- Ripple secures full DFSA license, becoming the first blockchain payments provider approved in Dubai’s DIFC.

- Dubai’s $40B cross-border payments market gets a boost with Ripple’s blockchain-powered solutions.

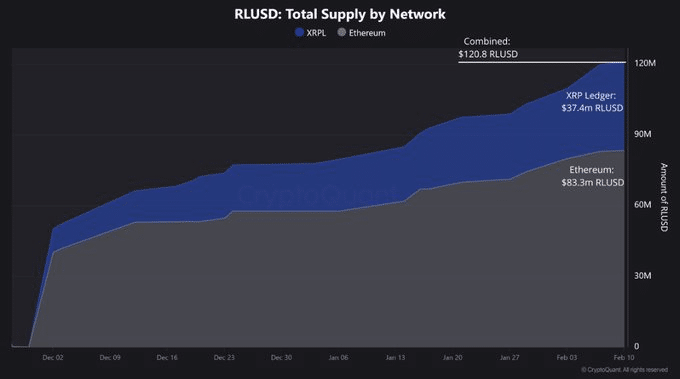

- Ripple’s RLUSD stablecoin surpasses $120M supply, reinforcing its push into the stablecoin sector.

Ripple is transforming cross-border payments, and its latest achievement reinforces its position as a leader in the blockchain-based financial services industry. Ripple has gained complete approval from the Dubai Financial Services Authority (DFSA) for providing regulated cryptocurrency payment services in the Dubai International Financial Centre (DIFC).

Huge news 🔥 @Ripple is now DFSA licensed to offer regulated crypto payments in the @DIFC bringing the speed and efficiencies of blockchain to one of the world’s biggest trade and cross-border payments hubs.

— Reece Merrick (@reece_merrick) March 13, 2025

A big thank you to our partners at @DIFC and the DFSA for their early…

This is a moment in history that transforms Ripple into the first DFSA-approved blockchain-based payment provider, positioning Dubai as a hub for digital asset innovation. Dubai, with its innovative crypto regulations, is now a magnet for blockchain firms that want to scale their business.

Ripple’s official announcement last March 13 validates its DFSA license, after receiving a preliminary in-principle approval last October 1, 2024. With this license, Ripple aims to speed up its blockchain payment solutions in the UAE, where digital finance adoption is surging.

Ripple highly values the Middle East market, with 20% of its existing customers already present there. A recent survey reported that 64% of Middle East finance leaders view blockchain payments as the future, a strong signal for demand for innovative digital asset services.

$40B Cross-Border Payment Market Gets a Blockchain Boost

Dubai’s status as a global remittance and cross-border payments hub with a $40 billion market is a key factor in Ripple’s expansion strategy. Businesses in the region will now benefit from faster, more cost-effective, and transparent payments powered by RippleNet and XRP Ledger.

CEO Brad Garlinghouse noted this attainment. He emphasized that regulatory openness and institutional acceptance are the major drivers behind the rapid growth of crypto and blockchain payments. He believes that Dubai’s business-friendly regulatory framework plays a key role in shaping the future of digital payments.

In spite of regulatory hurdles in the U.S., Ripple has been expanding globally in a big way, with more than 60 regulatory clearances worldwide. Some notable licenses include the Monetary Authority of Singapore (MAS) and the New York Department of Financial Services (NYDFS). Additionally, the Central Bank of Ireland is also a significant license.

Moreover, Ripple has obtained multiple state-level approvals across the U.S. This further solidifies its compliance and operational reach in key financial markets.

Ripple Expands in Stablecoins with RLUSD Growth

According to data from CryptoQuant, Ripple’s USD stablecoin (RLUSD) supply is now over $120 million. The RLUSD stablecoin has surpassed a $100 million market capitalization, reaffirming its commitment to becoming a leader in blockchain-based financial solutions.

Furthermore, Ripple’s momentum does not stop with regulatory wins. The company’s XRP ETF filing has raised hopes that the Ripple vs. SEC legal battle may soon be resolved. With approval, an XRP ETF would further fuel institutional adoption, further cementing Ripple’s place in the crypto community.

With Dubai’s approval now in hand, the coin is poised to reshape international finance. This move proves once again that blockchain technology is the future of global payments.

Related | U.S. House Overturns IRS DeFi Broker Rule in Landmark Crypto Victory

How would you rate your experience?