- ONDO is trading at $0.9312, up 0.07% in 24 hours, with trading volume down by 33.17% to $122.68 million.

- A price increase of 1.94% over the past week signals steady growth and positive momentum for the asset.

- RSI at 48.46 shows neutral market conditions, while MACD points to slight bearish momentum.

Ondo Finance (ONDO) is currently trading at $0.9312, up 0.07 percent over the past 24 hours. Its trading volume is down by 33.17%, which currently stands at $122.68 million. With the decrease in volume, the price has remained relatively consistent.

Source: CoinMarketCap

The price of ONDO has increased by 1.94% in the past seven days. This gradual increase shows encouraging strength of the cryptocurrency. Generally, the asset has maintained a steady growth in the recent days.

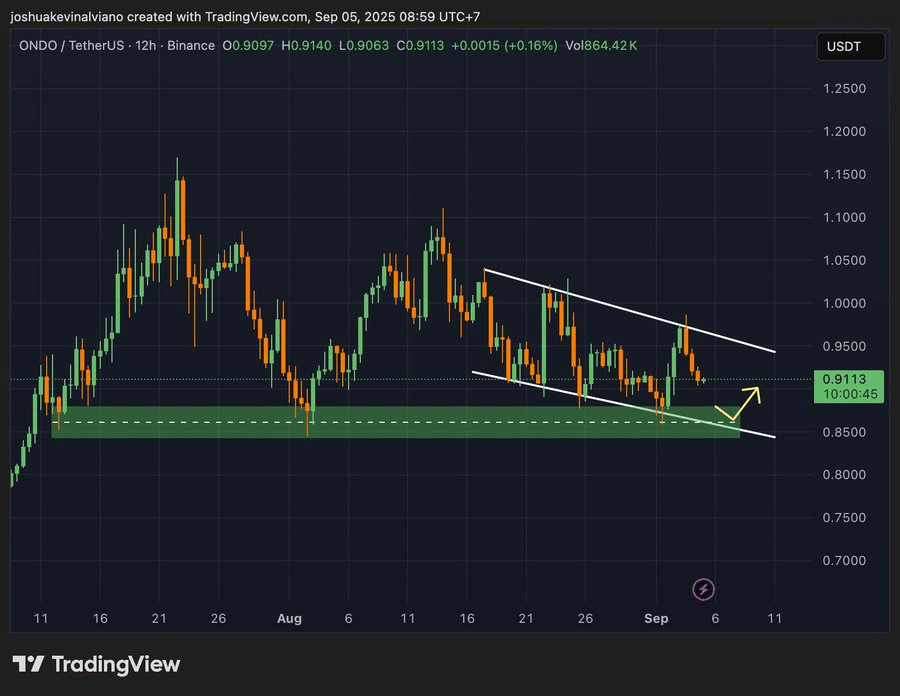

ONDO Faces Crucial Support, Volatility Looms

Crypto analyst CryptoPulse has highlighted that ONDO is undergoing consolidation in a downward direction. The price is floating above the green demand zone, which falls between $0.84 and $0.88. If the price maintains its support at this point, it might advance toward the resistance zone of $0.95-$1.00. Any breakout above this resistance may lead to a greater increase in the upward movement.

In case the price cannot hold above the zone of demand, there is a risk of a decline. The analysts are looking at lower liquidity areas below $0.80 as possible levels of support. ONDO may become unsustainable if it is not sustained at levels above its current level of support, which could lead to increased volatility.

Source: X

Also Read: Discover How B3’s XRPL Gamechain Could Revolutionize Crypto Adoption!

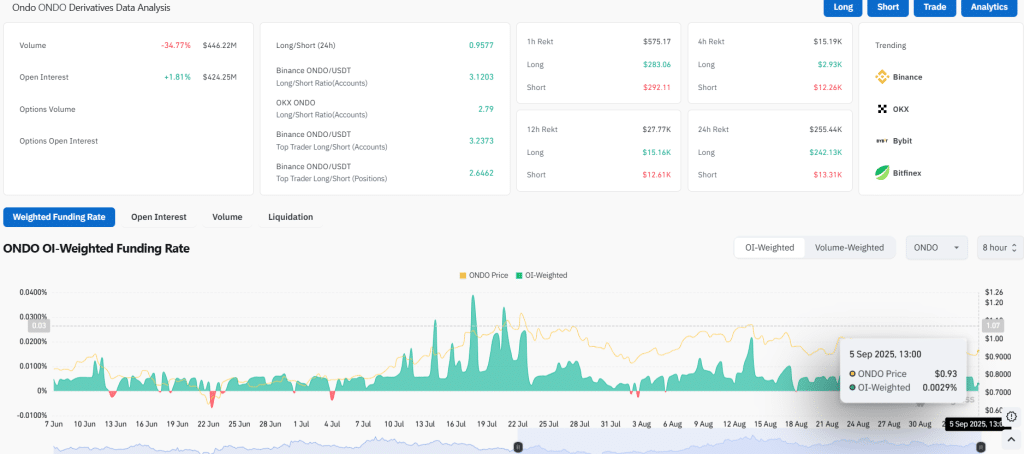

ONDO Volume Drops, Open Interest Rises

According to CoinGlass data, the volume declined by 34.77% to $446.22 million. The open interest has increased by 1.81% to $424.25 million. The OI-weighted funding rate is 0.0029%, indicating a strong market mood. This data implies that the interest in ONDO is still strong, but market participants are doubtful about its short-term price behavior.

Source: CoinGlass

RSI Neutral, MACD Indicates Bearish Momentum

The Relative Strength Index (RSI) of ONDO stands at 48.46, which is a neutral market situation. This indicates that the cryptocurrency is neither heavily bought nor sold. The prices may end up going either way, dependent on future market trends.

The MACD line is -0.0007 and the signal line is -0.0132, suggesting a slight bearishness. The unfavorable histogram confirms the declining bullish momentum. Still, the trend is not strong, and the market is not firm.

Source: TradingView

Ondo Finance is still stable even though the trading volume is falling. The price has stayed comparatively steady, and this is an indicator of strength in uncertain markets. The technical case shows possibilities of further movement. Investors will closely monitor whether ONDO will overcome resistance or experience a downward push.

Also Read: Solana Holdings Surge as DeFi Development Corp Expands Treasury to $371M

How would you rate your experience?