- Solana (SOL) sees a 1.31% increase to $242 despite a 23.51% drop in trading volume, showing resilience.

- The 19.39% rise in Solana’s price over the past week highlights growing investor confidence.

- A breakout above $260 could trigger further gains, while rejection at $255–265 may lead to a pullback.

Solana (SOL) is currently trading at $242 with a 1.31% increase over the past day. This price rise occurs as the trading volume has fallen by 23.51% to $9.86 billion. Liquidity continues to decline; however, SOL does not lose its attractiveness as it keeps moving upwards, which is of interest for investors. The coin has been resilient, continuing an upward trajectory in a choppy market.

Source: CoinMarketCap

In the last seven days, Solana has seen a rise of 19.39%. This sharp increase demonstrates increasing investor optimism. Market interest is good, and the community has strong confidence in Solana. As such, traders are bullish on the coin’s prospects moving forward.

Solana Faces Critical $255–265 Resistance

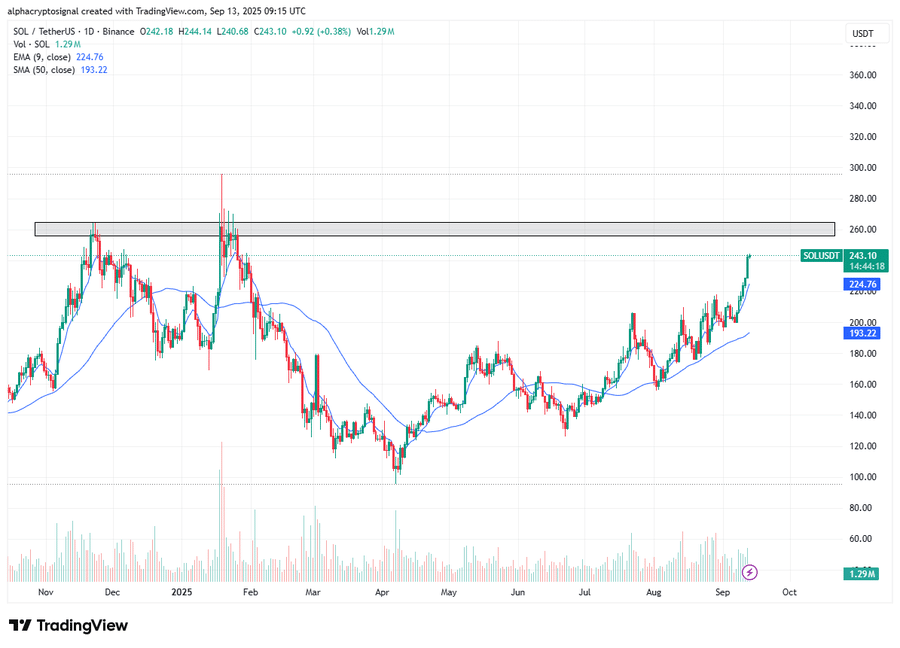

A prominent analyst, Alpha Crypto Signal, highlighted that Solana is about to tap a key resistance zone around $255 to $265. This level has historically acted as a seller’s zone, capping price appreciation. A rejection here could lead to a correction if Solana touches this resistance. For traders, it is important to be careful shorting SOL since the coin has a very strong bullish trend.

If SOL is denied by this resistance, the price could slump to $224–225. This level corresponds to the EMA-9 and is a local support area. But if Solana climbs above $260 and closes there, then it may spark a push toward $280–$300 and potentially nullify short trades. Traders must be alert to these important price levels.

Source: X

Also Read: Chainlink Achieves Historic $100B Milestone in Total Value Secured

RSI Shows Balance with Bullish MACD Momentum

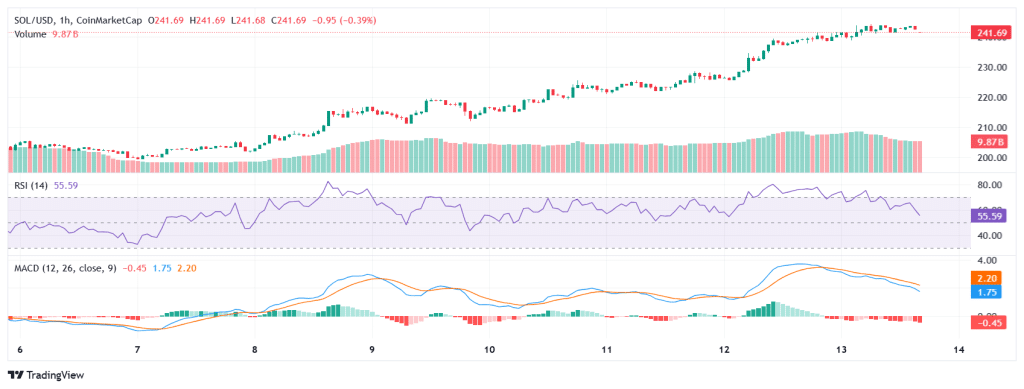

The Relative Strength Index (RSI) is at 55.59, indicating that Solana is in a neutral position. This neutrality indicates the market is in a balanced state that provides bear and bull fuel. At present, the market does not exhibit an immediate reversal.

MACD shows a bullish crossover. The MACD Line is 2.20, and the Signal Line is 1.75. The Histogram value is -0.45. These numbers represent strong, upward momentum; however, pullbacks could occur if the histogram moves lower.

Source: TradingView

Solana Faces Decreased Volume and Open Interest

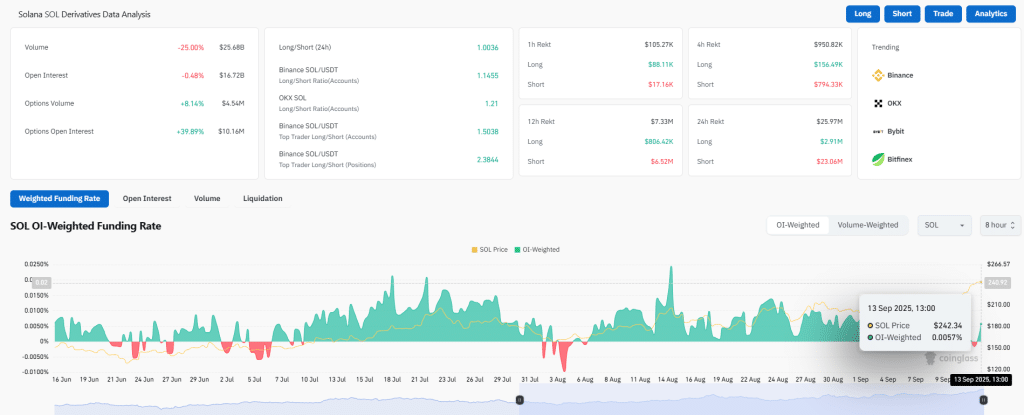

CoinGlass data shows that trading volume has fallen 25.00% to $25.68 billion. Open interest is down by 0.48%, sitting at $16.72 billion. The SOL’s OI-Weighted Funding Rate is 0.0057%.

Source: CoinGlass

Solana has recently seen some price growth that’s showing it still could have more upward momentum, even though trading volume is down. Key resistance levels will play a crucial role in determining the future direction of the price. Traders should consider additional forms of analysis to effectively manage risk in their trading activities.

Also Read: Mega Matrix’s $3M ENA Buy Signals Massive $2B DeFi Shift

How would you rate your experience?