- New bills (House Bill 506 and Senate Bill 709) propose including digital assets like Bitcoin, stablecoins, and NFTs in state retirement funds.

- The legislation aims to create the North Carolina Investment Authority to evaluate and select digital assets for state retirement investments, without strict market cap limits.

- Senate Bill 327 proposes a 10% allocation of public funds to Bitcoin, with strict liquidity rules and oversight from a Bitcoin Economic Advisory Board.

North Carolina lawmakers have introduced new legislation that could pave the way for the state to invest some of the retirement funds in cryptocurrencies like Bitcoin. House Bill 506 and Senate Bill 709, both aimed at revising the state’s investment policy by adding digital assets to the potential investment options of the state retirement funds.

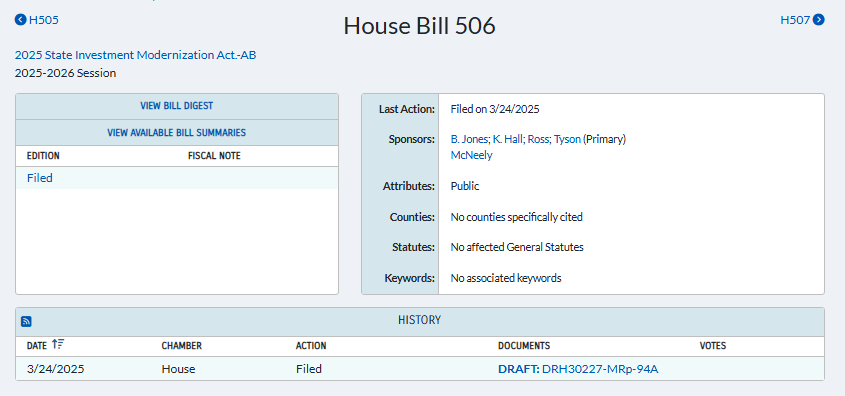

On March 24, Representative Brenden Jones introduced the Investment Modernization Act (House Bill 506). On March 25, lawmakers introduced Senate Bill 709. Both bills seek to establish the North Carolina Investment Authority. The new authority will explore the potential of digital assets, including cryptocurrencies, stablecoins, non-fungible tokens (NFTs), and other electronic assets. It will assess their inclusion in the state’s retirement funds.

🚨 NEW: North Carolina Bitcoin Investment Bill

— Bitcoin Laws (@Bitcoin_Laws) March 25, 2025

House Bill 506 would create a new independent NC Investment Authority headed by the Treasurer.

The NCIA would have authority to invest 5% of various state funds in digital assets. pic.twitter.com/YuYmI8YyY2

The bills are unique in that they offer a wide scope, granting the power to invest in various digital assets without setting strict market cap stipulations. This contrasts with some other state-level crypto-related bills that impose such restrictions.

These bills broadly define digital assets to encompass cryptocurrencies, stablecoins, NFTs, and any other electronic asset. These assets grant economic, proprietary, or access rights. The lack of market cap thresholds provides the North Carolina Investment Authority more leeway in selecting digital assets in which to invest.

However, the agency would still need to carefully review the risk and reward profiles of every asset. This would be necessary before adding it to the state retirement fund. The funds would also need to be secured to minimize risks associated with digital asset management.

North Carolina’s Bold Bitcoin Strategy with 10% Crypto Allocation

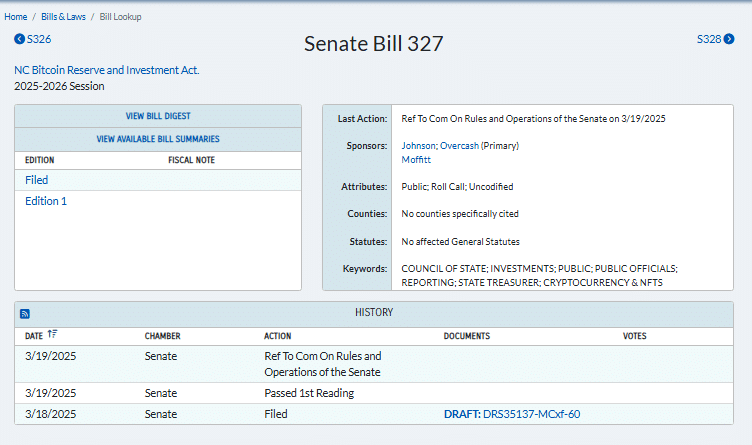

It’s important to note that while House Bill 506 and Senate Bill 709 open the door for crypto investment, they do not mandate the state to hold any specific digital asset, including Bitcoin. That said, another bill, Senate Bill 327, introduced on March 18, is much more focused on Bitcoin.

It’s worth noting that, though House Bill 506 and Senate Bill 709 clear the way for crypto investment, neither of them requires the state to maintain any particular digital asset, including Bitcoin. That being said, a different bill, Senate Bill 327, presented on March 18, is far more targeted at Bitcoin.

The Bitcoin Reserve and Investment Act proposes allocating up to 10% of the state’s public funds to Bitcoin. The Bitcoin would then reside in a multi-signature cold storage wallet. The bill also stipulates that Bitcoin could only be liquidated during a severe financial crisis. This would require approval from two-thirds of North Carolina’s General Assembly. The government would establish a Bitcoin Economic Advisory Board to oversee the reserve.

North Carolina’s move is part of a broader trend across the U.S., with 41 Bitcoin reserve bills introduced in 23 states, many of which are still under consideration. The trend reflects a growing interest in leveraging cryptocurrency to strengthen state economies and diversify investment strategies.

President Trump recently signed an executive order to create a strategic Bitcoin reserve and Digital Asset Stockpile. Cryptocurrency forfeited in government criminal cases will initially fund it.

As more states explore crypto investments, North Carolina’s legislative efforts could mark a significant milestone. This could be crucial in integrating digital assets into institutional financial strategies.

Related | Kentucky’s Bitcoin Rights Bill Signed into Law as a Major Crypto Milestone

How would you rate your experience?