- Mt. Gox moved over $1 billion in Bitcoin, sparking speculation about long-awaited creditor repayments.

- The exchange transferred 11,834 BTC to an unmarked address, its most significant transaction since January 2024.

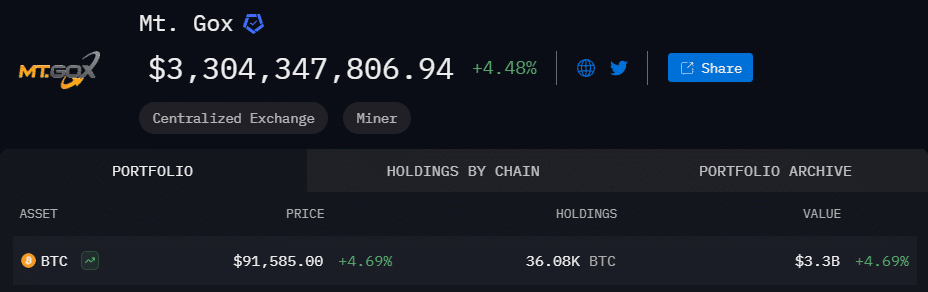

- Despite the transfers, Mt. Gox still holds 36,080 BTC ($3.3 billion), leaving uncertainty about the repayment timeline.

Mt. Gox, the once-dominant Bitcoin exchange that collapsed in 2014, has initiated a massive Bitcoin transfer, reigniting speculation about long-awaited creditor repayments. The exchange, which lost over 800,000 BTC in a historic hack, has been under bankruptcy proceedings for nearly a decade, leaving creditors in limbo.

Blockchain data from Arkham Intelligence reveals that Mt. Gox transferred 11,834 BTC, worth over $1 billion, from its wallet “1PuQB” to an unmarked address “1Mo1…9gR9.” Shortly after, an additional 166.5 BTC valued at $15.12 million was sent to another wallet. These are the most significant Bitcoin transfers from the exchange since January 2024. Analysts believe the exchange may be preparing for creditor distributions.

ARKHAM ALERT: MT GOX MOVING $1B $BTC pic.twitter.com/VpIkHdJQkl

— Arkham (@arkham) March 6, 2025

Mt. Gox’s wallets still hold 36,080 BTC, approximately $3.3 billion. This raises questions about whether these latest transactions mark the beginning of long-overdue repayments. Alternatively, they could be part of routine asset management

Founded in 2010, Mt. Gox was once the world’s leading Bitcoin trading platform, handling 70% of all BTC transactions. However, after suffering a catastrophic hack in 2014, the exchange filed for bankruptcy, leaving thousands of creditors waiting for restitution.

InRepayments were initially xpected in 2024, but in October of last year, the exchange postponed the deadline to October 31, 2025. The latest Bitcoin transfers have fueled speculation that Mt. Gox is finally taking steps to fulfill these long-standing obligations.

Massive Bitcoin Transfers Shake Market

Historically, large Bitcoin movements from defunct exchanges have triggered market volatility. Some believe these transfers indicate imminent creditor repayments. Others suggest they may be part of internal restructuring or security updates.

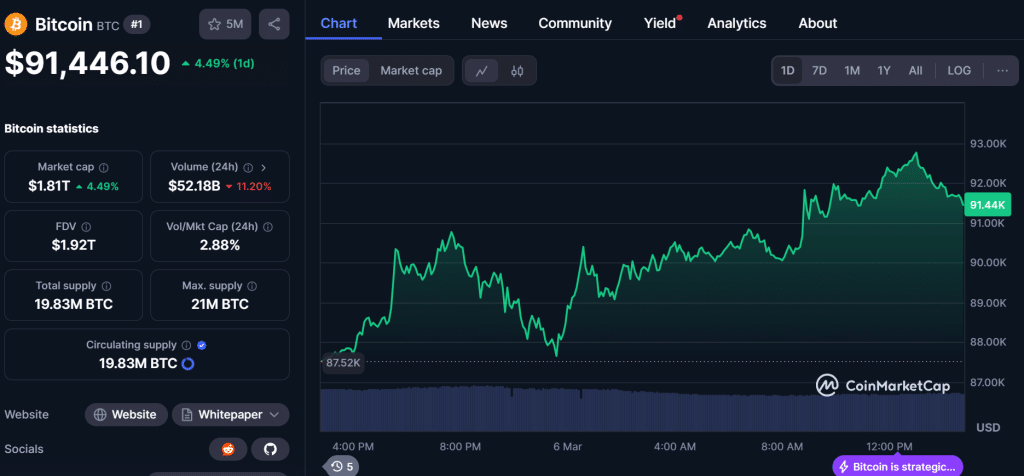

Following the transactions, Bitcoin briefly surged past $91,903, though broader market factors, including global macroeconomic conditions and Trump’s tariff policies, continue to influence its price trajectory.

With billions of dollars in Bitcoin still under Mt. Gox’s control, investors and creditors remain on high alert for any official confirmation regarding the long-awaited repayments.

Related | Upbit Surges as South Korea’s Top XRP Reserves Outpace Binance

How would you rate your experience?