- Nasdaq invests $50M in Gemini’s IPO, gaining access to custody and staking services from the exchange.

- Gemini boosts its IPO plans with Nasdaq as a partner, giving clients access to the Calypso collateral platform.

- The partnership underscores the merger of traditional finance with blockchain technology and tokenized securities trading.

Nasdaq has also formed a strategic alliance with the cryptocurrency exchange Gemini, established by Cameron and Tyler Winklevoss. The acquisition provides the Nasdaq with the ability to engage in custodianship and staking services with Gemini.

Nasdaq becomes a strategic partner of Gemini in its forthcoming initial public offering. According to Reuters, Gemini intends to raise a maximum of $317 million through the IPO. Nasdaq will acquire a total of $50 million shares through a private placement.

Nasdaq-Gemini Alliance Expands Digital Asset Integration

The joint venture will give Gemini capital and an extra high recommendation by one of the largest stock markets in the world. It also enhances the role of Nasdaq in the digital asset industry. Combined use of traditional financial systems with blockchain-based services opens opportunities to both parties. The contract is market contingent, or conditions may be altered.

This partnership is not solely financial. Nasdaq will provide institutional customers of Gemini with access to Calypso, a platform that is employed to monitor and supervise collateral in trade. Meanwhile, Gemini will be incorporating its staking and custody functions at Nasdaq. This service trade indicates adaptation of traditional markets to the increasing need for digital assets.

Also Read: Major $2.4M Exploit Rocks Sui-Based DeFi Platform Nemo Protocol!

The announcement comes soon following a significant regulatory step by Nasdaq. On Monday, the exchange submitted to the U.S. Securities and Exchange Commission to revise its securities regulations.

The proposed changes would enable traditional stocks to be traded in tokenized formats on regulated marketplaces. Nasdaq stated that the regulation of such products should apply to exchanges, not to fragmented and unregulated venues.

Gemini Backs Modernization Drive as Nasdaq Highlights Risks

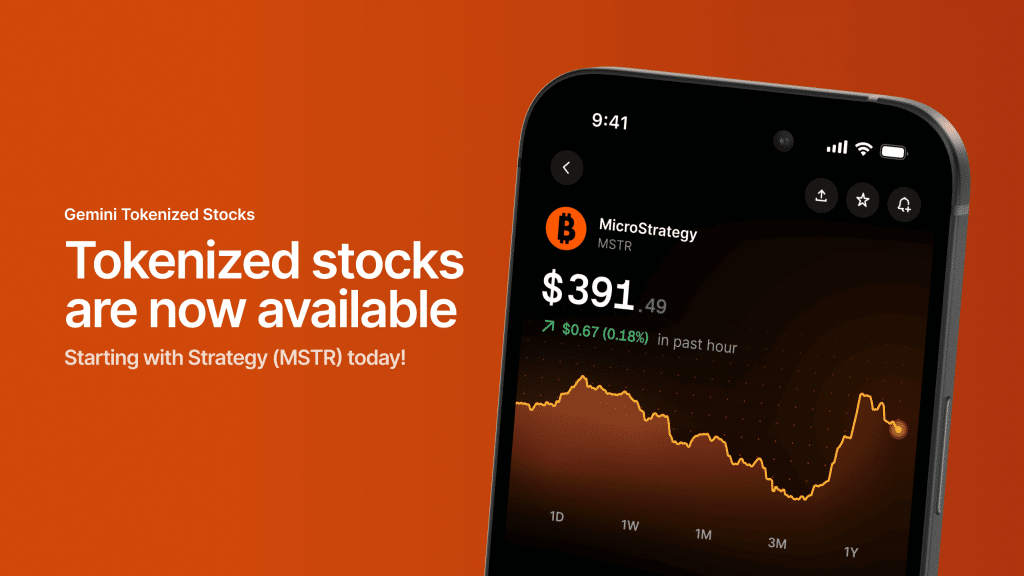

Nasdaq also expressed concerns regarding the proliferation of tokenized U.S. stocks in Europe. It added that such offerings lacked supervision and posed a threat to investors. Gemini has already introduced these products to foreign markets. In June, the firm launched tokenized shares that were correlated to firms such as MicroStrategy, under the leadership of Michael Saylor.

Source: Gemini

Gemini said at the time that financial systems were obsolete and inefficient. It claimed that tokenization would open up more markets and minimize barriers to investors. The company regards blockchain-based offerings as a mandatory move towards modernization. This investment by Nasdaq adds more credibility to these goals as Gemini pursues them.

In the case of Nasdaq, the collaboration makes it stronger in the movement towards blockchain-based finance. To Gemini, it gives the right to have capital and a reputed partner prior to going public. The acquisition demonstrates the growing convergence of the financial and crypto worlds.

Also Read: Bitcoin Stockpile Plans Included in Treasury Budget Alongside IRS and Cybersecurity Funding

How would you rate your experience?