- Solana saw a $3.53M withdrawal from Binance on May 25, with nearly all of it staked, an indicator of whale accumulation and long-term conviction.

- Long liquidations surged to $6.11M, heavily outweighing shorts and highlighting leveraged trader vulnerability amid rising volatility.

- Price remains capped below the $193 resistance, with RSI at 61.87 and net outflows suggesting cautious market participation.

Solana has seen a notable on-chain development that hints at growing long-term confidence, but broader market signals continue to flash caution.

On May 25, a newly created wallet made headlines by withdrawing 20,009 SOL, worth approximately $3.53 million, from Binance. Almost immediately, 19,875 SOL were staked, while an additional 134 SOL were transferred to another staking address. The combined staked holdings reached 9,270.4 SOL, totaling nearly $1.6 million.

A newly created wallet withdrew 20,009 $SOL ($3.53M) from #Binance and then sent 19,875 $SOL ($3.5M) into #Staking.

— Onchain Lens (@OnchainLens) May 25, 2025

Also sent 134 SOL to another wallet for staking, with total staking reaching 9,270.4 SOL ($1.6M).https://t.co/vEPuuOLqOahttps://t.co/5EtAbDtacB pic.twitter.com/b1bRFN5hhT

Such heavy staking from a fresh wallet is a classic signal of whale accumulation and long-term conviction. Yet, despite this bullish on-chain activity, Solana’s price has remained relatively muted. This disconnect suggests a growing undercurrent of quiet confidence rather than an immediate market breakout.

At the same time, market volatility has ramped up. On May 25, long liquidations soared to $6.11 million across major exchanges, far outweighing the $326K in short liquidations. Binance alone accounted for $2.76 million in long-side losses, highlighting the dominance of sell-side momentum and the vulnerability of leveraged bulls.

Historically, analysts see such a sharp imbalance in liquidations as a potential inflection point. It either signals a cooldown in speculative activity or warns of deeper bearish pressure building beneath the surface.

Solana Price Struggles to Break Past $193 Level

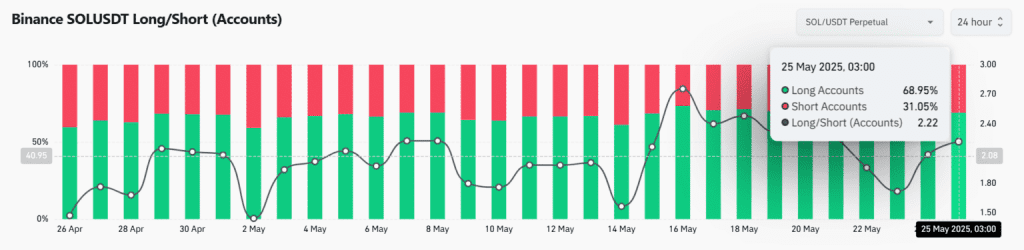

Despite the liquidation carnage, retail traders haven’t backed down. Binance’s long/short ratio for SOL stood at 2.22, with 68.95% of traders holding long positions, showing a continued lean toward bullish expectations. However, this skewed sentiment often precedes further volatility, especially if price action fails to validate the optimism.

At the time of writing, Solana traded at $177.90, still unable to clear the crucial 0.786 Fibonacci resistance level at $193. The Relative Strength Index (RSI) has cooled from previous highs to 61.87, indicating that while bullish pressure still exists, it lacks the strength needed to confirm a breakout.

From a macro view, spot market flows on May 25 showed $158.93 million in outflows versus $141.42 million in inflows, resulting in a net outflow. This indicates that while some large players may be accumulating, broader participation remains cautious or profit-driven.

Solana’s short-term outlook remains mixed: on-chain whale behavior signals belief in future growth, but the continued pressure from liquidations, net outflows, and technical resistance at $193 suggests the asset is not out of the woods yet.

For bulls, reclaiming the $193 level with convincing volume is key to targeting the next resistance near $229.46. Until then, traders should be prepared for more sideways consolidation or further downside risk, especially if leveraged long positions continue to unwind.

In conclusion, while Solana’s on-chain signals hint at strengthening fundamentals, the broader market structure demands caution. Until bullish conviction is matched by price action and inflows, the upside remains capped and the path forward is uncertain.

Related | Ripple CEO Brad Garlinghouse Breaks Down XRP ETF Launch on Nasdaq

How would you rate your experience?