- Berachain Expands PoL to Include More Vaults and Apps for Rewards.

- BGT Holders Gain Control Over Reward Distribution in Berachain Ecosystem.

- Berachain’s PoL Solves PoS Liquidity Issues, Boosts DeFi Activity.

The Berachain Foundation announced a significant update on March 21 via X. Its Proof-of-Liquidity (PoL) mechanism is set to go live on March 24, introducing additional vaults into the reward pool. Initially, PoL was limited to BEX pools, where it distributed Berachain Governance Tokens (BGT) to enable decentralized on-chain governance. Starting next week, the system will expand to include more applications and vaults, allowing them to participate in earning rewards.

Phase 0 → Phase 1

— Berachain Foundation 🐻⛓ (@berachain) March 20, 2025

PoL started with a limited rollout within BEX pools, to sufficiently decentralize the BGT supply for on-chain governance.

In preparation for Monday, contracts have been upgraded to support incentive distribution across users, applications, and validators.

The foundation has also released the first approved Request for Reward Vaults. At the moment, rewards will be concentrated on DEX pools, but it seems that new types of vaults and cases will be introduced shortly. This expansion allows the BGT holders more control over where the revenues are given, thereby decentralizing the awards given in the ecosystem.

Berachain’s blockchain solves one of the most fundamental issues of the current Proof-of-Stake (PoS) systems. In the PoS blockchains, people deposit their tokens to validate the transactions and get staking rewards. Despite this enhancing security, it limits the amount of liquidity available for DeFi uses and operations. Consequently, people focus more on staking than on using decentralized finance platforms, which inhibits economic activity.

Berachain’s Innovative PoL Solution

Berachain was built to solve this dilemma between security and DeFi activity through its novel PoL consensus mechanism. Compared to other PoS systems, which let validators retain large portions of their earned rewards, in Berachain, the validators must contribute most of the application reward vaults denominated in BGT. This leads to a competitive situation where applications can convince validators, often by offering native tokens, to bring more BGT rewards. This leads to a system that rewards validators for supporting well-performing apps.

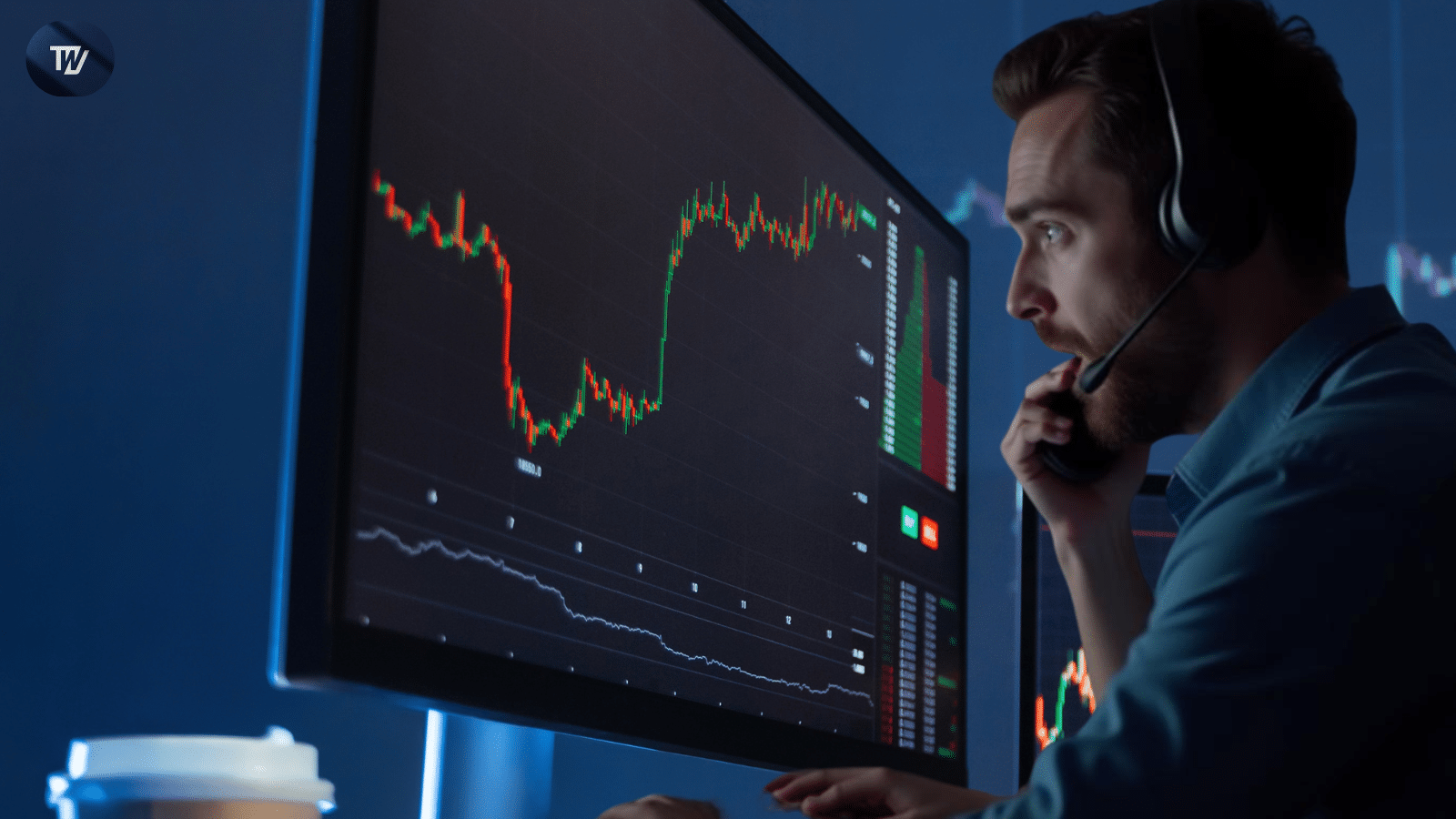

It is worth looking at the value of Berachain’s business token, BERA, which has experience significant volatility since it was establish. It is currently trading at $6.53, and this is 57% lower than its peak at $14.99 on February 6th this year. The price, which started at $4 upon the launch, fluctuated around $4 to $5 before rising again in late February at $9 due to the trading volume.

Source: TradingView

The recovery process persisted till the early part of March when BERA rose to $9.2 level but started facing some resistance and started declining. The token has been trading within the bracket of $6 and has lost much of its daily trading activity.

How would you rate your experience?