- Metaplanet bought $104.3 million more in Bitcoin, raising its total holdings to 7,800 BTC worth about $806 million.

- The firm plans to increase its Bitcoin stash to 10,000 BTC by the end of 2025. This move is part of its strategy for treasury diversification.

- Metaplanet funds purchases through bond issuances, avoiding the liquidation of other assets.

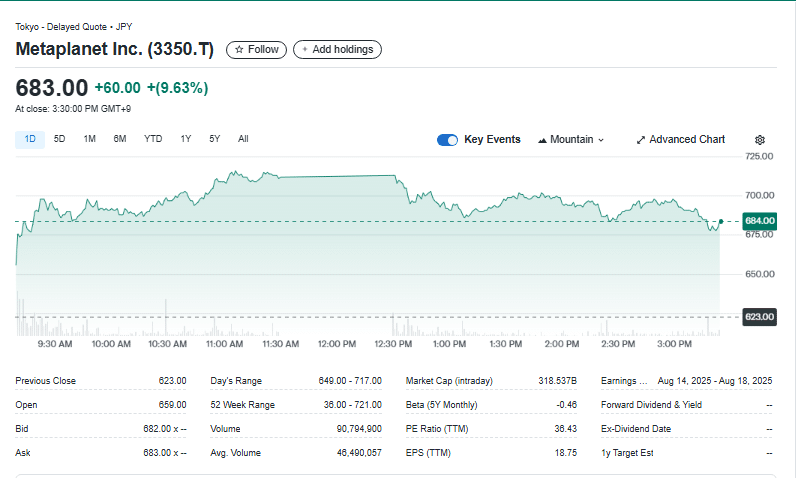

- Following the announcement, its stock surged 12.2% in Tokyo, reflecting strong investor confidence in its crypto strategy.

Tokyo-based investment firm Metaplanet continues to solidify its position as a major bitcoin accumulator in Asia, recently acquiring an additional $104.3 million worth of Bitcoin. The move highlights the company’s unwavering confidence in the world’s largest cryptocurrency. It comes amid a broader market rally pushing Bitcoin prices close to historic highs.

On Monday, Metaplanet publicly disclosed its latest purchase of 1,004 bitcoins, acquired at an average price of approximately $103,873 per coin. This latest acquisition pushes the firm’s total bitcoin holdings to 7,800 BTC, amassed at an average cost of $91,343 per bitcoin. According to Metaplanet CEO Simon Gerovich, the total investment amounts to roughly $712.5 million. At current market values, these holdings are now worth an estimated $806 million, underscoring significant unrealized gains.

Metaplanet has acquired 1004 BTC for ~$104.3 million at ~$103,873 per bitcoin and has achieved BTC Yield of 189.1% YTD 2025. As of 5/19/2025, we hold 7800 $BTC acquired for ~$712.5 million at ~$91,343 per bitcoin. $MTPLF pic.twitter.com/w4tqZA2QPK

— Simon Gerovich (@gerovich) May 19, 2025

Consequently, the strategic bitcoin accumulation began in April 2024 as part of Metaplanet’s broader treasury diversification plan. The company has openly stated its ambition to increase its Bitcoin reserves to 10,000 BTC by the end of 2025. It marks a substantial long-term commitment to the asset. This incremental build-up comes as bitcoin itself experiences a bullish upswing, recently hovering near all-time price peaks.

At the time of writing, Bitcoin is trading at $ 103,050 with a 24-hour trading volume of $ 125.86B and a market cap of $ 2.04T. The BTC price decreased -0.86% in the last 24 hours.

Metaplanet Buys More Bitcoin with $15M Bond

Moreover, funding these sizable Bitcoin purchases has involved a series of bond issuances. The firm has been utilizing capital markets to support its crypto treasury strategy. The latest funding round, announced last week, involved a $15 million ordinary bond sale, the 15th such issuance by the company to date. This innovative financing approach allows Metaplanet to steadily expand its digital asset portfolio without liquidating other holdings.

*Metaplanet Issues 15 Million USD in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/dBQYwJGOfy

— Metaplanet Inc. (@Metaplanet_JP) May 13, 2025

Furthermore, in terms of market positioning, Metaplanet has emerged as Asia’s largest publicly traded corporate holder of bitcoin. According to Bitcointreasuries.net data, it ranks 11th globally. For context, the industry leader remains Michael Saylor’s strategy, which commands an unparalleled 568,840 BTC stash.

Metaplanet’s aggressive bitcoin strategy appears to be resonating with investors as well. According to Yahoo Finance, on Monday, the firm’s stock price climbed 9.63% in Tokyo trading, reflecting growing market optimism around its crypto-centric business model.

Moreover, as Bitcoin continues to attract institutional interest worldwide, Metaplanet’s methodical approach and transparent accumulation strategy illustrate a significant trend: Asian firms are increasingly embracing cryptocurrency as a core treasury asset. This adoption signals a shift in the region’s financial landscape. It highlights Bitcoin’s evolving role beyond just a speculative instrument to a strategic reserve asset.

Related | Cardano (ADA) Declines 3% as Crypto Market Retreats

How would you rate your experience?