- Trump-linked World Liberty Fi scoops up $775K in SEI, fueling speculation of political capital flowing into blockchain.

- SEI surges 11% in 24 hours after the bold move, signaling renewed investor confidence amid a broader market recovery.

- Arkham confirms the purchase using USDC, placing World Liberty Fi’s total crypto holdings at over $101 million.

World Liberty Fi (WLF) a digital asset project reportedly linked to the family of U.S. President Donald J. Trump has acquired $775,000 worth of SEI tokens, sparking widespread excitement within the SEI community and beyond.

The purchase, confirmed via Arkham Intelligence, was executed using USD Coin (USDC) and comes at a time when the SEI market has been showing early signs of recovery after a prolonged bearish trend.

ARKHAM ALERT: DONALD TRUMP’S PROJECT JUST BOUGHT $775K SEI

— Arkham (@arkham) April 12, 2025

Donald Trump’s project World Liberty Fi just purchased $775K SEI with USDC.

What will they buy next? pic.twitter.com/V65kyt7miB

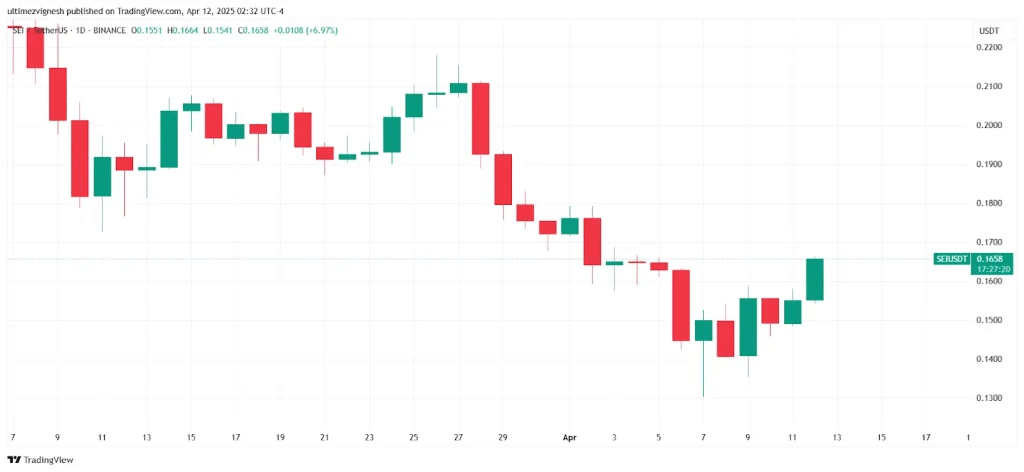

At the time of writing, Sei is trading at $ 0.169504 with a 24-hour trading volume of $ 164.27M and a market cap of $ 827.58M. The SEI price increased 11.08% in the last 24 hours.

People believe that World Liberty Fi has close ties to the Trump family. The company has drawn increased attention since Trump began his first presidential term. Now, as Trump continues to play a central role in U.S. politics and media, his involvement in any financial movement sends ripples across sectors and crypto feels the impact too.

As of now, World Liberty Fi’s total crypto holdings stand at a staggering $101 million, with a modest 1.18% growth recorded in the last 24 hours alone. The recent SEI token acquisition appears to be a strategic bet on a blockchain platform that’s been quietly building under the radar.

SEI Breaks Down Then Bounces Back

SEI is the native token of the Sei Network, a high-performance Layer 1 blockchain specifically tailored for decentralized finance (DeFi), high-frequency trading, and real-time digital exchanges. With a focus on blazing-fast transaction speeds and scalability, Sei positions itself as a foundational infrastructure for next-gen crypto trading platforms.

Once a rising star, SEI has seen a rough ride recently. Over the past year, the token has plunged over 75.9%, with a 12% decline over the last 30 days and a 14.4% drop in just the past two weeks. At the start of April, SEI was trading at $0.1720, but it fell as low as $0.1293 on April 7. Despite this, April 6 offered a glimmer of hope with a 10.52% intraday surge, a sign that buyers were circling.

World Liberty Fi’s SEI Bet Sparks Trump Speculation

The timing of this investment is critical. Just as SEI began showing signs of market strength, World Liberty Fi stepped in with a bold injection of capital. This has led to speculation that Trump-affiliated capital may be positioning itself for a bigger play in the blockchain space.

Market watchers are now interpreting the move not just as an isolated investment but as a potential signal of institutional-level interest in SEI. Given Trump’s influence and media reach, any associated venture especially in crypto tends to generate significant ripple effects.

This isn’t the first time Donald Trump has intersected with crypto. From NFT drops to policy debates around Bitcoin, Trump’s indirect presence in the digital asset space is well documented. However, the latest move by World Liberty Fi could mark a more structured, strategic entry into blockchain ecosystems.

As bullish sentiment builds, the big question remains: is this the start of a new era for SEI and politically influenced crypto investments?

Related | FTX Unstakes 21 Million in Solana Triggering Market Concerns

How would you rate your experience?