- The XRP price dropped over 13% in the past week as investor sentiment slipped into extreme fear territory.

- Nearly $30B in February inflows came from new retail investors, many now holding positions near the top.

- Despite a strong $5M debut for the new 2x XRP ETF, XRP has continued its slide, down 19% over the past 30 days.

XRP’s February surge was nothing short of spectacular, but new data shows the momentum may be running out of steam as retail enthusiasm fades and losses mount.

Fresh on-chain data reveals that retail investors were the primary force behind XRP’s explosive rally in February, but the tide appears to be turning. The price of XRP has dropped by over 13% in the past week, with investor sentiment sliding into “Extreme Fear” territory, according to recent market indicators.

Data from Glassnode shows that XRP’s realized market capitalization, a metric reflecting the total value of coins at the price they were last moved, nearly doubled, jumping from $30.1 billion to $64.2 billion during February’s bullish run. Of that, nearly $30 billion in inflows came from new investors, pointing to a retail-led momentum spike.

<6M old supply now makes up 62.8% of $XRP Realized Cap, up from just 23%. This rapid concentration in new holders reflects strong retail involvement – but also raises risk of fragility, as many hold elevated cost bases. pic.twitter.com/SzpDaA6H77

— glassnode (@glassnode) April 8, 2025

The surge didn’t just reflect numbers; it marked a major shift in who owns XRP. Addresses that hadn’t moved coins in a long time now hold 62.8% of XRP’s realized cap. This is up from just 23%. This suggests a wave of fresh, enthusiastic retail buyers but also signals fragility. Many holders are now sitting on positions purchased at or near the top.

XRP Holders Rise to 6 Million While Losses Mount

Since the February peak, the tide has shifted. On-chain metrics show a steady decline in XRP’s profit/loss ratio, a sign that more investors are now holding losses than gains. Glassnode warns that this wealth concentration among recent buyers makes the network “top-heavy and vulnerable.”

Crypto analyst Ali Martinez highlighted a notable milestone amid the volatility: the XRP network recently hit an all-time high of 6.26 million addresses holding at least 1 coin. XRP futures trading volume surged to a monthly high of $21.62 billion, signaling continued interest. However, it remains to be seen whether this reflects bullish conviction or speculative churn.

Despite the recent volatility, the $XRP network is growing stronger! Now reaching an all-time high of 6.26 million addresses holding 1 #XRP or more. pic.twitter.com/Vavv9FkmuP

— Ali (@ali_charts) April 9, 2025

XXRP Lands in Top 5 % of ETF Launches

One bright spot came from traditional finance. The newly launched Teucrium 2x Long Daily XRP ETF (XXRP) made waves with a $5 million debut trading volume, placing it in the top 5% of all ETF launches. That’s a staggering entrance for a crypto asset that was entangled in legal drama not long ago.

To put it in perspective, XXRP’s launch volume was four times higher than that of Solana’s 2x ETF, which had far more pre-launch hype. Despite no spot XRP ETF in the U.S. yet, Teucrium used a creative mix of European products to build its swap-based exposure, an unconventional approach that seems to be paying off.

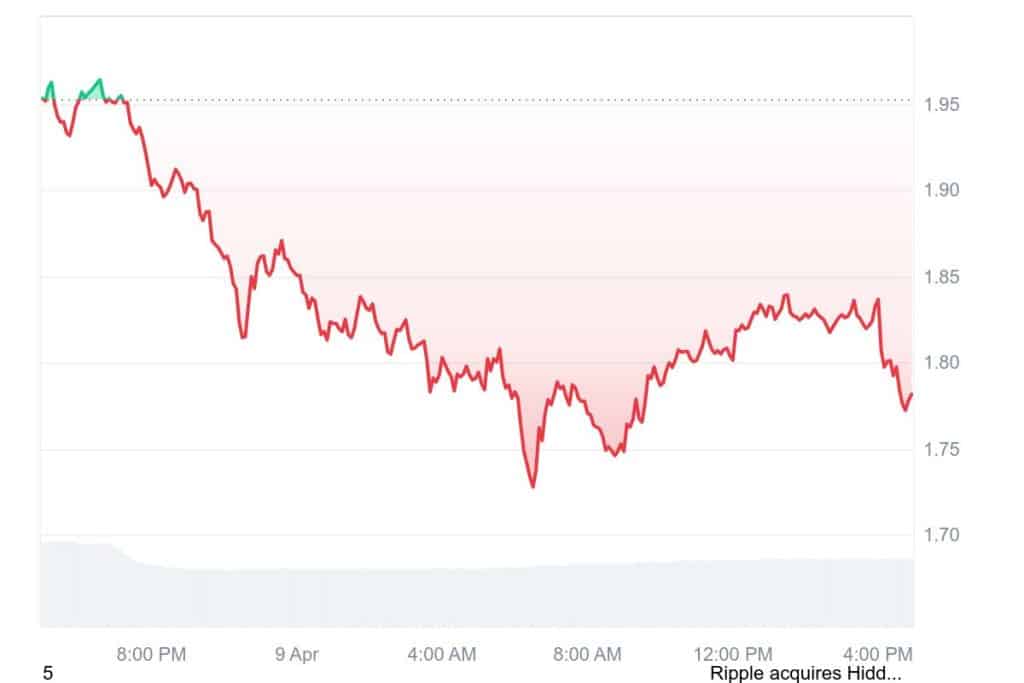

But even a record-breaking ETF debut couldn’t halt XRP’s price slide. The token dropped another 3% in the last 24 hours, bringing its 30-day losses to 19%. XRP is currently trading at $1.783602 with a 24-hour trading volume of $ 14.09B and a market cap of $ 103.94B. The XRP price decreased -8.84% in the last 24 hours.

Related | Teucrium Launches First-Ever 2x XRP ETF in United States

How would you rate your experience?