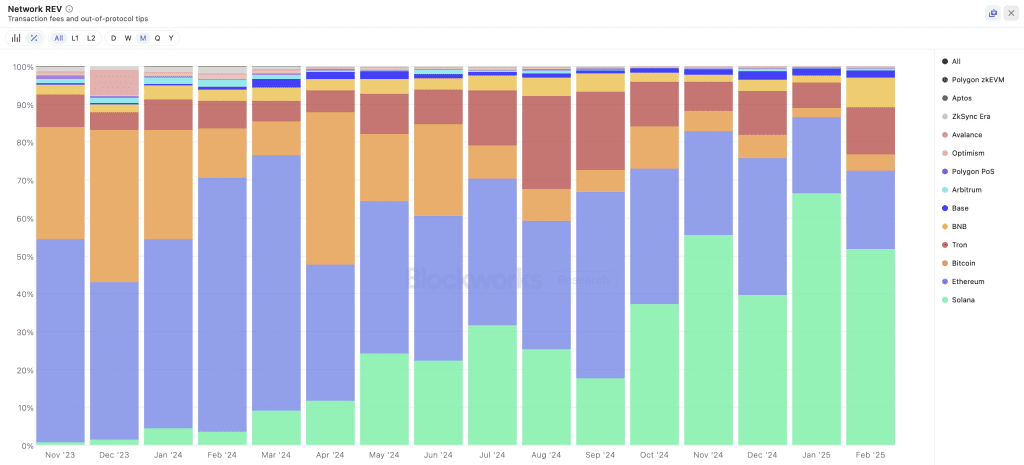

- Solana captured 52% of global demand for on-chain transactions, outpacing Ethereum’s 21% share.

- Solana apps generated 54% of total blockchain app revenue despite a 56% monthly decline.

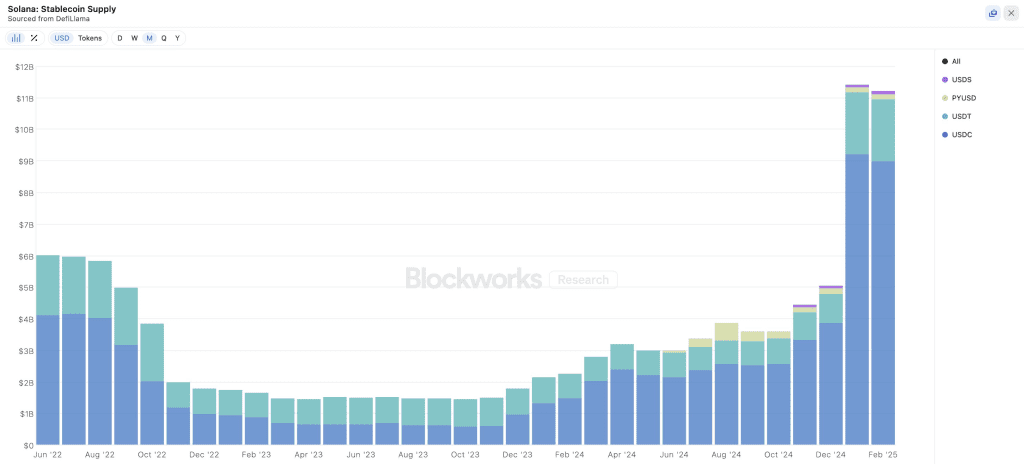

- Memecoins drove 64% of Solana’s $156B DEX volumes, while USDC dominated 80% of its stablecoin market.

After a fast-paced start to the year, Solana’s on-chain activity cooled in February, reflecting a broader market slowdown. Key indicators, including transaction demand, application revenue, and decentralized exchange volumes, showed notable declines compared to January. However, despite these monthly drops, year-over-year trends remain strong, signaling that interest in SOL ecosystem is still significant.

One of the core metrics used to track blockchain usage is Real Economic Value (REV), which measures the total fees users pay for transactions. In February, Solana recorded $196 million in REV, capturing 52% of global demand for on-chain transactions. By comparison, Ethereum, the second-largest chain in this category, held a 21% market share.

Application revenue, another key performance indicator, also took a hit last month. Solana-based apps generated $284 million, a 56% decline from January. Despite this, Solana remains dominant, accounting for 54% of total app revenue across all chains, with Ethereum trailing at 14%.

Solana’s Market Shifts: DEX Volumes Fall While USDC Gains Ground

Solana’s decentralized exchange (DEX) sector also experienced a contraction in trading volumes. The chain processed $156 billion in DEX transactions in February, down 54% MoM. However, on an annual basis, DEX volumes remain strong, posting a sixfold increase year-over-year. A significant portion of this activity came from memecoins, which contributed 64% of total volume, while the SOL-USD pair accounted for 22%.

Meanwhile, Solana’s stablecoin supply shrank by 1.8%, ending February at $11.2 billion. The chain’s stablecoin landscape is increasingly dominated by USDC, which makes up 80% of the stablecoin market cap on Solana.

This contrasts with Ethereum, where USDT holds a 55% share. Despite February’s slowdown, Sol remains a key player in the blockchain space. The ecosystem remains active, with ongoing improvements and innovations shaping its future trajectory.

Related Reading: Will Bitcoin (BTC) Hold $90K, or Is a Major Drop Coming?

How would you rate your experience?