- The committee advanced House Bill 302 with a 16-1 vote, allowing the state to invest up to 5% of its funds in Bitcoin.

- The bill restricts digital asset investments to those with a $500B market cap, limiting it to Bitcoin.

- Stablecoins and staking removed, aligning HB 302 with traditional investment strategies.

New Hampshire has taken a significant step toward incorporating Bitcoin into its financial strategy. On March 5, the state’s House Commerce and Consumer Affairs Committee passed House Bill 302 in a 16-1 vote, bringing it closer to a full House floor vote. This positions New Hampshire among many U.S. states pushing for Bitcoin-related legislation.

NEW HAMPSHIRE Update:

— Bitcoin Laws (@Bitcoin_Laws) March 6, 2025

Bitcoin Reserve Bill HB302 has passed the House Commerce and Consumer Affairs Committee.

The vote was 16 – 1 pic.twitter.com/7DpzFzxgda

House Bill 302, introduced by Republican Keith Ammon on Jan. 10, proposes that the state treasurer be granted discretionary power to invest up to 5% of the general fund, the revenue stabilization fund, or other state-authorized funds into eligible digital assets. The bill initially suggested a 10% allocation, but later, lawmakers revised it to 5%.

BIG BREAKING: A bill to create a ‘Strategic Bitcoin Reserve’ has been introduced in the State of New Hampshire by @RepKeithAmmon. pic.twitter.com/5lAqFpopda

— Dennis Porter (@Dennis_Porter_) January 10, 2025

Moreover, the bill restricts digital asset investments to those with an average market capitalization of at least $500 billion over the past year. Although Bitcoin isn’t explicitly mentioned, it is the sole eligible asset. A qualified custodian must hold any acquisitions or structure them as an exchange-traded product to ensure regulatory compliance.

Additionally, the bill authorizes investments in precious metals such as gold, silver, and platinum, broadening the scope of New Hampshire’s asset diversification strategy.

Bitcoin Bill HB 302 Moves Forward

HB 302 enjoys bipartisan support, with Democratic representatives Chris McAleer and Carry Spier co-sponsoring alongside Ammon. The March 5 committee session saw amendments that removed stablecoins and staking from the bill, aligning it with more traditional investment vehicles.

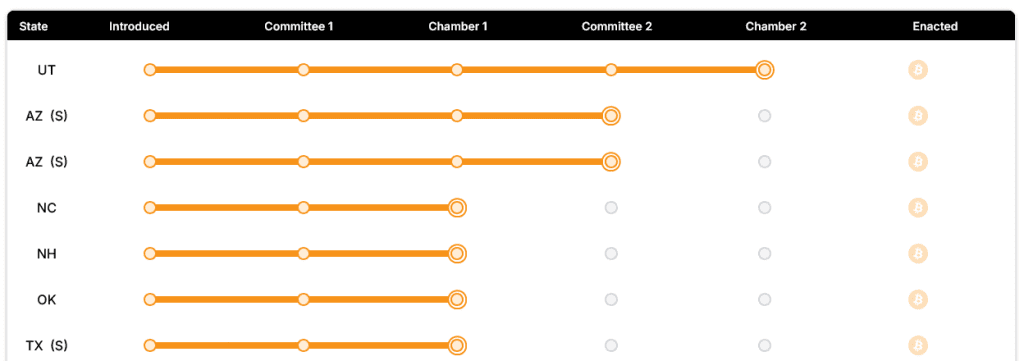

Monica Mezzapelle, New Hampshire’s Treasurer, has reportedly expressed interest in leveraging these investment options if the bill is enacted. If passed, the state will join others, such as North Carolina, Oklahoma, and Texas, awaiting full House votes on similar Bitcoin-related proposals. Meanwhile, Utah and Arizona have already advanced related bills beyond this stage.

The movement at the state level coincides with broader federal discussions on Bitcoin’s role in the economy. On March 2, former U.S. President Donald Trump announced the establishment of a Crypto Strategic Reserve, which would include Bitcoin, Ethereum, XRP, Solana, and Cardano. However, Bitwise’s Chief Investment Officer, Matt Hougan, emphasized that Bitcoin would likely dominate the reserve’s composition.

As regulatory clarity increases and more states explore Bitcoin-related policies, New Hampshire’s initiative underscores the growing recognition of Bitcoin as a legitimate asset for institutional investment. If passed, the bill could set a precedent for other states looking to integrate Bitcoin into their financial frameworks.

Related | Upbit Surges as South Korea’s Top XRP Reserves Outpace Binance

How would you rate your experience?