- Metaplanet adds 1,088 BTC, raising total holdings to 8,888 BTC (worth ~$930M), nearing its 10,000 BTC year-end goal.

- The $117.5M purchase follows a zero-interest $50M bond issuance, showcasing aggressive treasury expansion.

- Metaplanet stock surged 2000% in the past year as investors backed its Bitcoin-focused growth strategy.

Japan’s Metaplanet, a leading player in the cryptocurrency space and Asia’s largest publicly traded Bitcoin holder, has announced a substantial expansion of its Bitcoin treasury. The company today revealed it has purchased an additional 1,088 BTC, pushing its total Bitcoin holdings to an impressive 8,888 BTC, currently valued at approximately $930 million.

*Metaplanet Acquires Additional 1,088 $BTC, Total Holdings Reach 8,888 BTC* pic.twitter.com/X2clAIKNbR

— Metaplanet Inc. (@Metaplanet_JP) June 2, 2025

This latest acquisition cost Metaplanet 16.885 billion Japanese yen (around $117.5 million), reflecting a per-Bitcoin purchase price of 15.5 million yen, or roughly $108,051. The move comes shortly after the company successfully issued zero-interest bonds worth $50 million last week, indicating a strategic effort to capitalize on favorable financing conditions to boost its crypto assets.

Metaplanet’s aggressive accumulation strategy has been a defining feature of its 2025 agenda. Since adopting Bitcoin as a core treasury asset in April 2024, the company has acquired an impressive 7,126 BTC this year alone. The recent purchase brings Metaplanet significantly closer to its year-end goal of holding 10,000 BTC, a milestone that would further cement its standing among the world’s largest corporate Bitcoin holders.

Furthermore, Metaplanet currently ranks among the top 10 Bitcoin holders globally, with a presence only overshadowed by industry giants like Strategy, which leads with a colossal 580,250 BTC under management.

Metaplanet and MicroStrategy Drive Crypto Adoption

Metaplanet’s CEO, Simon Gerovich, has openly credited MicroStrategy’s pioneering Bitcoin treasury model and the vision of its executive chairman, Michael Saylor, as major influences behind Metaplanet’s strategic embrace of Bitcoin. MicroStrategy’s success story, showcasing how corporate Bitcoin holdings can serve as a long-term store of value and hedge against inflation, has resonated deeply with firms worldwide.

Following the example set by Strategy and Metaplanet, a growing number of companies have jumped on the crypto treasury trend. Notably, Jack Mallers’ Twenty One has expanded corporate crypto holdings beyond Bitcoin into other major altcoins like Ether (ETH), XRP, and Solana (SOL), signaling an evolving landscape where digital assets are increasingly integrated into corporate finance strategies.

Metaplanet Stock Soars 2000% on Bitcoin Strategy

Metaplanet’s bold moves appear to be well-received by investors. Shares of Metaplanet traded on the Tokyo Stock Exchange saw a 2.34% increase today, closing at 1,094 yen as of early afternoon local time. Over the past year, Metaplanet’s stock price has skyrocketed an astonishing 2000%, underscoring strong market confidence in the company’s crypto-driven growth model. However, on the U.S. over-the-counter (OTC) market, its stock (MTPLF) experienced a slight dip last Friday, closing down 7.64% at $7.25.

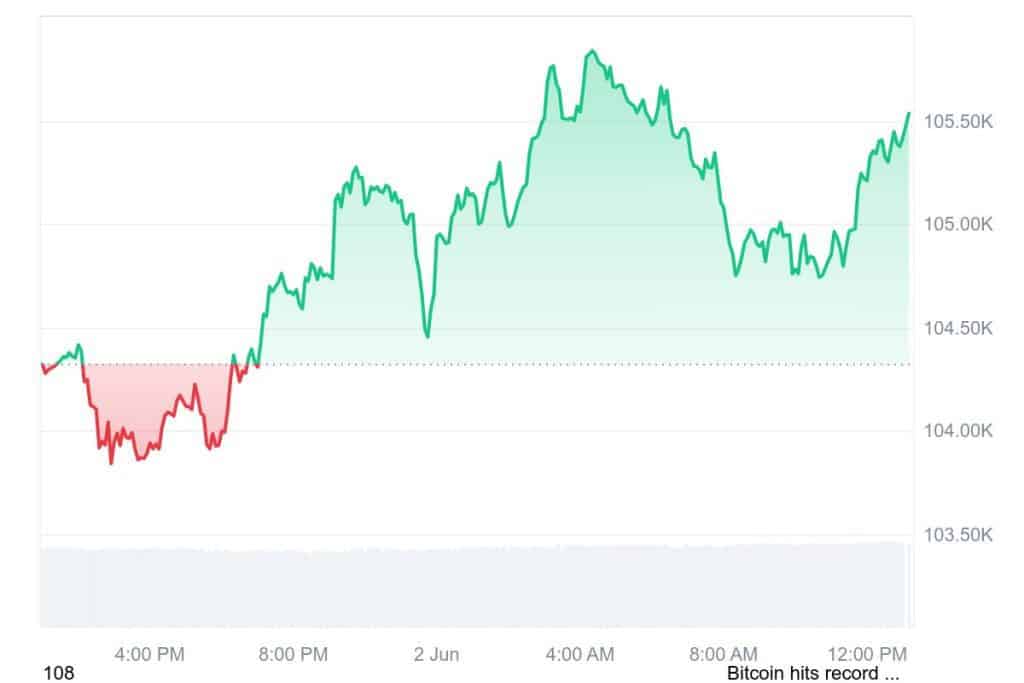

Meanwhile, Bitcoin’s price remains robust, currently trading near $105,500. This follows a brief retreat from last week’s all-time record high of $111,800. Market watchers see this consolidation phase as a healthy sign of stabilization amid heightened institutional activity, with investors closely monitoring how major corporate buyers like Metaplanet continue to shape Bitcoin’s trajectory.

Moreover, Metaplanet’s recent $117.5 million Bitcoin purchase exemplifies a growing trend of corporations embracing digital assets as key treasury components. With a clear roadmap to 10,000 BTC and inspiration drawn from industry leaders, Metaplanet is positioning itself as a major force in Asia’s crypto, fueling investor confidence and reinforcing Bitcoin’s status as a preferred corporate treasury asset.

Related | Ethereum Dips but Smart Money Invests Billions in Quiet Accumulation

How would you rate your experience?