- Bitcoin slips below its 200-day average, with $66,000 as the next key support level, raising concerns.

- Weak accumulation signals investor hesitation, increasing the risk of further price declines and volatility.

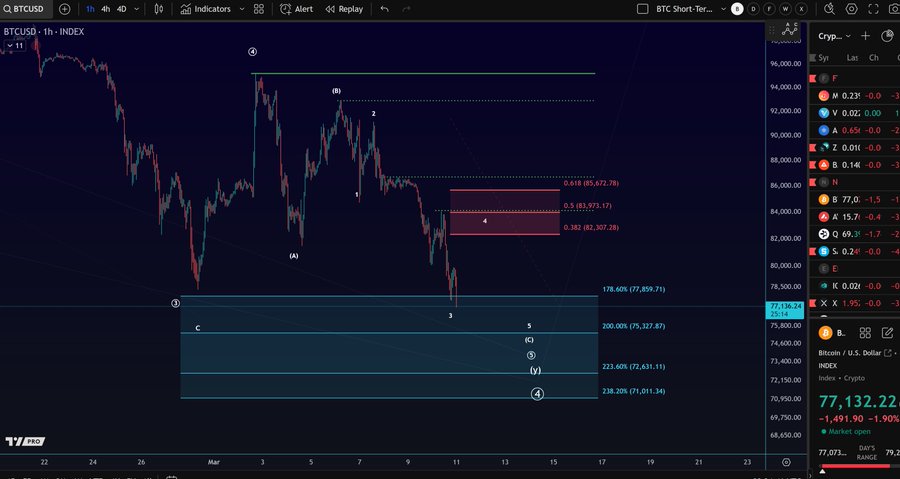

- Analysts warn of a deeper drop unless Bitcoin breaks $85,672 with a strong five-wave reversal.

Bitcoin is in the red territory again after it fell below its key 200-day moving average which is considered a significant indication of a shift in trends. In an X post, analyst Ali stated that according to the factors in the Mayer Multiple, the next critical support level for Bitcoin is $66,000. This metric has been quite useful in the past in the analysis of the performance of Bitcoin in the market. Markets are focusing on price bars in the hope that a pull back or even a reversal is imminent.

BitcoinWeak Accumulation

As of press time, BTC is trading at 81,547$ and slid down bu 1.34% in the last 24 hours. There is a weak accumulation activity from the side of investors at the current price levels. The Accumulation Trend Score show that there is a lack of strong buying signal this implies that most holders are prefer to wait in moving up to higher grounds waiting for signs of clearer direction of the market.

If Bitcoin cannot attract buyer in the near future, it might lack the requisite fuel to regain its momentum. This in turn will result to further decrease in the price and increased volatility in the market.

Ali Martenez has also said that the third year is generally volatile, in terms of the crypto market, where prices may make steep incline and equally steep decline. The current movement of BTC fits the previous trends where erratic set backs challenge short-term dealers and the long-term investors. These corrections while bring salty can also bring good revenues those who will invest when the price is low. The following movement is expected to define whether Bitcoin is set for more stability or if it will decline further.

Source: Ali

Further Downside Risks Loom

However, as stated by More Crypto Online, it has been identified that Bitcoin has the weakest support base. In an X post, he pointed out that wave three is still making a new low thereby pointing that further downside risks prevail unless the momentum changes. If the current trend remains so, Bitcoin will first reach 475,327 and then plunge to $72,631. Thus, any bullish signal can be consider as speculative unless $85,672 is overcome with the five-wave reversal.

The direction that will be taken soon by Bitcoin will be one that will set the tone in the market. This would result in an increase in the confidence of investors in as far as the key support levels are achieved. Nevertheless, the failure to stabilize may well pull the trigger another round of selling, which will intensify the volatility. Still, investors stay alert and attempt to trace any indications of the beginning of a trend. Several days could prove to be decisive for bitcoin’s further evolution in the current cycle.

How would you rate your experience?