- Strategy Inc.’s Bitcoin holdings hit a record $77.4B, solidifying its position as the largest corporate holder.

- Consistent Bitcoin purchases during market downturns helped the firm double its valuation to $77.4B.

- Holding 48% of global Bitcoin among public and private companies, Strategy Inc. strengthens its market dominance.

Strategy Inc., a Bitcoin treasury firm co-founded by Michael Saylor, has attained an all-time high in the amount of Bitcoin they hold in their treasury, which has now been valued at $77.4 billion. As of October 3, the company has 640,031 BTC. This is an upswing in the growth of Bitcoin, whose price has risen above $120,000 after weeks of fluctuation.

The valuation of the firm is over twice the all-time high of the firm of $41.8 billion. This boom can be highly linked to the recent boost of the price of Bitcoin. Strategy still bought Bitcoin stock and yet again, solidified its claim of the lead through its entries as the biggest corporate owner of Bitcoin by both value and the number of Bitcoins it owns.

Strategy Inc.’s Bold Bitcoin Strategy Pays Off with Record Holdings

Michael Saylor was excited about the new record on X when he remembered how the firm had invested $250 million in Bitcoin. He discussed the investment that resulted in an unrealized loss of $40 million at the start. Now, with Bitcoin, the company has seized fortunes through its holdings. We started with $0.25 billion in Bitcoin, Saylor said, and an unrealized purchase loss of $0.04 billion. We have now closed at an all-time high: $77.4 billion in BTC NAV.

The company strategy of buying Bitcoins consistently, even during sluggish market periods, has already paid off. Strategy has acquired 11,085 BTC in its reserves over the past seven weeks. The latest purchase consisted of 196 BTC on October 2.

Our journey began with $0.25 billion in Bitcoin — and an immediate $0.04 billion unrealized loss. Today, we closed at a new all-time high: $77.4 billion in BTC NAV. pic.twitter.com/9k5VkAaG8p

— Michael Saylor (@saylor) October 2, 2025

Shares of Strategy Inc. Soar 4% as mNAV Rebounds Above 1.5

The market-based net asset value (mNAV) associated with the strategy has recovered violently. Following the decline of the mNAV at 1.195 in the September correction, it is now above 1.5. Nonetheless, it still is much less than 2.5, which has been an important figure in capitalized investment in the past. This increase maximizes the capacity of Strategy to raise new equity at a premium, thus allowing future Bitcoin acquisition without a dilution risk to shareholders.

Also Read: Ripple’s RLUSD Stablecoin Launches in Africa with Chipper Cash, VALR, and Yellow Card

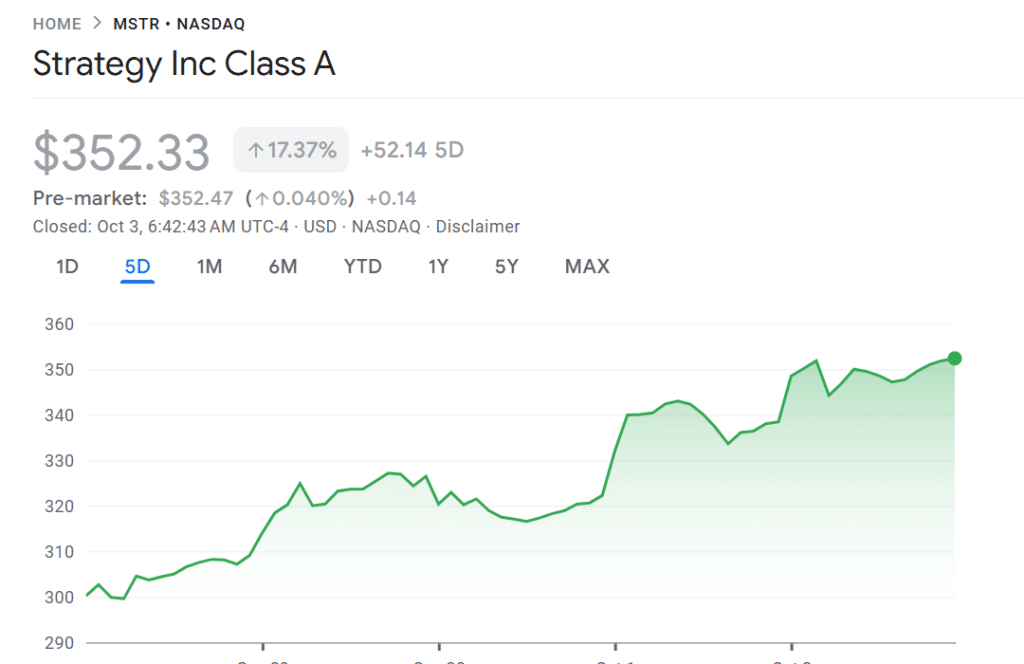

The recovery has also increased investor confidence. Instead, shares in strategy, with the ticker MSTR, soared 4% on October 2, ending at a price of $352.33, as per Google Finance data. Although still below its July peak of $457, the recent upward trend indicates the possibility that the stock can improve even further.

Source: Google Finance

According to BitcoinTreasuries.NET data, Strategy Inc. is estimated to hold approximately 48% of the total 1.32 million BTC owned by public and private companies globally. This establishes Strategy even more as the giant in the Bitcoin market, as it has become one of the crucial players in the Bitcoin corporate environment.

Also Read: Avalanche Treasury Co. Strikes $675M Deal with MLAC to Launch Nasdaq-Listed AVAX Vehicle

How would you rate your experience?