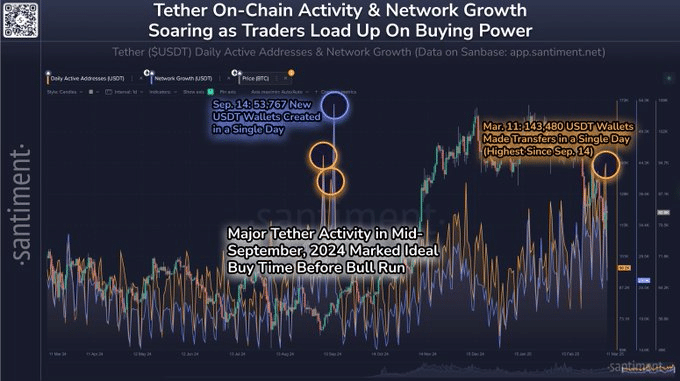

- USDT transactions hit a six-month high, with over 143,000 wallets making transfers on March 11, signaling traders’ market re-entry.

- Analysts suggest traders are accumulating USDT during downturns, using it as a haven before reinvesting.

- Tether CEO Paolo Ardoino highlights USDT’s role in financial inclusion and regulatory cooperation, reinforcing its significance in the crypto landscape.

Tether’s onchain activity has reached its highest point in six months. Analysts suggest this could signal that traders are gearing up to re-enter the cryptocurrency market.

Blockchain analytics platform Santiment pointed out in a March 12 tweet that the on-chain activity in Tether has experienced a steep climb, reaching a record number of more than 143,000 wallets transferring funds on March 11. This is the biggest jump since late in 2023.

Santiment stated, “The more USDT and other stablecoin trades that occur during price declines, the more likely it is that people are preparing to buy, with the added buying pressure serving to drive prices back up in the crypto market.”

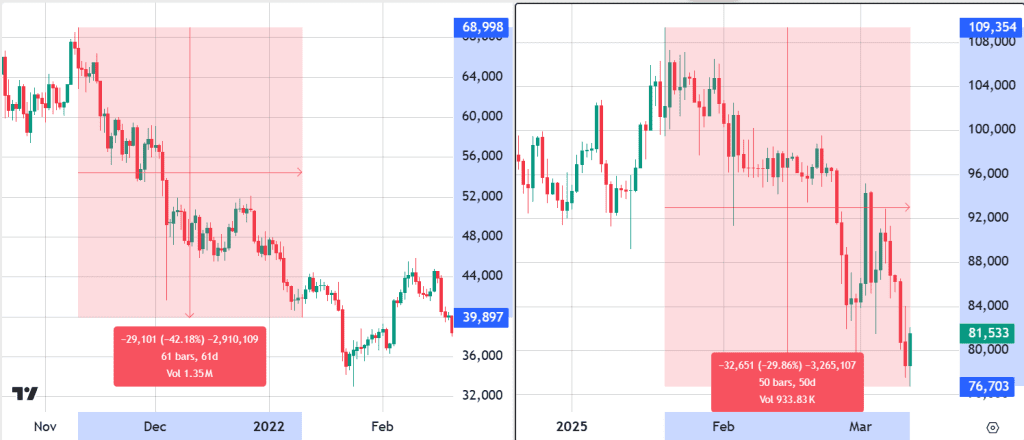

The surge in trades in USDT comes alongside Bitcoin dipping to a four-month low at $76,700 last March 11. The global cryptocurrency market has also suffered, losing much of the gains it achieved after the U.S. election. This decline comes in the wake of ongoing economic uncertainties in the world and a widening trade war.

Kronos Research chief investment officer Vincent Liu said that in bear markets, traders tend to accumulate USDT. This is done in preparation for future buying opportunities. That, in his view, is evidence that market volatility is what is being tapped by traders through this increased stablecoin activity.

The underlying reasons for this include macroeconomic concerns, regulatory developments, and the popularity of Tether as a stable asset. It is being used by numerous people as a safe haven before investing capital in the market, according to Liu.

Liu stated that while USDT activity has risen, a sustainable market recovery depends on economic conditions and investor sentiment. He also pointed to upcoming events, such as the March 18 Federal Open Market Committee (FOMC) meeting.

Tether Dominance Surges Amid Market Uncertainty

Swyftx lead analyst Pav Hundal noted that key financial metrics, such as M2 money supply, are trending upward. However, the crypto market remains in limbo. “Inflation data from China and the U.S. have been constructive, but as long as the trade war continues, market confidence will remain low,” Hundal stated.

explained that numerous investors are parking money in USDT but not actively trading, holding out for the opportune moment to enter.

“The market is in holding pattern. More cash is orbiting above the market, waiting for a landing slot,” he said.

Even with short-term volatility, Hundal noted that the dominance by Tether is once again at October levels before Bitcoin’s record $100,000 rally in December.

Additionally, the Crypto Fear & Greed Index hit its lowest level in over two years on February 26, plunging into “Extreme Fear” territory with a score of 10. While it has since rebounded, it still registered a fear-level score of 45 on March 13.

Tether’s Role in the Global Financial Landscape

Meanwhile, Tether CEO Paolo Ardoino is on a U.S. tour as lawmakers intensify regulatory discussions around stablecoins.

Speaking at the Cantor Fitzgerald Global Technology Conference on March 12, Ardoino revealed that about 37% of USDT holders use it as a savings account due to a lack of traditional banking access.

CEO of @Tether_to, @paoloardoino, speaks at Cantor's Global Tech Conference. #CantorTechhttps://t.co/2z8d46WDMG

— Cantor (@Official_Cantor) March 12, 2025

“They don’t have bank accounts. The only thing that they have in their life is usually cash,” Ardoino said. “Now they finally can hold the most used and most important stable currency in the world, the US dollar, but in their smartphones.”

At the same time, Ardoino positioned Tether as a stronghold for the U.S. dollar, countering fears that the greenback could lose its status as the world’s dominant reserve currency.

Additionally, Tether has intensified its efforts to combat illicit activities in the crypto space, collaborating on more than 170 law enforcement operations and freezing $2.5 billion in suspicious funds.

Related | U.S. House Overturns IRS DeFi Broker Rule in Landmark Crypto Victory

How would you rate your experience?