- The Tokyo-based firm acquired 68.59 BTC for $6.6M, bringing its total Bitcoin reserves to 2,100 BTC.

- Aims to reach 10,000 BTC by 2025 and 21,000 BTC by 2026, backed by a 21 million share issuance plan.

- Despite fluctuations, Metaplanet’s stock has surged 3,600% since pivoting to Bitcoin.

Tokyo-based investment company Metaplanet unveiled Thursday its Bitcoin accumulation plan with the latest acquisition of 68.59 BTC valued at about 996 million yen (about $6.6 million). The latest acquisition pushes the company’s total Bitcoin holdings to 2,100 BTC, which is valued at 0.01% of the Bitcoin supply. With a growing appetite among institutions to purchase Bitcoin, Metaplanet is positioning itself as a major company player within the sector.

*Metaplanet Reaches 0.01% of Total Bitcoin Supply* pic.twitter.com/0fgubEYkaA

— Metaplanet Inc. (@Metaplanet_JP) February 20, 2025

Metaplanet first added Bitcoin to its company plan on April 8, 2024, within its plan to buy 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026. With this latest purchase, the company has made 2.38% of its grand “21 Million Plan.” The plan involved 21 million 0% discount stock acquisition rights to the company’s EVO FUND to complement its Bitcoin treasury plan.

In the Feb. 20 news update, Metaplanet announced that the newest Bitcoin purchase had a 14.53 million yen average price per BTC. The company also tracks BTC Yield, a key metric that measures Bitcoin holdings to fully diluted shares. It increased substantially from 41.7% in Q3 2024 to 309.8% in Q4 2024, showing the company’s ramping Bitcoin accumulation plan.

Metaplanet Bitcoin Bet Pays Off Stock Soars 3,600%

Following the news of its latest Bitcoin purchase, the shares of Metaplanet rose 1.79% in the over-the-counter (OTC) market amid investors’ support of its Bitcoin-driven approach. However, earlier in February, the company’s stock had fallen by over 8% earlier this month amid a 10-for-1 stock split to improve the company’s liquidity. It followed 10 shares to 1 reverse stock split that was undertaken in August 2024 to align accessibility with valuation among the investors.

In spite of all the turbulence, Metaplanet is Japan’s highest-performing stock, having increased 3,600% since entering Bitcoin. The performance is a testament to the growing appetite among investors for company Bitcoin adoption, with Metaplanet taking a cue from companies like MicroStrategy that have accepted Bitcoin as a treasury asset.

With the Bitcoin halving date drawing closer to April 2024, Metaplanet’s bullish accumulation strategy is simultaneous with increasing institutional adoption of the BTC asset to hedge against inflation and mainstream market volatility. With Bitcoin’s rarity growing following the halving, Metaplanet’s move to occupy a larger percentage of the digital asset will lead the company to the forefront of company Bitcoin holders.

With the crypto market continuing to evolve, all eyes are on Metaplanet’s next Bitcoin acquisitions. Will the company succeed in reaching its 10,000 BTC target by 2025? Investors and experts will have a very sharp eye on its performance as the Bitcoin bull trend grows stronger.

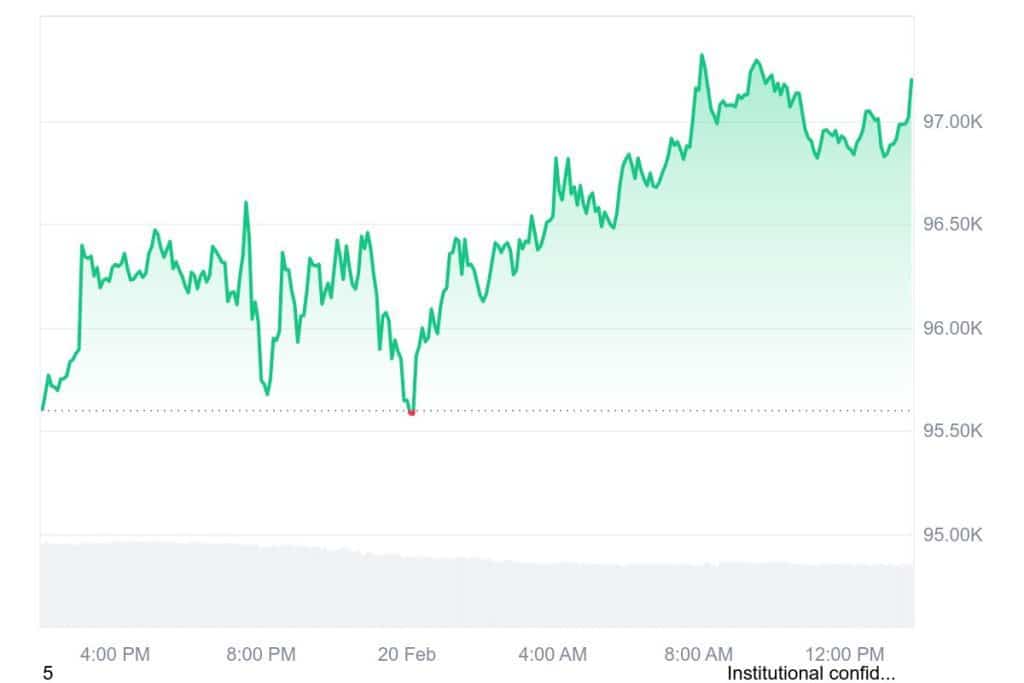

At the time of this writing, Bitcoin price today is $ 97,028 with 24h trading volume of $ 50.22B, market cap of $ 1.92T. The price of the BTC increased by 1.56% in the last 24 hours.

Related | Is XRP’s Next Move Towards a $1 Trillion Market Cap ‘Super Doable’?

How would you rate your experience?