Related Reading | SEC’s Crypto Enforcement in Flux: Task Force and Leadership Shifts Signal Change

How would you rate your experience?